GBP likes Brexit News: GBP/USD, EUR/GBP

In a duel over Brexit negotiations where something had to give, traders seem to think it has! Earlier, comments from EU negotiator Barnier that a deal is “within reach” if both sides “compromise” seem to be exciting GBP traders. After Boris Johnson had walked away from the table on Friday, it seems the EU is willing to get negotiations moving again. Current comments are calling for a deal by mid-November.

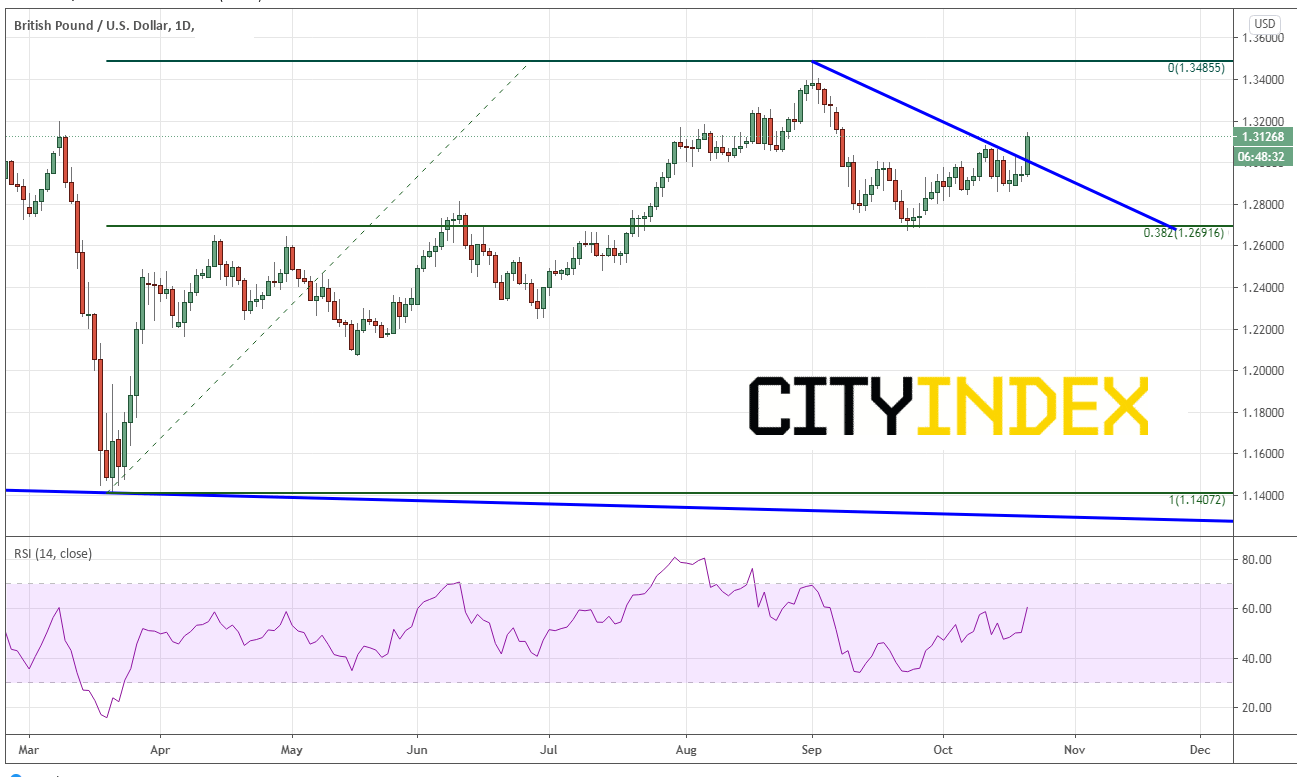

GBP/USD

Source: Tradingview, City Index

GBP/USD had pulled back to the 38.2% Fibonacci retracement level from the March lows to the September 1st highs near 1.2690 and bounced. Over the last week, the pair consolidated between 1.2875 and 1.3075 and traders waited for the next Brexit headline. Today, price broke out above the downward sloping trendline from September 1st.

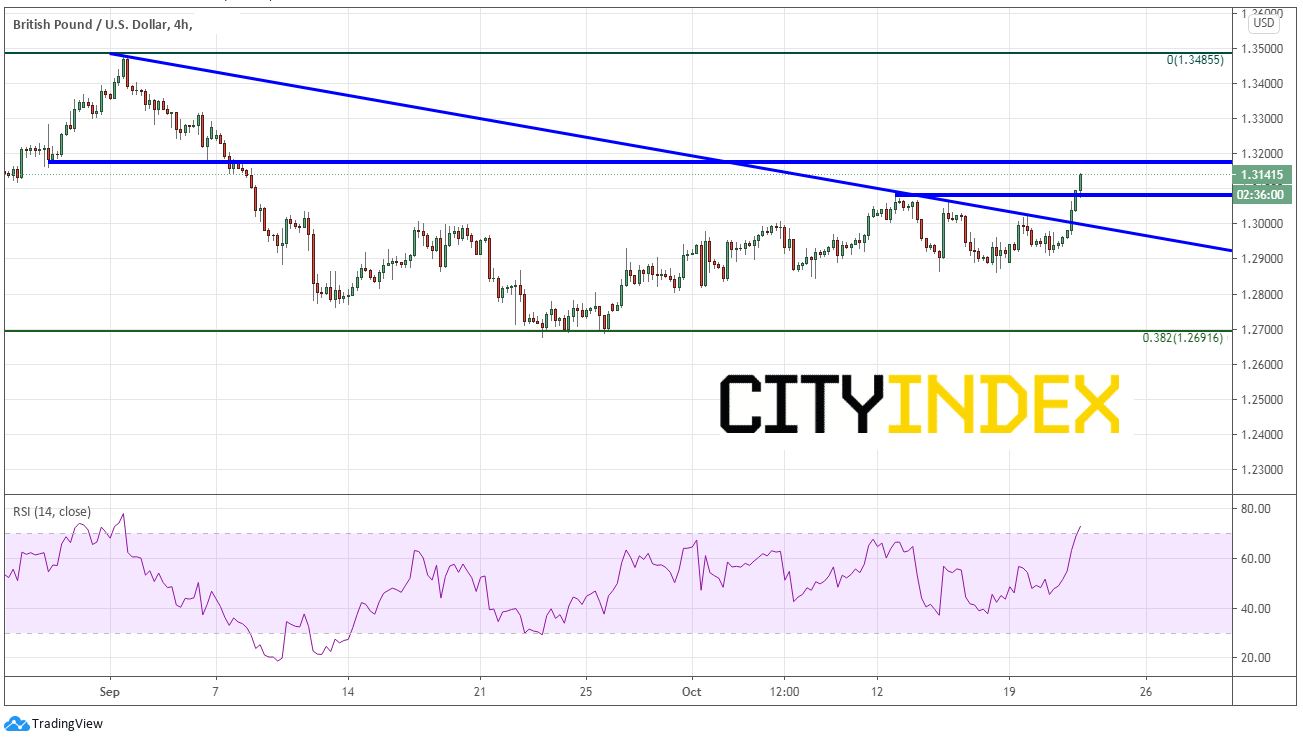

Source: Tradingview, City Index

On a 240-minute time frame, the RSI has moved into overbought territory indicating GBP/USD a could be ready for a possible pullback. Buyers will be looking to enter the market and there may be stops near 1.3082, which is the October 12th highs. Support below there is the downward sloping trendline from the triangle near 1.3000. First horizontal resistance is near 1.3175, where sellers/ profit takers may be waiting. However, if price breaks above, it could test the September highs near 1.3485!

EUR/GBP

Source: Tradingview, City Index

After breaking above a downward sloping channel yesterday (favoring the Euro), the news today as reversed price as it moved back into the channel (favoring GBP), taking out stops on long positions along the way. First support is the October 14th lows near .9007 and the 50% retracement level from the April 30th lows to the September 11th highs, near .8980. An upward sloping trendline from April 30th lows is just below there at .8950. First resistance is yesterday’s lows near .9080 and then yesterday’s highs near .9150.

When trading the GBP pairs, be careful of the headline risk. If news continues to be positive on negotiations, GBP will should remain bid. However, if the headlines change, traders should be ready for sharp pullbacks in the GBP pairs.