GBP/USD is trading lower in early trade, although off session lows, as UK government steps up its response to the coronavirus outbreak and the UK prepares itself for an Italian style lock down amid a jump in the number of coronavirus deaths.

Boris Johnson has warned that he is considering additional restrictions to movement as the public flout recommendations for social distancing. The UK government has already closed pubs, clubs, gyms and restaurants. Unessential retailers could also be closed in addition to parks.

The UK also suspended its rail franchise system as passenger numbers slump. This has been done for 6 months prompting fears that the coronavirus hit will last much longer than the 12 weeks that Boris Johnson mentioned last week.

Adding to the pounds pain is the Brexit question. Boris Johnson has so far been adamant that the Brexit transition will go ahead regardless of the coronavirus delay. EU Chief negotiator Michel Barnier has been diagnosed with coronavirus. This means that more delays to talks are unavoidable. The timeline is already very tight, the latest developments, or lack there of mean a no deal situation is more likely.

Whilst the pound is maintaining losses of 1% versus EUR, GBP has pared some losses versus the USD. But this is a USD weakness story

Whilst the pound is maintaining losses of 1% versus EUR, GBP has pared some losses versus the USD. But this is a USD weakness story

Fed commits to unlimited QE

The USD dropped sharply after the Fed committed to unlimited purchases of US Treasuries and agency mortgage backed securities in addition to setting up additional lending tools to struggling companies. The move cane after the Fed slashed interest rates to near zero last week. The Fed really has thrown the kitchen sink at the problem; however, it hasn’t stemmed the decline of cable.

The USD dropped sharply after the Fed committed to unlimited purchases of US Treasuries and agency mortgage backed securities in addition to setting up additional lending tools to struggling companies. The move cane after the Fed slashed interest rates to near zero last week. The Fed really has thrown the kitchen sink at the problem; however, it hasn’t stemmed the decline of cable.

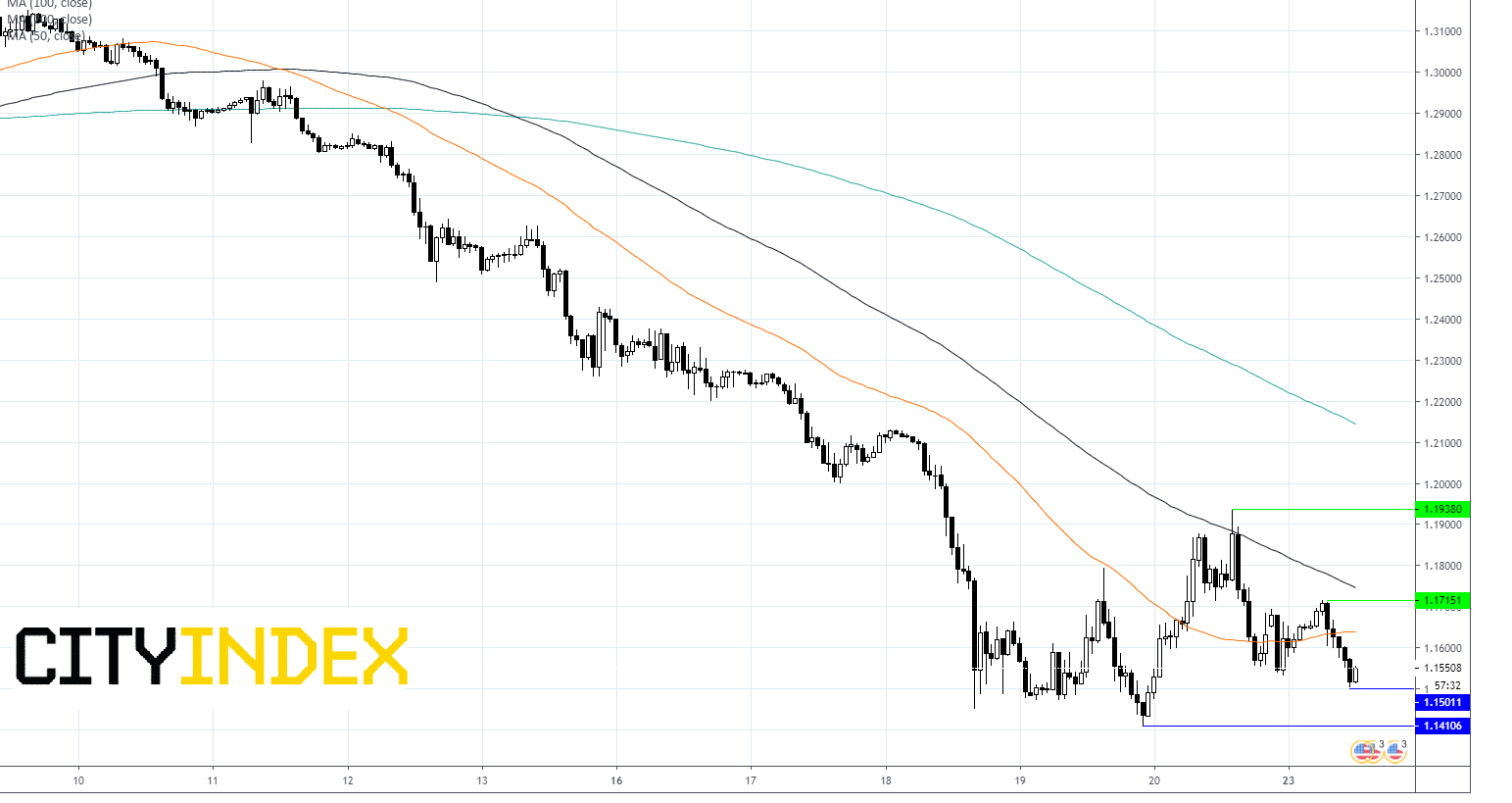

Levels to watch

GBP/USD has picked up from session lows following the Fed action but is still trading lower. At the time of writing GBP/USD is trading -0.4% at $1.1610 as it looks to attack the 50 sma on the 1hr chart.

Resistance can be seen at $1.1635 (50 sma) prior to $1.1715 (today’s high) prior to $1.1745 (100 sma) and $1.1938.

Support can be seen at $1.1506 (today’s low) prior to $1.1435 (35 year low 19th March).

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM