You can’t help but feel sorry for the New Zealand cricket team after Sunday’s final against England, who became world champions for first time after an incredible win in the super over. While the kiwis agonisingly lost that particular fight, there is no doubt over who is winning the FX battle. The GBP/NZD has been trending lower since early May, mainly because of Brexit uncertainty weighing on the UK economy and the pound. Meanwhile, the New Zealand dollar has found some support as the Reserve Bank of New Zealand decided against cutting interest rates at its most recent meeting. And thanks to the publication of stronger-than-expected macroeconomic numbers from China overnight, the likes of the Aussie and kiwi have managed to extend their gains further.

This week could be even more important for the GBP/NZD, with both currencies likely to move sharply in response to fresh top tier data from New Zealand and the UK.

New Zealand CPI could impact RBNZ rate decision

Tuesday will kick off with the release of New Zealand CPI. Investors will be watching incoming data from NZ very closely after the RBNZ decided against cutting interest rates further last month. It held rates at a record low of 1.5%, opting not to play catch up with RBA’s 1.25%. Yet by reintroducing talk of a cut, they kept the door open easing in August. The RNBZ noted that the risks related to trade activity had intensified and with downside risks around employment and inflation outlook rising, a looser policy may be needed. This makes this quarterly CPI release very important. In the last couple of quarters, CPI barely grew with prints of +0.1% respectively. Another such reading, or lower, could seriously increase the odds of a rate cut in August. But a positive surprise is what trend-following market participants will be hoping for, as this could keep the pressure on the GBP/NZD. Analysts are expecting a 0.6% increase in quarterly CPI.

Potential weakness in UK wages and inflation eyed

As far as the UK is concerned, well things aren’t going too well at all here. After remaining stubbornly resilient, Brexit uncertainty has finally taken its toll on the UK economy after consumers and businesses repeatedly delayed their purchasing and expansion plans. With the economy deteriorating, traders will be monitoring incoming data closely while also keeping an eye on Brexit developments. As such, the publication of wages, inflation and retail sales figures over the next three days respectively could be very important for the pound’s near-term direction. Any signs of weakness could see speculators punish the pound hard as calls for rate cuts would grow, while any positive surprises could lead to a relief rebound.

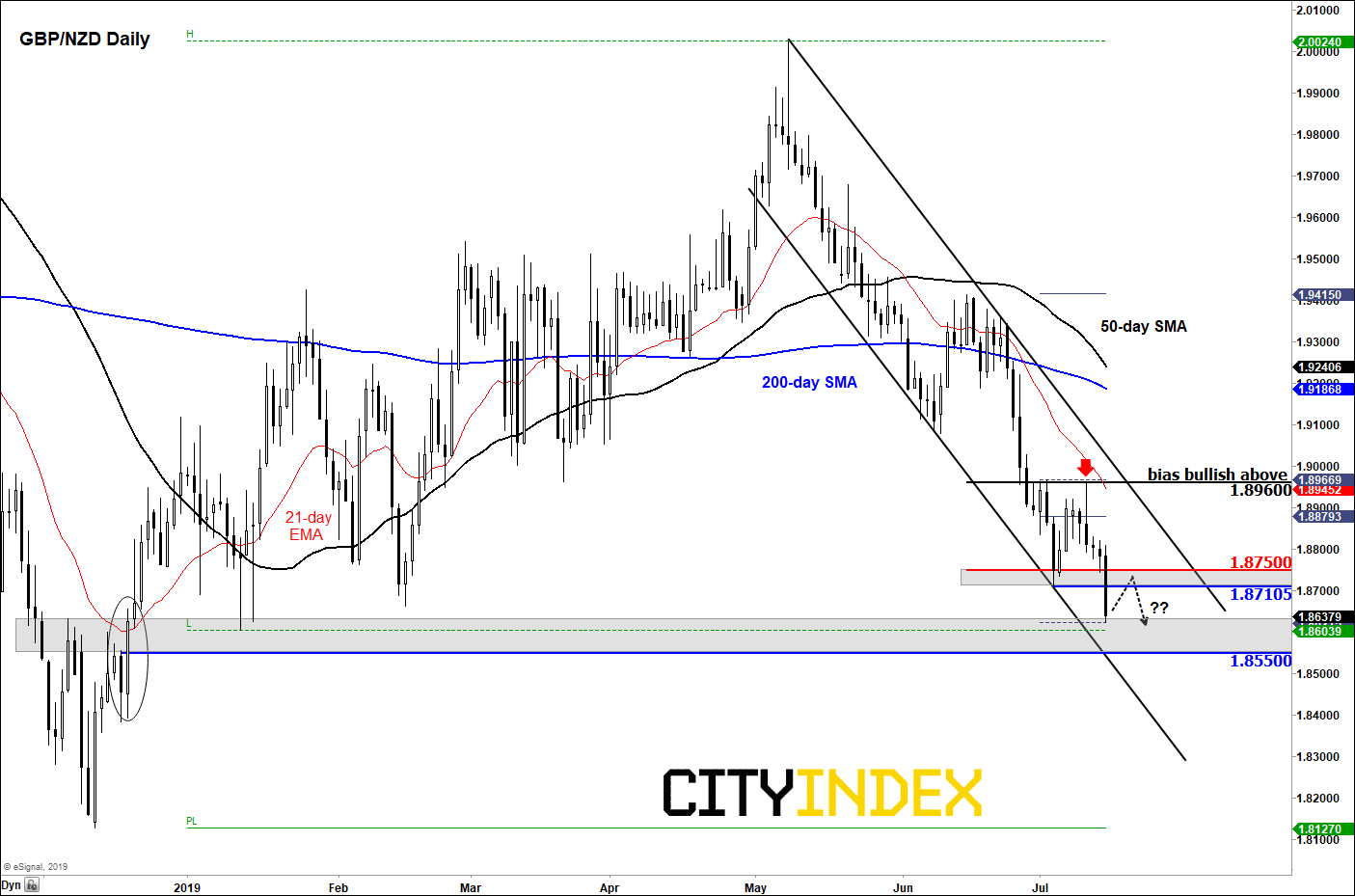

GBP/NZD declines inside bear channel

Ahead of the above the fundamental events, the trend is clearly bearish for the GBP/NZD. The cross is stuck inside a bearish channel, making lower lows and lower highs and the key moving averages are all pointing lower. After the latest drop, the GBP/NZD has almost taken out the January low at 1.86 after breaking support in the 1.8710-1.8750 region overnight. This area is now the first line of defence for the bears and so it represents a key resistance to watch. A potential support below the 1.86 handle could be at 1.8550, the base of the breakout in December.

Source: eSignal and City Index.