The Bank of England voted to keep interest rates on hold ay 0.75%. The MPC vote split was 7 – 2; a more hawkish vote split than what markets were expecting sending the pound shooting higher.

MPC members have decided to listen to the improvement in sentiment data, which has shown signs of a bounce following the decisive Conservative win in the elections. The committee will now watch closely to see whether the early indication of an improved outlook will translate into stronger hard data.

Whilst holding back on the rate cut, the BoE also slashed growth forecasts for the British economy to the lowest level since WWII.

- 2020 GDP revised to 0.8%, down from 1.2%.

- 2021 GDP revised lower to 1.4% down from 1.8%.

The move by the BoE reflected how the central bank viewed Britain’s adjustment after Brexit.

Whilst the BoE are cautiously optimistic over the state of the UK economy currently, there are still fears over how the UK will leave the EU. At the end of this year higher trade tariffs could cause a disruption to the economy. Brexit uncertainty dragged on the UK economy across the past year and could potentially continue to do so this year.

The BoE also added that interest rate policy in the short term “may need to reinforce the expected recovery of GDP growth, should more positive signals from recent indicators are not sustained.” In other words, should the hard data not reflect the improvement in sentiment, the BoE could cut rates.

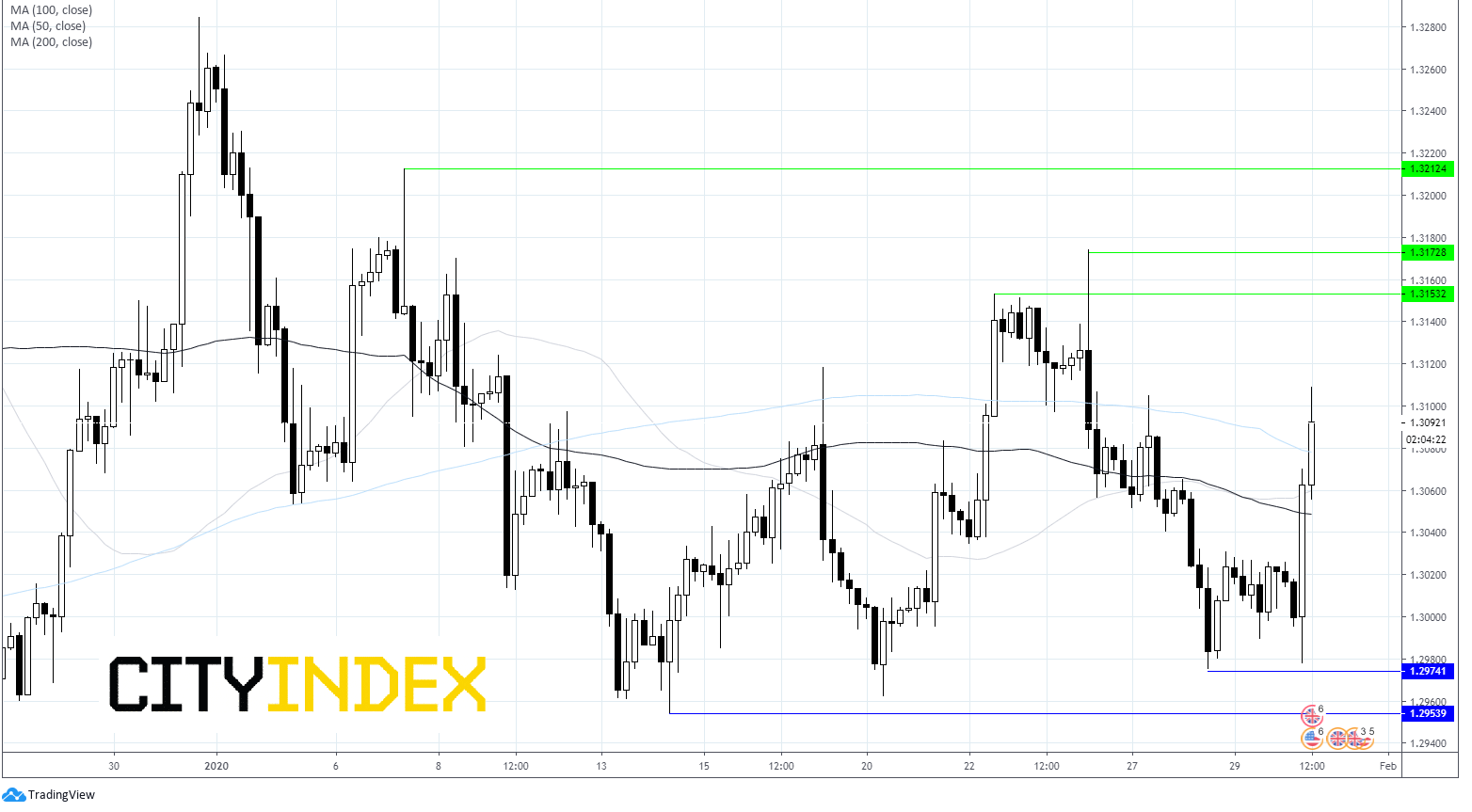

Given that the market was pricing in a 50% chance of a rate cut, volatility was expected either way. However the hawkish vote split and broadly upbeat sounding BoE lifted sterling.Prior to the announcement GBPUSD was flat around $1.3024. The pair surged to $1.3108 and is currently finding support around $1.31.

Traders will now look ahead to Brexit tomorrow. This is priced in, so no big swings are expected. However, it will refocus attention onto the complex trade negotiations ahead which could pressurise the pound.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM