The pound is struggling around the $1.28 mark following weaker than forecast UK service sector pmi data and amid speculation that the BoE could follow the Fed and cut interest rates. After the Fed’s punchy 50 basis point rate cut traders are attempting to gauge which central bank could be next.

Will the BoE cut?

Improved sentiment following the outright Conservative win in the December election was enough to convince the BoE to stand back from an interest rate cut in January. With business and consumer confidence rising, expectations for modest economic growth across the first half of the year had been penciled in. However, a corona virus epidemic could create a demand shock and choke that growth.

Improved sentiment following the outright Conservative win in the December election was enough to convince the BoE to stand back from an interest rate cut in January. With business and consumer confidence rising, expectations for modest economic growth across the first half of the year had been penciled in. However, a corona virus epidemic could create a demand shock and choke that growth.

The number of cases of coronavirus leaps to 85, up 34 from yesterday. The Chief medical officer for England said that a coronavirus epidemic in the UK was “likely”. The public is already traveling less. As the situation escalates, we can expect unnecessary travel and going to public places such as shopping centres, restaurants and bars to halt. This will hit demand for services and products, in addition to consumer confidence.

The next BoE MPC meeting is not until 26th March, which arguably gives the BoE plenty of time to see how coronavirus outbreak pans out in the UK. The BoE is considered to be less sensitive than the Federal Reserve to market moves which again supports the idea that the BoE could wait until the next meeting in late March to make an announcement.

Whilst a 25 basis point cut could support any economic slowdown caused by coronavirus, it also would mean that the BoE is running short of ammunition heading towards June when the UK could walk away from Brexit trade talks with the EU to prepare for a no trade deal Brexit.

Whilst a 25 basis point cut could support any economic slowdown caused by coronavirus, it also would mean that the BoE is running short of ammunition heading towards June when the UK could walk away from Brexit trade talks with the EU to prepare for a no trade deal Brexit.

Levels to watch

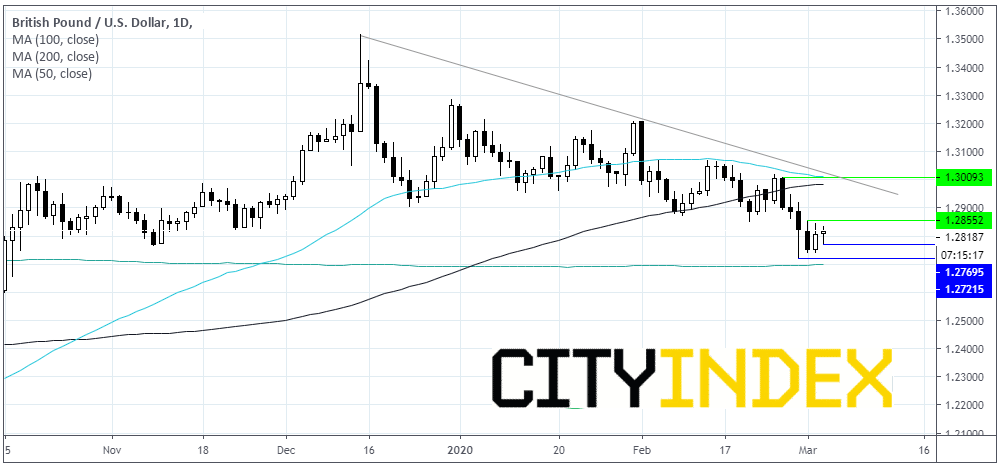

GBP/USD is holding steady at $1.28, in wait and see mode. Across the coming days it should become clearer as to whether efforts to contain the virus are working or whether the coronavirus outbreak will indeed become an epidemic, sending the pound back towards $1.25.

Immediate support is at $1.2770, $1.2725 and $1.2695 (200 sma).

Resistance can be seen at $1.2850 prior to strong resistance around $1.30 (trend line, 50,sma & 100 sma).

Latest market news

Yesterday 08:33 AM