The unemployment rate in Britain remains defiantly at the historic low levels of 3.9%, rather than ticking higher to 4.2% as expected. That’s where the good news ends. Cracks are starting to appear in the UK labour market and they ain’t small.

The UK claimant count, so the number of people who signed up for unemployment benefits jumped by 94.4k, well ahead of the 10k forecast and after falling 28k in June. Just last month 81,000 jobs were lost in the UK, owing to the coronavirus crisis..

Suddenly we are starting to see some of those who had been in the no man’s land of furlough, start to appear in the statistics. This is a trend which is set to continue over the coming months as the government tapers its support from the job retention scheme.

As the government withdraws its support, these numbers will get worse. The BoE expects unemployment to reach 7.5%. So far this month we have heard big names across principally the hospitality sector and retail sector announce job losses. This will become more common as the 9 million furloughed either find themselves back in their place of work or in the dole queue.

Importantly consumption showed signs of returning to normality in July. Consumptions needs to pick up as the government withdraws support, in order for spending to be maintained and jobs kept.

Average earnings were also worse than forecast declining -1.2%, against -1.1% expectations.

Fears are rising that a post lockdown labour market crisis could hamper the so far solid economic recovery.

Fears are rising that a post lockdown labour market crisis could hamper the so far solid economic recovery.

GDP tomorrow

Attention will now turn to the UK GDP reading due tomorrow. Expectations are for a contraction in the region -20.5% after -2.2% decline in Q1. Investors will be particularly keen to see how quickly the economy is bouncing back. We know that in April GDP contracted -20.4%, in May it rebounded with a 1.8% gain. The reopening of non-essential shops in June spurred consumer spending and factories resumed productions. A strong June GDP reading could help pull the quarterly figures back into the high teens whilst boost optimism surrounding a V shaped recovery.

Attention will now turn to the UK GDP reading due tomorrow. Expectations are for a contraction in the region -20.5% after -2.2% decline in Q1. Investors will be particularly keen to see how quickly the economy is bouncing back. We know that in April GDP contracted -20.4%, in May it rebounded with a 1.8% gain. The reopening of non-essential shops in June spurred consumer spending and factories resumed productions. A strong June GDP reading could help pull the quarterly figures back into the high teens whilst boost optimism surrounding a V shaped recovery.

Chart thoughts

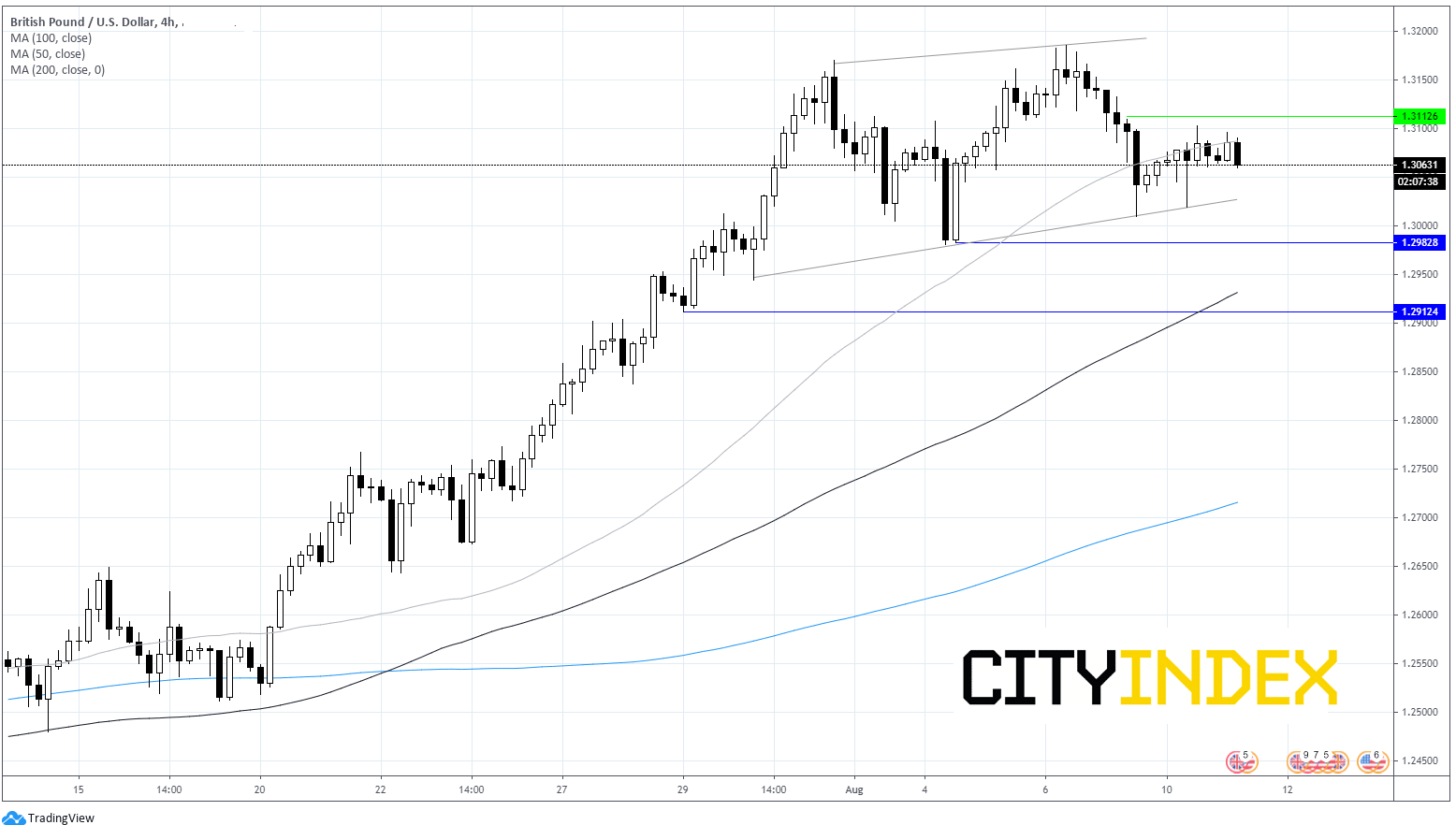

Following the release GBP/USD dropped lower, hit by the disappointment of such an elevated claimant count. From trading above $1.31 prior to the release, GBP/USD has skidded through the 50 sma on the 4 hour chart, although the ascending channel remains intact. Support can be seen at $1.3025, (ascending trendline) a breakthrough here could open the door to $1.2980 and onto $1.29. On the flip side, should GBP/USD push back above 50 sma at $1.3085, the pair could advance to $1.3115.

GBP/USD Chart

Latest market news

Today 08:15 AM