BoE Minutes - more room to cut

Meanwhile GBP is on the back foot after the BoE released the minutes to its unscheduled policy meeting when it voted to cut interest rates from 0.75% to 0.25%. The minutes show that the BoE excpect UK economic activity to weaken over the coming week and months and that they will also have more information on the size of that hit as data starts coming through over Q2. The BoE believes there are still tools in its toolbox and another rate cut is possible.

GBP also appears to be questioning Boris Johnson’s approach to coronavirus. UK school are still open whilst those across Europe and the US are starting to close. There is no ban on large scale public meetings in England yet. A lack of confidence in the approach means the pound sees a bigger financial hit as the virus spreads uncontrolled

In addition to the coronavirus hit to the economy, GBP traders are also fretting about its impact on post Brexit trade talks. Talks next week have been postponed. This put pressure on an already very tight timeline.

US Consumer confidence up next

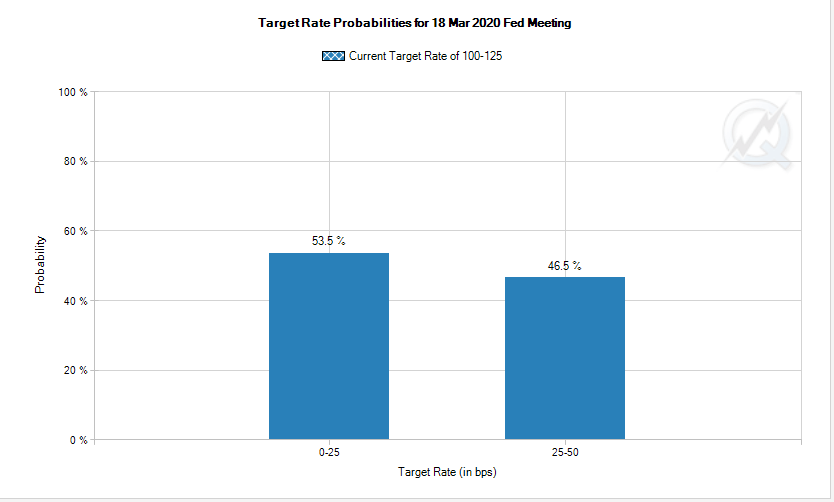

US Consumer confidence data is next. The release is for March, therefore will reveal the first coronavirus impact. Expectations are for consumer confidence to fall to 95, down from 101 in February which was the second highest reading since the financial crisis. So far, the US economy hasn’t experienced large scale closures but that dean’s mean that the mind of the US consumer isn’t changing. Markets have already priced in a big economic hit from coronavirus as long as consumerism remain relatively optimistic the dollar should hold its gain.

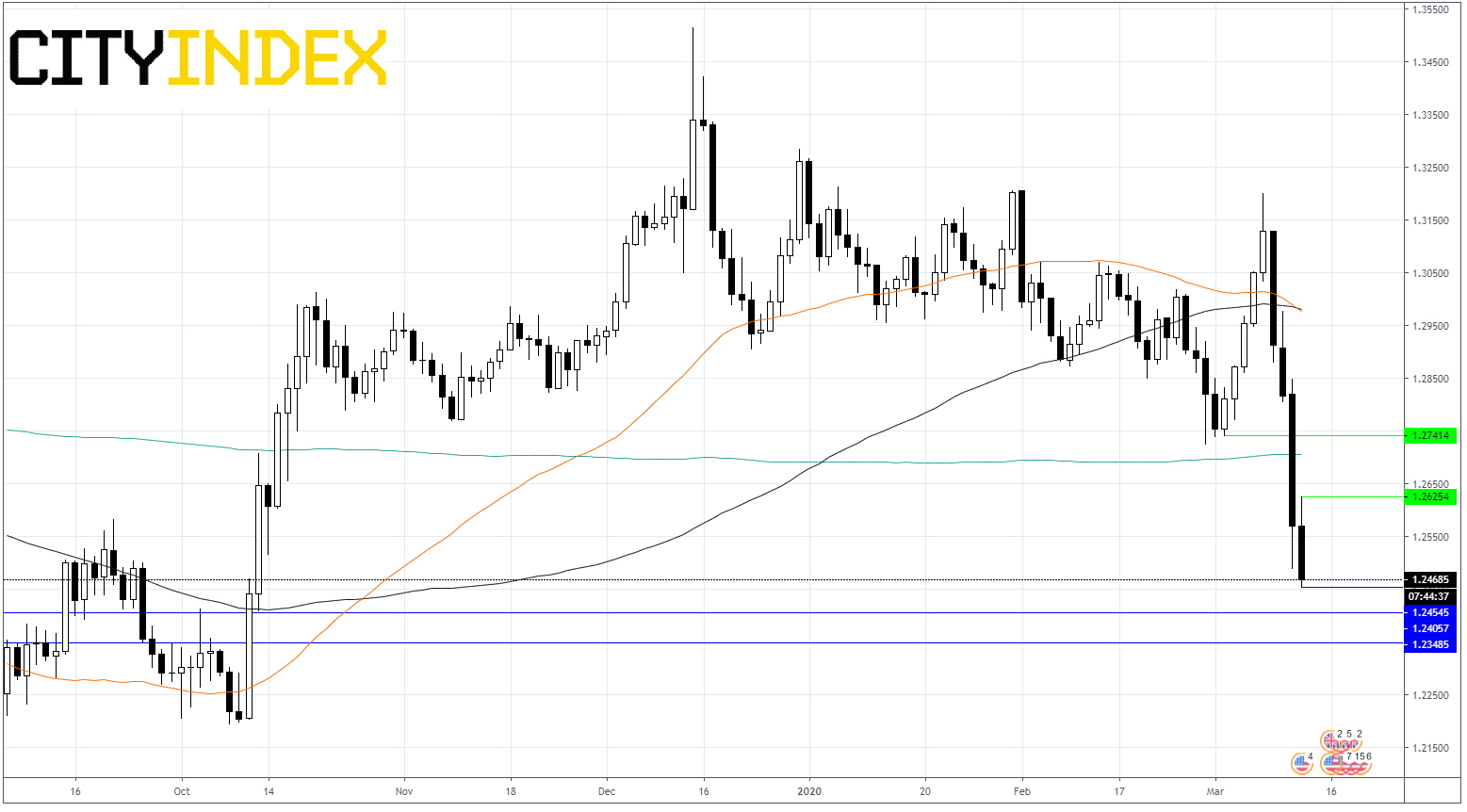

GBP/USD Levels to watch

GBPUSD is trading at fresh 5 month lows, through $1.25. It tades below its 50, 100 & 200 sma on a bearish chart.

It trades at its daily low of $1.2466. Support can be seen at $1.2450 and $1.2350 lows from October last year.

Support can be seen at $1.2625 (today’s high) , $1.2705 (200 sma) and $1.2745 (low 3rd March).