The Pound has managed to hold those gains even after a dark outlook for the UK economy from the central bank. Forecasts of a -14% contraction in GDP, expectations of higher unemployment and a tepid recovery which could drag into next year. Inflation is expected to slip below 1%.

Given such dire projection, more QE is almost a given, its just a matter of time.

Attention will now turn towards Boris Johnson and his exit strategy, which is expected to be announced on Sunday.

US Initial jobless claims

Looking ahead, attention will turn to US initial claims data. Expectations are for a further 3 million Americans to have filed for unemployment insurance in the week of 1st May. This will take the total to 33 million, or 20% of the US labour force in just 7 weeks, as the coronavirus crisis reaches further into the labour market. Whilst this week would represent a 56% decline from the top is still shockingly high, particularly given that several states have lifted lockdown restrictions and that the highest level of initial claims reached during the financial crisis was 665,000.

Whilst the shocks of the earlier releases have passed, these figures will need to be digested on top of yesterday’s 20.2 million private sector job losses and ahead of tomorrows non-farm payroll.

Levels to watch:

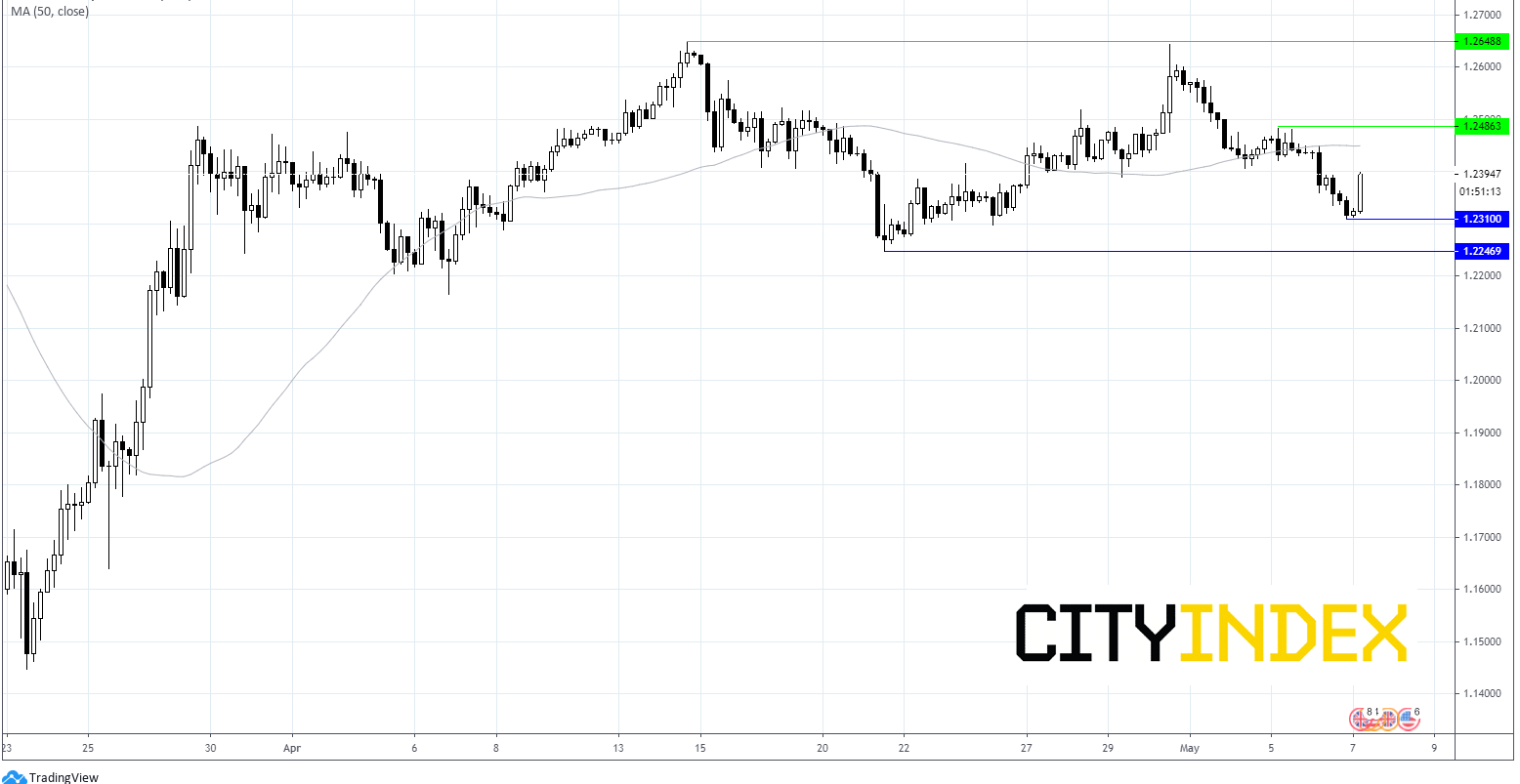

GBP/USD rebounded off session lows pierce through US$1.24. The pair remains below 50 sma on 4 hour chart. A move above $1.2450 (50 sma) could see more bulls jump in driving the price to resistance at $1.2486 (high 5th May) prior to $1.2640/50 (high 30th April & 14th April).

Immediate support can be seen at US$1.2310 (today’s low) prior to $1.2247 (low21st April)