The pound is on the brink as Brexit uncertainty takes toll on UK economy, while improvement in jobs growth in the US has reduced the prospects of deeper rate cuts.

Today might be void of any major market-moving data, but that hasn’t stopped the markets from staging sizeable moves. At the time of this writing, European stocks and US index futures were coming off their worst levels after dropping at the European open, while in FX, the US dollar had extended its gains while the pound and the Aussie were on among the weakest. It almost feels like a repeat of Friday, when a surprisingly strong US jobs report caused a similar reaction in the markets. It certainly looks like investors are reassessing their extremely dovish expectations over interest rates in the US. For example, prior to Friday’s jobs report, the implied probability of a 50-basis point rate cut at this month’s FOMC meeting was more than 25%. The likelihood of such a move has been slashed to just under 5% now. What’s more, the probability that the July’s highly likely 25-basis point rate cut will be a one-off has risen, although there is still a good chance of another cut in September (at 59%).

FedSpeak and US CPI key events for dollar

Looking ahead, there will be a few Federal Reserve speakers who could spark some further volatility in the dollar. We will hear from Chairman Jerome Powell and FOMC members James Bullard and Randal Quarles later on. It could be the first time we will get some feedback from the Fed in reaction to the latest jobs and wages data, which, as we found out on Friday, beat on the headline but missed on the wages front. But this week’s big day for the greenback will likely be Thursday, when the US Consumer Price Index (CPI) for the month of June will be published. Inflation has remained weak over the past years, which has increased the calls for looser policy as trade tensions chipped away at sentiment. With Friday’s wages data pointing to subdued wage growth, inflationary pressures are low. But there could be a surprise in the CPI that could catch a few people off guard.

The GBP/USD, being the weakest pair so far in today’s session, could certainly fall further should we hear some surprisingly hawkish remarks from the Fed members later today or US CPI comes out surprisingly strong on Thursday.

Brexit uncertainty takes toll on the UK economy

Meanwhile the pound continues to be undermined by concerns that ongoing Brexit uncertainty is taking its toll on the UK economy. We have seen the release of some very poor domestic macro data in recent weeks. That run could continue tomorrow if the latest monthly GDP, construction output and manufacturing production figures disappoint expectations. All these numbers fell noticeably last time and judging by the latest PMI data, I am not expecting to see a sharp rebound. Another poor set of figures could increase the pressure on the pound even more.

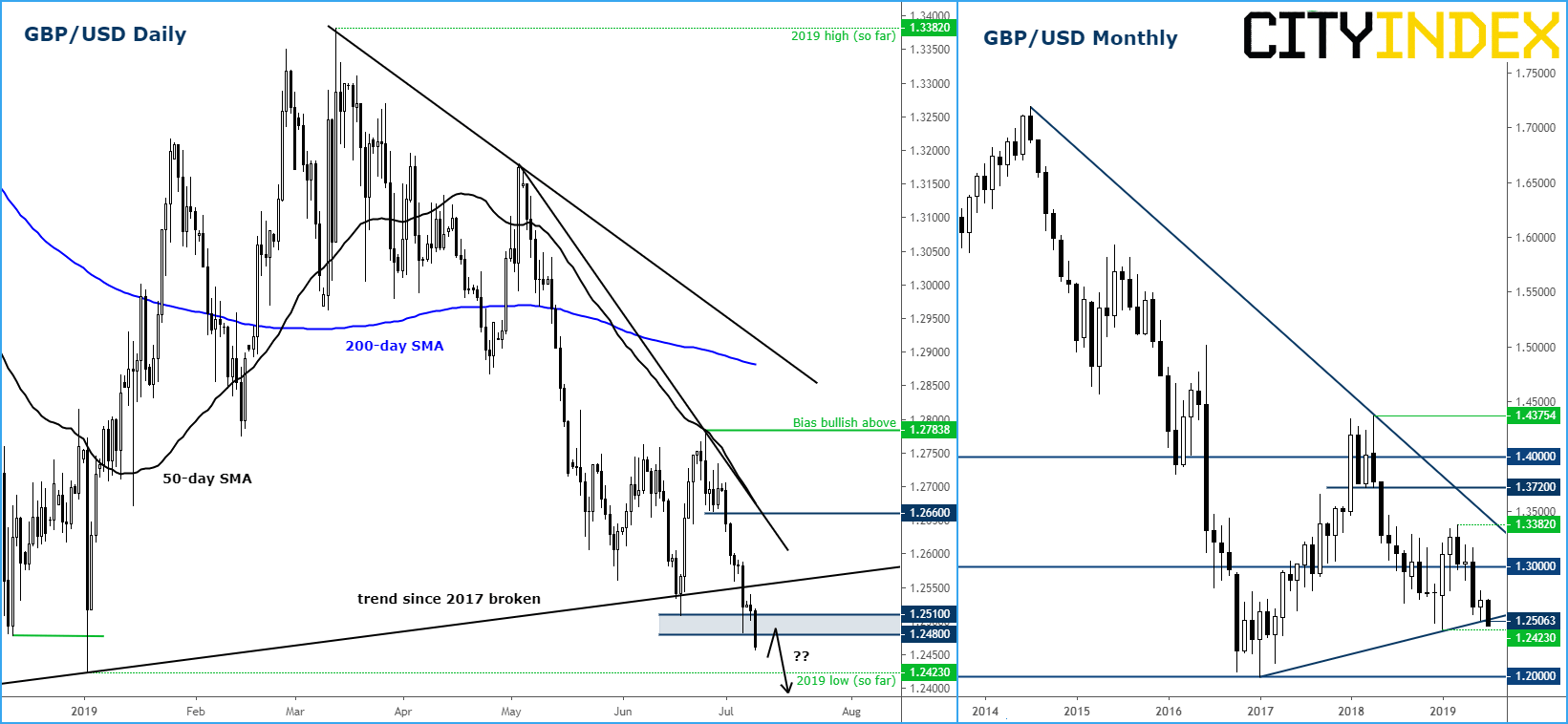

GBP/USD bears targeting 2019 low

The GBP/USD looks like it is about to break to a new low for the year below January’s low of 1.2423. After making a series or lower lows and lower highs, it has broken and held below the trend line which had been in place since 2017. It has also broken the 1.25 handle, where price had previously found support from last month. Thus, for as long as it remains below 1.25, the path of least resistance would be to the downside, with the bears targeting liquidity that would be resting below this year’s earlier low. Even if the cable manages to put on a good showing from here, the bears would still maintain overall control so long as price remains below the prior high around 1.2780/5 area.

Source: Trading View and City Index