GBP/USD at Key 1.3000 before Employment Data

Tomorrow, the UK will release December’s Claimant Count Change for the month of December. The claimant change count is the number of new people who have applied for unemployment benefits. A higher number than the expectation is bad (more people unemployed) whereas a worse number is good (less people filing for unemployment.) This is different than the headline employment number released in many countries, as most show the number of new jobs added to the economy, not the number of people filing for unemployment claims. Expectations for the claimant count for December are for an increase of 26,000 new claims for unemployment benefits vs 28,800 in November.

In addition, Average Hourly Earnings for November are going to be released. Expectations are for 3.3% vs 3.5% last. Remember that this data is 2 months old, and before the elections, so it should be taken with a grain of salt. However, it is still the most recent employment inflation data we have.

This could be the last straw for the MPC if the data is worse. Inflation data last week was much weaker than expected. Retail Sales data was much weaker than expected. The MPC already has 2 dissenters who wanted to cut rates, and more have spoken recently with a more dovish tone. GBP/USD has been trending lower since the elections. These are all indications the market is looking for a possible cut when the BOE’s Monetary Policy Committee meets again on January 30th.

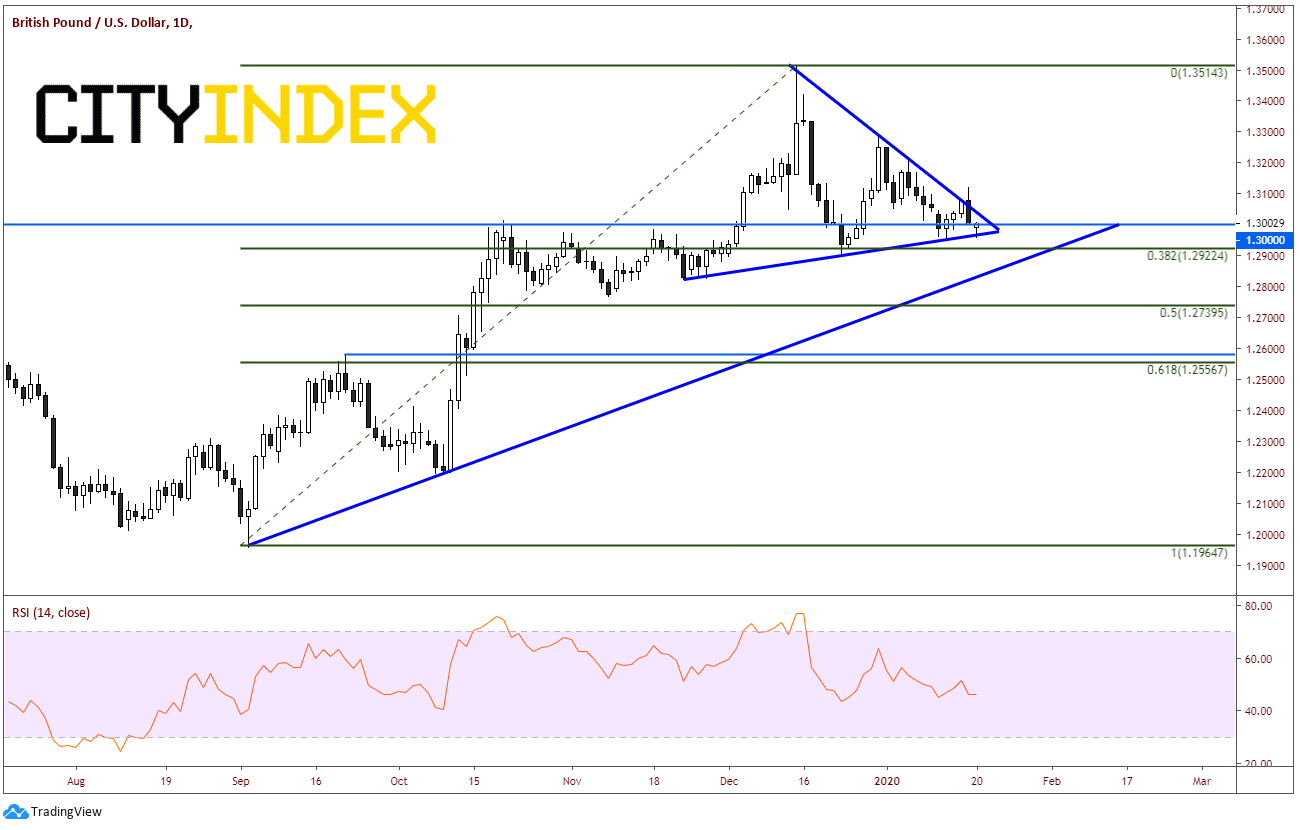

GBP/USD initially bounced as the exit polls showed Boris Johnson winning in a landslide victory, but the possibility of a hard Brexit and worse data has been helping the Pound move lower. It is currently trading at 1.3000. This has been a key inflection point since mid-October as this level has been used numerous times as both support and resistance. GBP/USD is currently as the apex of a symmetrical triangle going back to election day.

Source: Tradingview, City Index

The employment data will be key for the market and the MPC. If the data is better than expected, GBP/USD could trade higher from 1.3000, as expectations of a rate cut on January 30th may be reduced. However, if the data is worse than expected, the pair may continue to weaken as the expectations of a rate cut will increase.