Sterling is heading lower at the start of trading in 2020, drifting away from high’s reached at the end of 2019.

The pound is being weighed down by weaker manufacturing data and uncertainty over the future of UK – EU relations.

Manufacturing Output Drops Sharply

The final UK manufacturing pmi printed at 47.5, below the 47.6 forecast, sharply down from 49.1 in November.

Despite being an upwards revision in December, PMI failed to boost the pound as it not only missed estimates, but also showed that UK manufacturing output declined at the fastest pace since 2012. Slowing global demand and UK firms reducing stockpiled inventory in the case of a no deal Brexit has dragged on the sector. With Brexit uncertainty set to continue in, 2020 could see the UK economy once again overly reliant on the consumer sector of the economy for another year.

The final UK manufacturing pmi printed at 47.5, below the 47.6 forecast, sharply down from 49.1 in November.

Despite being an upwards revision in December, PMI failed to boost the pound as it not only missed estimates, but also showed that UK manufacturing output declined at the fastest pace since 2012. Slowing global demand and UK firms reducing stockpiled inventory in the case of a no deal Brexit has dragged on the sector. With Brexit uncertainty set to continue in, 2020 could see the UK economy once again overly reliant on the consumer sector of the economy for another year.

Brexit

The UK looks set to leave the EU on 31st January with a transition deal in place until the end of 2020. This leaves Boris Johnson and his team just one year for complex negotiations to secure a longer-term trade deal with the EU. Failure to do so will see the UK leave on WTO trade rules, a cliff edge Brexit. Whilst cliff edge Brexit fears had eased across the festive period, we expect those fears to be a central theme for the coming year.

The UK looks set to leave the EU on 31st January with a transition deal in place until the end of 2020. This leaves Boris Johnson and his team just one year for complex negotiations to secure a longer-term trade deal with the EU. Failure to do so will see the UK leave on WTO trade rules, a cliff edge Brexit. Whilst cliff edge Brexit fears had eased across the festive period, we expect those fears to be a central theme for the coming year.

Dollar Advances Despite Weaker Manufacturing PMI

The dollar moved broadly higher on Tuesday after being out of favour across recent weeks. Amid US – China trade deal progress and an improved outlook for the global economy flows out of the safe haven had been on the rise.

Whilst US manufacturing pmi disappointed, jobless claims were marginally better than forecast. Investors will now look to the minutes from the December Fed meeting for fresh impetus.

The dollar moved broadly higher on Tuesday after being out of favour across recent weeks. Amid US – China trade deal progress and an improved outlook for the global economy flows out of the safe haven had been on the rise.

Whilst US manufacturing pmi disappointed, jobless claims were marginally better than forecast. Investors will now look to the minutes from the December Fed meeting for fresh impetus.

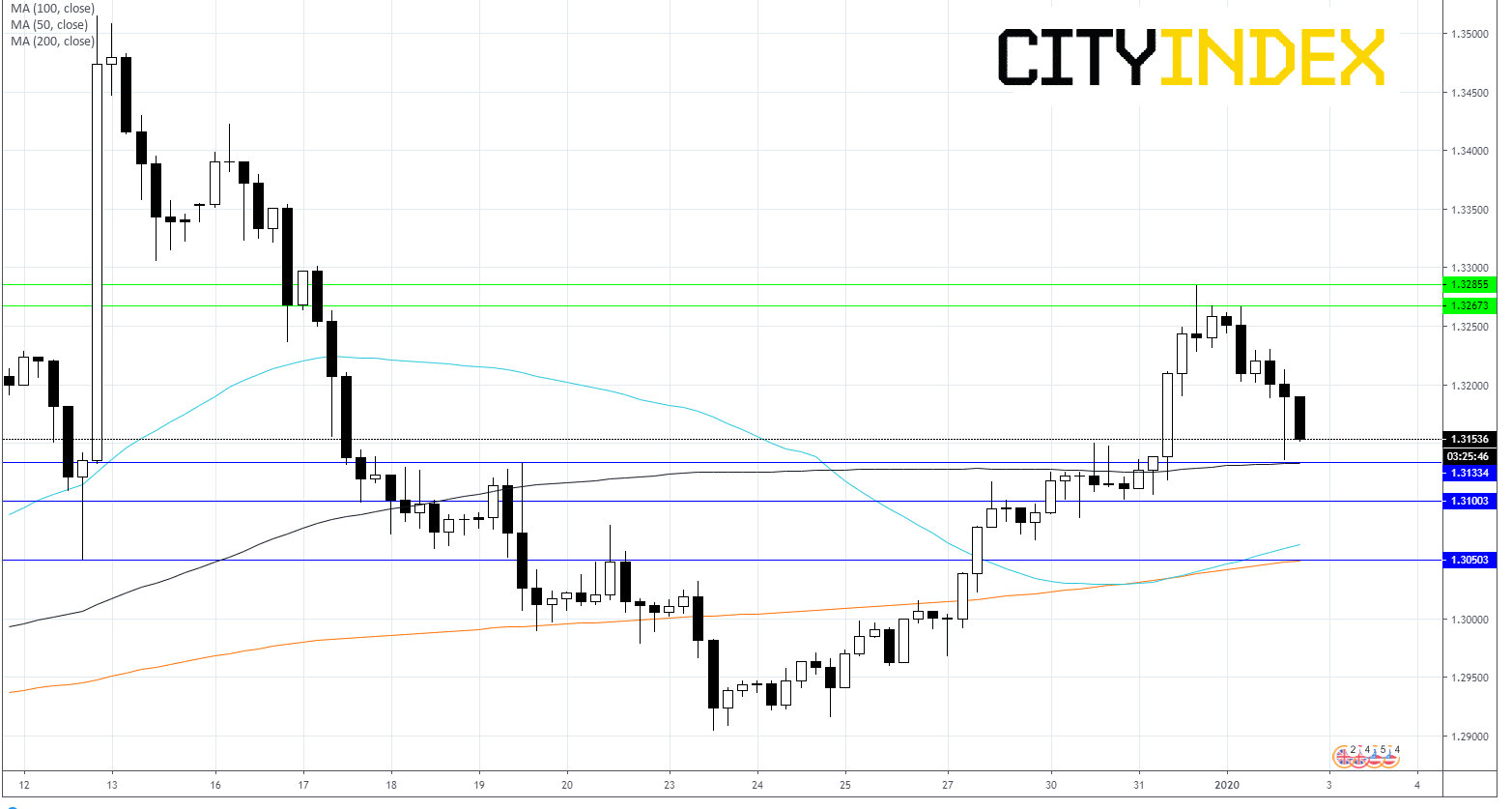

Levels to watch:

Following overnight selling, the leg lower could continue. The pair has broken through support at $1.32 which opens the door to $1.3133, the next level to watch, prior to $1.31 and $1.3050. A move above resistance at $1.3267 is needed to negate the bearish picture. Strong resistance can be seen at $1.3285.

Latest market news

Yesterday 08:33 AM