GBP/USD is clawing back losses after the BoE made an emergency 50 basis point rate cut early on Wednesday, in an unscheduled move. This takes the interest rate from 0.75% to 0.25%, ahead of the Chancellor’s arguably more important budget due later in the day.

Budget up next

UK Chancellor Rishi Sunak’s Budget is the arguably more important of today's events. It is expected to be dominated by money for the NHS and to businesses to help them survive over what is expected to be a very difficult few months.

The Chancellor is expected to be generous in his fight to limit the economic impact that coronavirus will have on the UK economy. Investors will be looking for strong short-term measures and spending plans that will prevent a very hard but temporary hit on the economy becoming something far more deeply entrenched and longer term.

Should the markets consider than Chancellor Rishi Sunak has not gone far enough with spending to support the economy, the pound could fall.

GBP/USD levels to watch

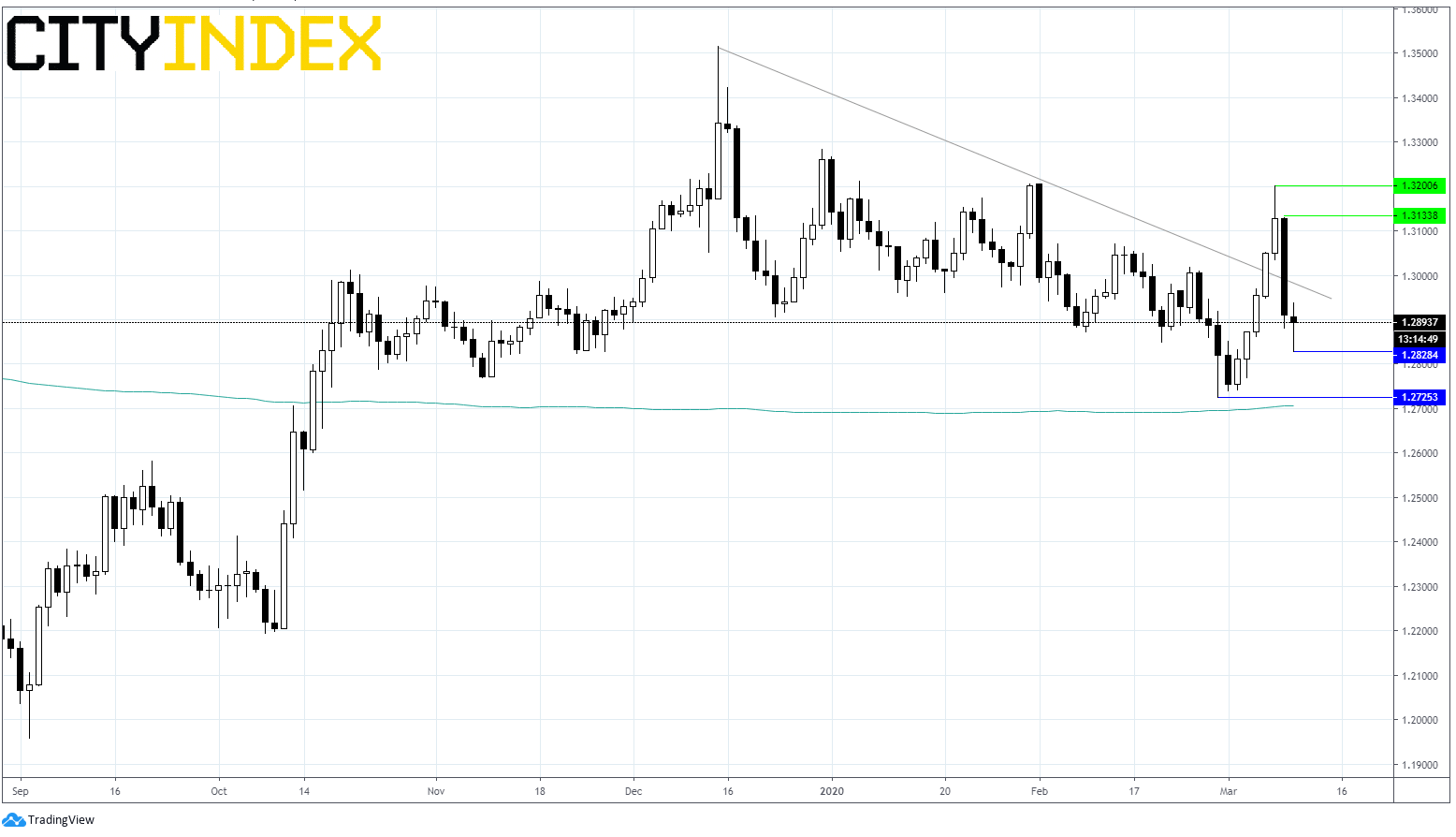

GBP/USD dived an initial 100 points hitting a weekly low on the news of the cut, in a knee jerk reaction. However, the pair is clawing back those losses and is pushing back into positive territory at $1.29.

Whilst GBP/USD traded above the descending trend line in the previous session, it hasn’t managed to remain above it. A sustained move above $1.2970 could negate the current bearish trend.

Immediate support can be seen at $1.2828 (today’s low) prior to $1.2725 (low 28th Feb) and $1.2705 (200 sma).

Resistance can be seen at $1.2970 (trendline) ahead of $1.3130 (yesterday’s high) and $1.32 (Monday’s high).