GBP USD Forms Bullish Correction Pattern

GBP/USD (daily chart) as of March 21, 2013 has settled into a potential bullish correction/reversal pattern in an inverted head and shoulders formation. While these […]

GBP/USD (daily chart) as of March 21, 2013 has settled into a potential bullish correction/reversal pattern in an inverted head and shoulders formation. While these […]

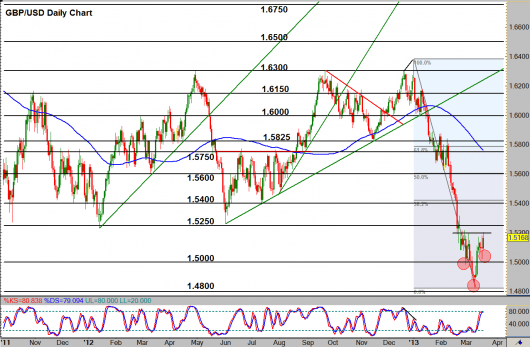

GBP/USD (daily chart) as of March 21, 2013 has settled into a potential bullish correction/reversal pattern in an inverted head and shoulders formation. While these types of patterns are often expected to reverse trends, they can also serve as indicators of potential corrections in a trend without the complete reversal. The current head and shoulders pattern may be just such an indication. The left shoulder in the beginning of March is at 1.4985, the head in mid-March is at 1.4830 (with a hammer candle reversal pattern), and the right shoulder just yesterday is at 1.5025. Within this pattern, the neckline breakout trigger is around the 1.5200 level.

With a neckline breakout, major resistance resides nearby in the 1.5250 area. Further to the upside is the key 1.5400 resistance objective, also around the 38.2% retracement of the downtrend from the 1.6376 high in January to the 1.4830 low in March. If the expected head and shoulders price target is to be reached, the low of the pattern at the head measured to the high of the pattern at the neckline can be projected to the upside towards the 1.5600 area, with is also the key 50% trend retracement.