GBP/USD remains under pressure

The US Dollar was bullish against most of its major pairs on Friday with the exception of the CHF and EUR.

On the economic data front, Personal Income fell 4.2% on month in May (-6.0% expected), from a revised +10.8% in April. Personal Spending jumped 8.2% on month in May (+9.3% expected), from a revised -12.6% in April, marking a record high. The University of Michigan's Consumer Sentiment Index slipped to 78.1 on month in the June final reading (79.2 expected), from 78.9 in the June preliminary reading.

On Monday, no major economic data is expected.

The Euro was bullish against all of its major pairs. In Europe, in the Eurozone, M3 annual growth of money supply was 8.9% in May, compared with +8.7% forecast by economists and +8.2% (revised from +8.3%) the previous month. In Germany, import prices rose by 0.3% in May after a decline of 1.8% the previous month. Economists expected an increase of 0.4%. In France, June consumer confidence index rose to 97 from 93 the previous month and 95 expected.

The Australian dollar was bearish against most of its major pairs with the exception of the GBP.

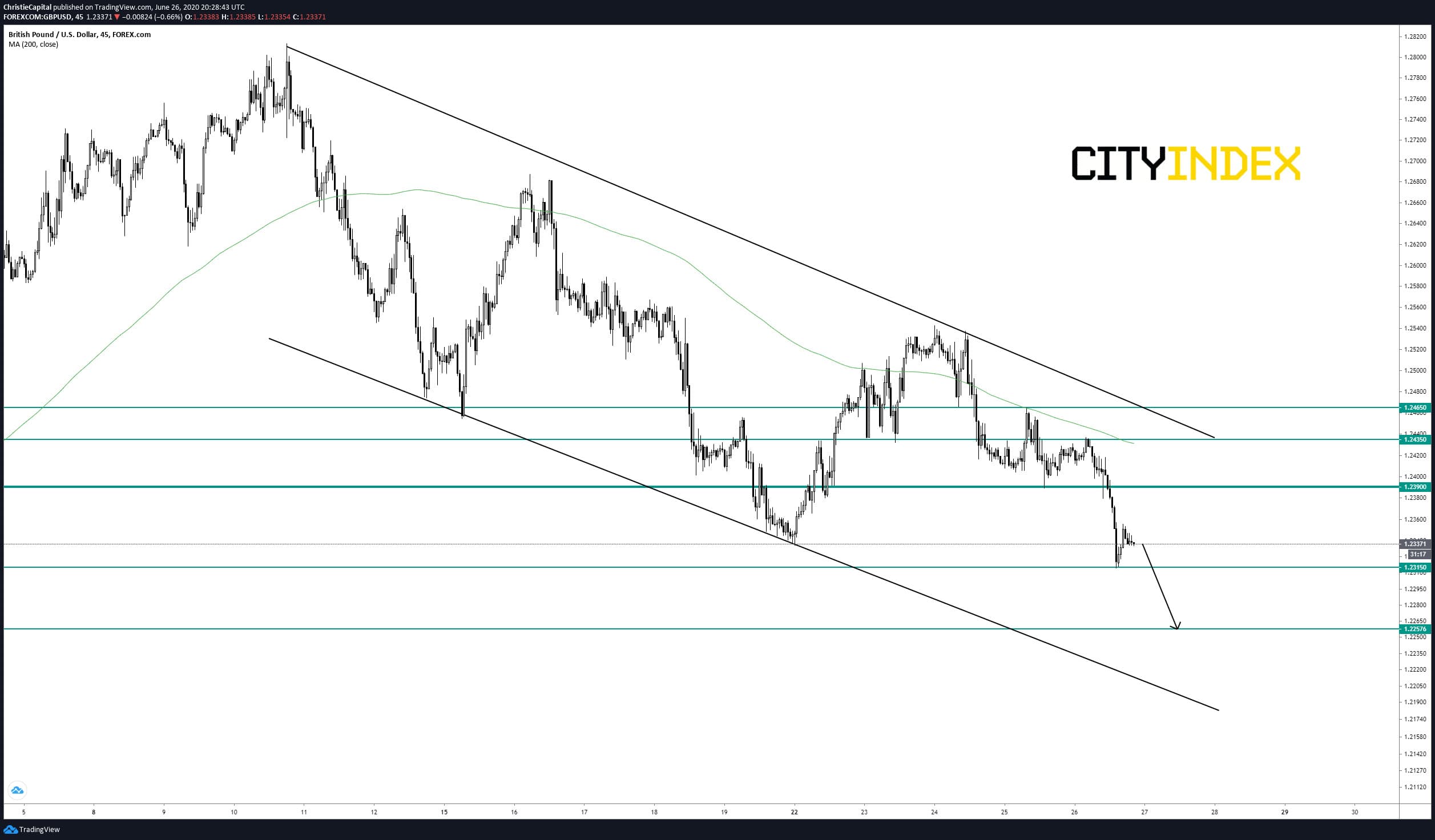

The largest currency pair mover on Friday was the GBP/USD which dropped 82 pips to 1.2337. The pair has reached the downside target we set on Wednesday at 1.234. As the pair remains in a bearish trend channel we have updated key levels to watch in the trend. As long as the GBP/USD can remain below 1.239 resistance, look for a test of recent lows at 1.2315 and ultimately 1.2576 in extension.

Source: GAIN Capital, TradingView

Have a great weekend

On the economic data front, Personal Income fell 4.2% on month in May (-6.0% expected), from a revised +10.8% in April. Personal Spending jumped 8.2% on month in May (+9.3% expected), from a revised -12.6% in April, marking a record high. The University of Michigan's Consumer Sentiment Index slipped to 78.1 on month in the June final reading (79.2 expected), from 78.9 in the June preliminary reading.

On Monday, no major economic data is expected.

The Euro was bullish against all of its major pairs. In Europe, in the Eurozone, M3 annual growth of money supply was 8.9% in May, compared with +8.7% forecast by economists and +8.2% (revised from +8.3%) the previous month. In Germany, import prices rose by 0.3% in May after a decline of 1.8% the previous month. Economists expected an increase of 0.4%. In France, June consumer confidence index rose to 97 from 93 the previous month and 95 expected.

The Australian dollar was bearish against most of its major pairs with the exception of the GBP.

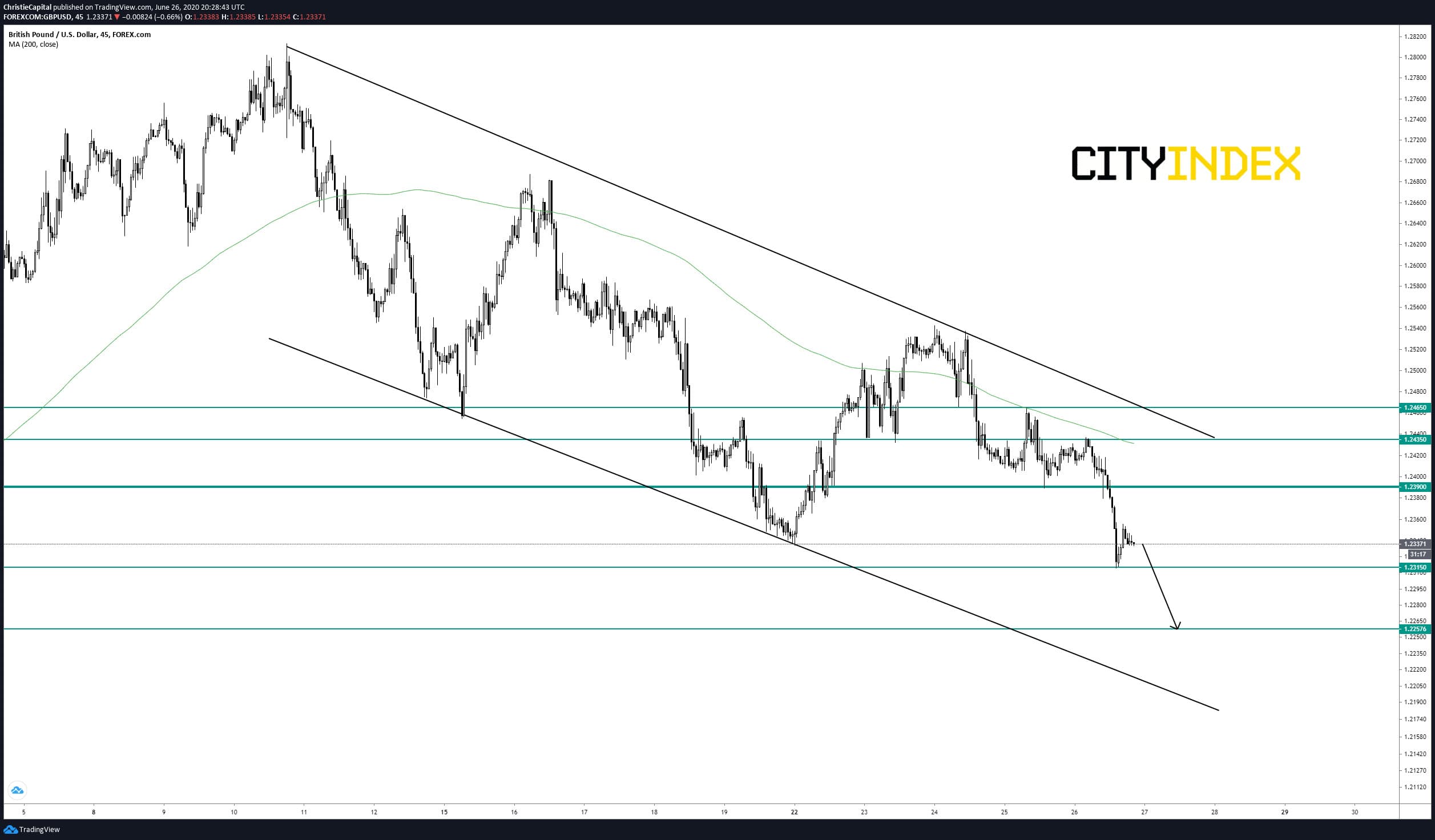

The largest currency pair mover on Friday was the GBP/USD which dropped 82 pips to 1.2337. The pair has reached the downside target we set on Wednesday at 1.234. As the pair remains in a bearish trend channel we have updated key levels to watch in the trend. As long as the GBP/USD can remain below 1.239 resistance, look for a test of recent lows at 1.2315 and ultimately 1.2576 in extension.

Source: GAIN Capital, TradingView

Have a great weekend

Latest market news

Today 07:49 AM

Today 04:24 AM

Yesterday 10:48 PM