Following the surprisingly cautious Bank of England (BOE) meeting earlier this week, pound sterling is in freefall.

Looking at GBP/USD in particular, the pair is falling nearly 200 pips from Monday’s open, which would mark its worst week since August. More importantly, cable is approaching its year-to-date low at 1.3412; the last time the pair traded below that level was two days before last Christmas!

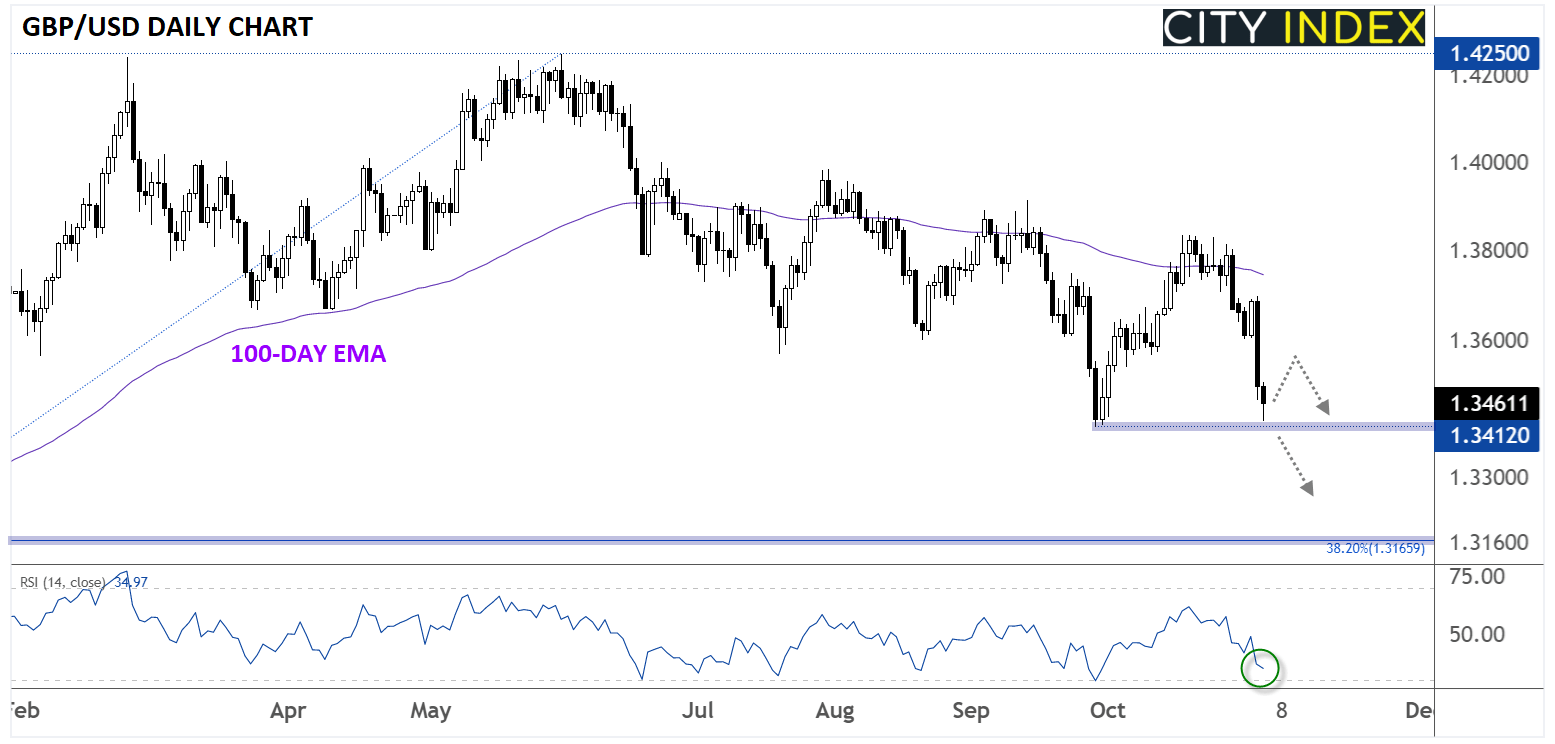

As the chart below shows, the pair is not yet oversold on its 14-day RSI indicator, despite the sharp drop so far this week. This suggests that rates could still fall further in the coming days, though after such a dramatic move, it wouldn’t be surprising to see a quick bounce of profit-taking ahead of the weekend:

Source: TradingView, StoneX

Regardless, it’s clear that GBP/USD bears have the upper hand in the short term. A confirmed break below 1.3412 in the coming days could open the door for a continuation lower, with little in the way of previous support until the 38.2% Fibonacci retracement of the entire 2020-2021 rally down below 1.3200. At this point, only a sharp reversal above the October highs in the 1.3800 area would erase the near-term bearish bias.

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade