- MoM -0.6% vs +0.6% exp.

- YoY +0.9% vs 2.9% exp.

Expectations were running high for December retail sales as the data included black Friday and Cyber Monday as well as an expected rebound in confidence following the UK general election.

However, the downbeat numbers show that the improved political landscape following the election didn’t create the boost in sales that was expected, and black Friday was a damp squib. Consumers were not prepared to part with their cash amid so much uncertainty and Brexit just around the corner.

The weak data comes after UK GDP unexpectedly contracting -0.3% in November and inflation unexpectedly dropping to a 3-year low in December. Figures coming from the UK show the economy to be on a slippery downward slope, raising the prospect of a rate cut from the BoE when they meet 30th January.

In the last BoE meeting of 2019, there were two dissenters. Since then Tenreyo, Vlieghe and Carney have adopted a more dovish stance. The pound is falling, reflecting the increased likelihood of BoE cutting interest rates from 0.75% to 0.5%

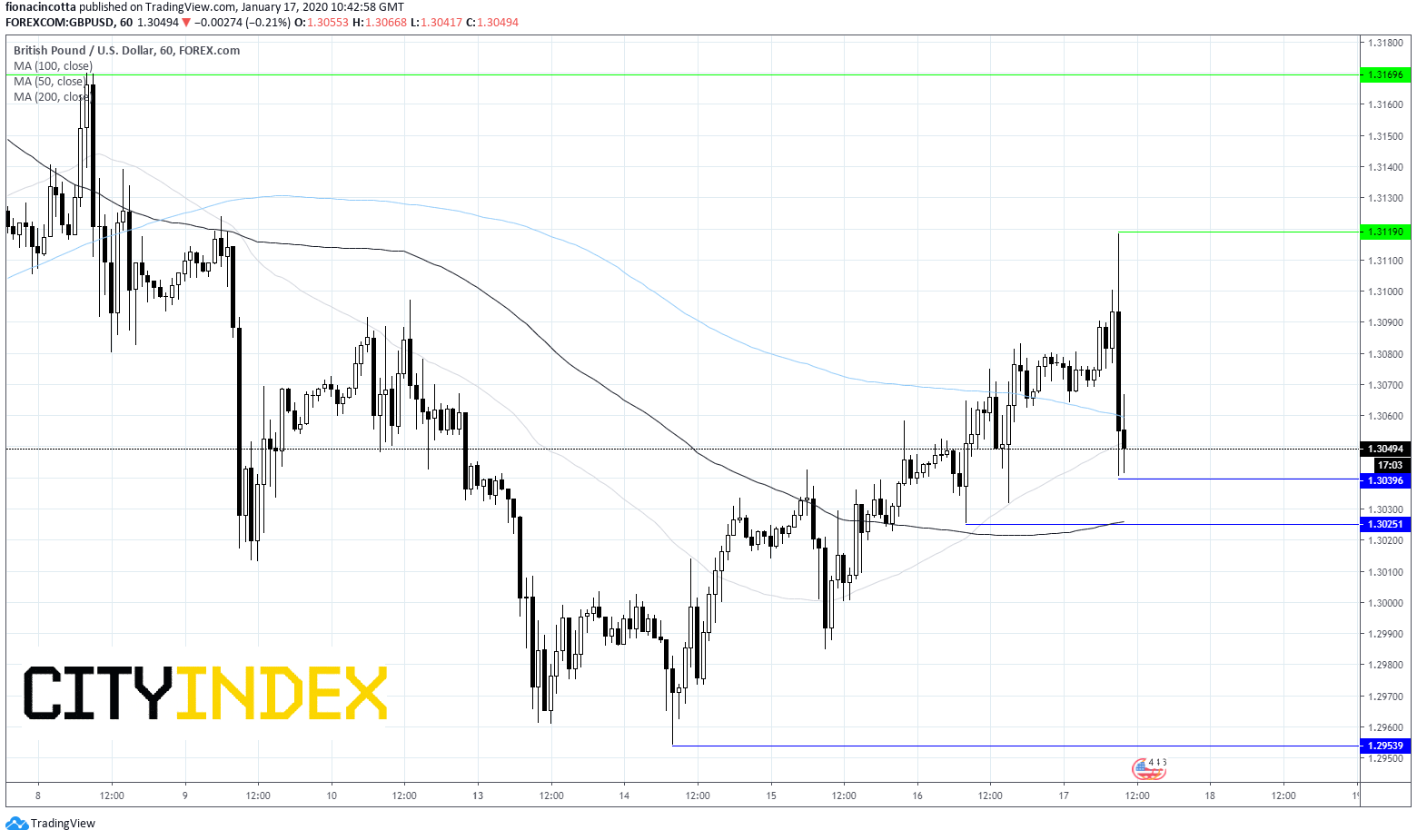

Levels to watch:

GBP/USD has snapped a three-day winning streak which saw it advance from $1.2950 to $1.3118. The pair is trading down 0.2% on the day and is finding immediate support on 100 sma, with the bullish trend just about intact, although looking shaky at best.

Immediate support can be seen at $1.3039 (today’s low), prior to $1.3025 (yesterday’s low, & 50 sma) and $1.2953 (low 14th Jan).

On the upside resistance sits at $1.3119 (today’s high) before $1.3169 (high 8th Jan)