Whilst data is stacking up against the pound, so are domestic political developments. Yesterday MP’s failed in their latest bid to stop a no deal Brexit whilst Boris Johnson’s hawkish approach to Brexit also unnerved pound traders. With both Tory leadership candidates willing to accept a no deal Brexit, the prospects for the pound are not great.

Attention will swing towards the pmi for the UK’s dominant service sector which is due for release tomorrow. Expectations are for the service sector to remain steady at 51 in June. However, when the manufacturing pmi and the construction pmi miss expectations it isn’t uncommon for the service sector pmi to underwhelm.

Dollar eases ahead of non-manufacturing ISM data

The dollar was broadly in favour in the previous session as investors cheered the US – Sino trade truce and the possible implications for the global economy. Not even US manufacturing activity dropping to a two-year low could deter the dollar bulls. However, today, in the cold light of day the dollar is encountering some weakness. With data pointing to a weakening US economy and with a lot of work still needed to turn a trade truce into a trade agreement, the Fed are unlikely to press the pause button again right now.

US non-manufacturing is due this afternoon. It is expected to show that the dominant US service sector remains solid at 56. This could offer some support to the dollar, should consumers underpin the economy amid a slowing manufacturing sector.

Levels to watch;

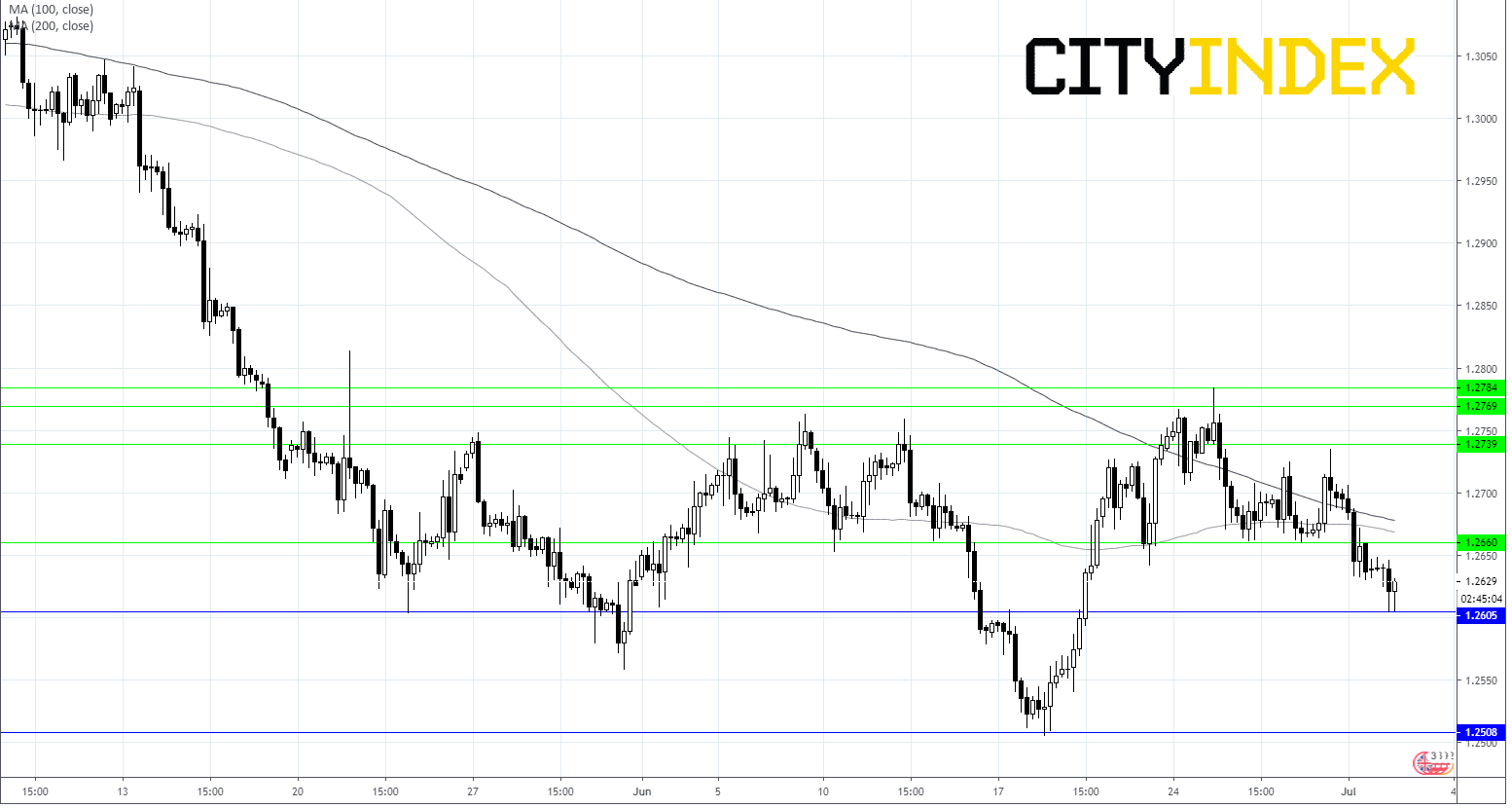

GBP/USD has broken through 50, 100 ad 200 sma on 4 hour chart, showing bearish momentum. Critical support is so far holding at $1.2605, should the pair break through this level, further strong support can be seen at $1.2505. Beyond there the next level to watch is $1.2475.

On the upside resistance at $1.2660 followed by $1.2740 come into play.