GBP/USD is snapping a wo day winning streak on Wednesday, after climbing to a fresh five week high. Grim coronavirus statistics and Brexit returning to the headlines has dragged on sterling.

The number of daily coronavirus deaths remain elevated a 778 However the number of hospital admissions is easing, indicating that the social distancing and lock down measures are working.

-13% GDP

Yet whilst these measures are slowing the spread of coronavirus, they are hitting the UK economy hard. Predictions, yesterday from the OBR made for grim reading. The OBR warned that the UK economy could shrink by 13% in 2020, with a 35% drop in GDP from April – June alone. Unemployment could quickly more than double to 10%.

Yet whilst these measures are slowing the spread of coronavirus, they are hitting the UK economy hard. Predictions, yesterday from the OBR made for grim reading. The OBR warned that the UK economy could shrink by 13% in 2020, with a 35% drop in GDP from April – June alone. Unemployment could quickly more than double to 10%.

Adding insult to injury, data today from British Chambers of Commerce showed that 2/3rds of small British companies have put at least some of their staff on temporary government funded leave. These figures paint a “troubling picture” of the UK economy, in the words of Chancellor Rishi Sunak.

Brexit talks timetable

Brexit is back in focus today with negotiators set to discuss a timetable for talks. Traders will ideally want to see a conversation on the Brexit transition period being extended. Otherwise GBP could find itself back under pressure before its recovery has really taken off.

Brexit is back in focus today with negotiators set to discuss a timetable for talks. Traders will ideally want to see a conversation on the Brexit transition period being extended. Otherwise GBP could find itself back under pressure before its recovery has really taken off.

With the UK lock down due to end tomorrow, traders will also be listening out for an update. An extension is certain, but the lack of any exit strategy could keep sterling under pressure.

US To Reopen Prior To 1st May?

USD is pushing higher amid expectations of early economic restoration after President Trump rekindled optimism that some states of the US could reopen for business on May 1st and some could even reopen before then.

USD is pushing higher amid expectations of early economic restoration after President Trump rekindled optimism that some states of the US could reopen for business on May 1st and some could even reopen before then.

US retail sales

So far US dollar traders have Attention will turn to US retail sales. Analysts are expecting retail sales to plunge -8% month on month in March, the lowest level on record, as the coronavirus lock down kicked in and sent consumption levels tumbling. With unemployment in the US soaring the rebound in retail sales could be hampered.

So far US dollar traders have Attention will turn to US retail sales. Analysts are expecting retail sales to plunge -8% month on month in March, the lowest level on record, as the coronavirus lock down kicked in and sent consumption levels tumbling. With unemployment in the US soaring the rebound in retail sales could be hampered.

Levels to watch

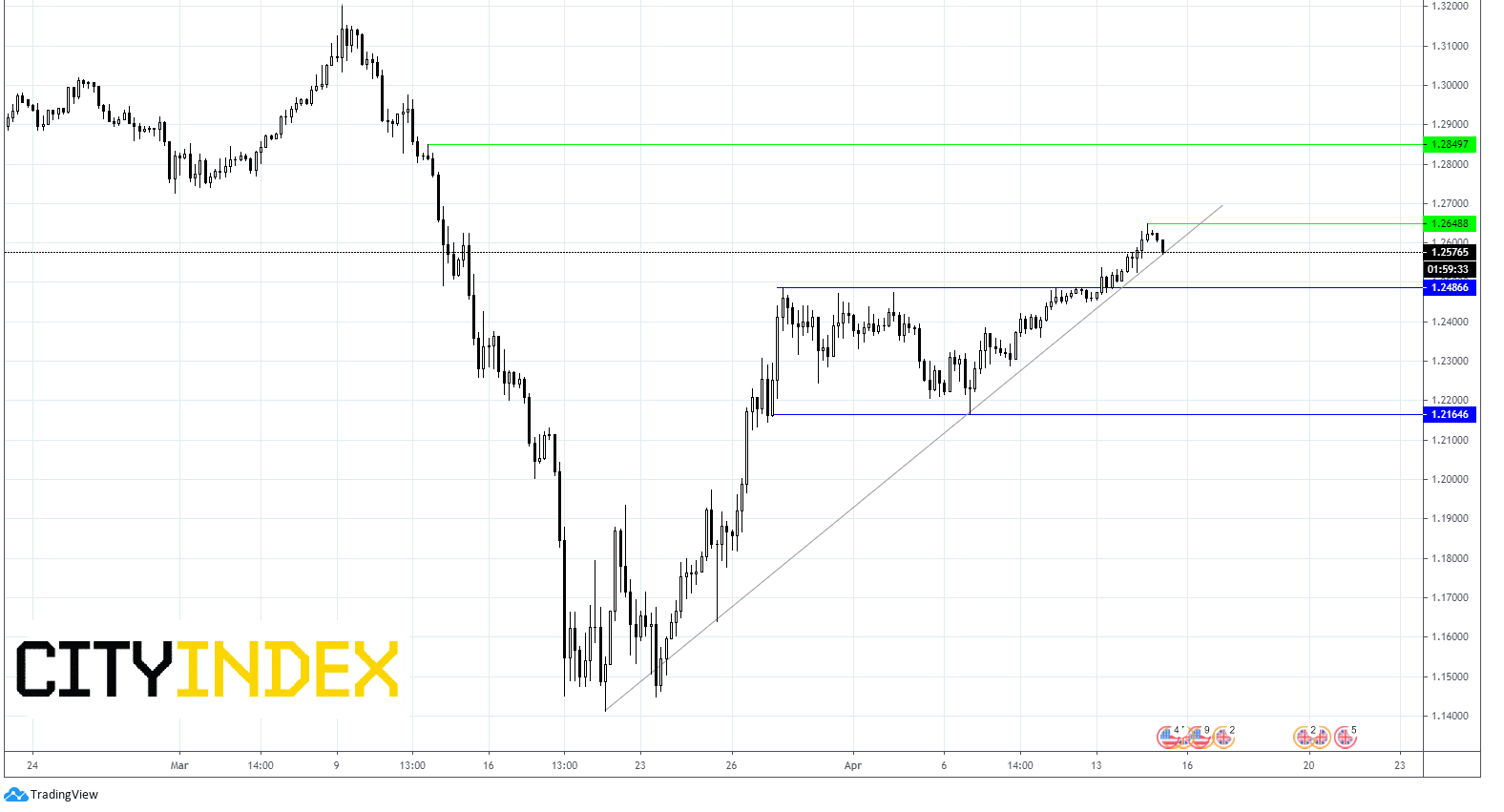

GBPUSD has advanced convincingly from 19th March low of $1.1410 to its 5-week high of $1.2647 yesterday.

Immediate trendline support is being tested at the time of writing. A breakthrough this level at $1.2575 could see more bears pile in and the price test strong support at $1.2485.

Should the trend line support hold, the price could push higher to test yesterday’s peak of $1.2647 prior to $1.2850 (high 12th March).

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM