GBP Higher as Brexit Rules

The Great British Pound is higher against most G-10 currencies after UK Prime Minister Boris Johnson and Ireland Taoiseach Leo Varadar met today. The 2 leaders declared they had a positive meeting and that a deal for an orderly Brexit can be done by the end of the month! Although GDP, Industrial Production, and manufacturing data out of the UK were worse than expected, Brexit continues to rule the markets.

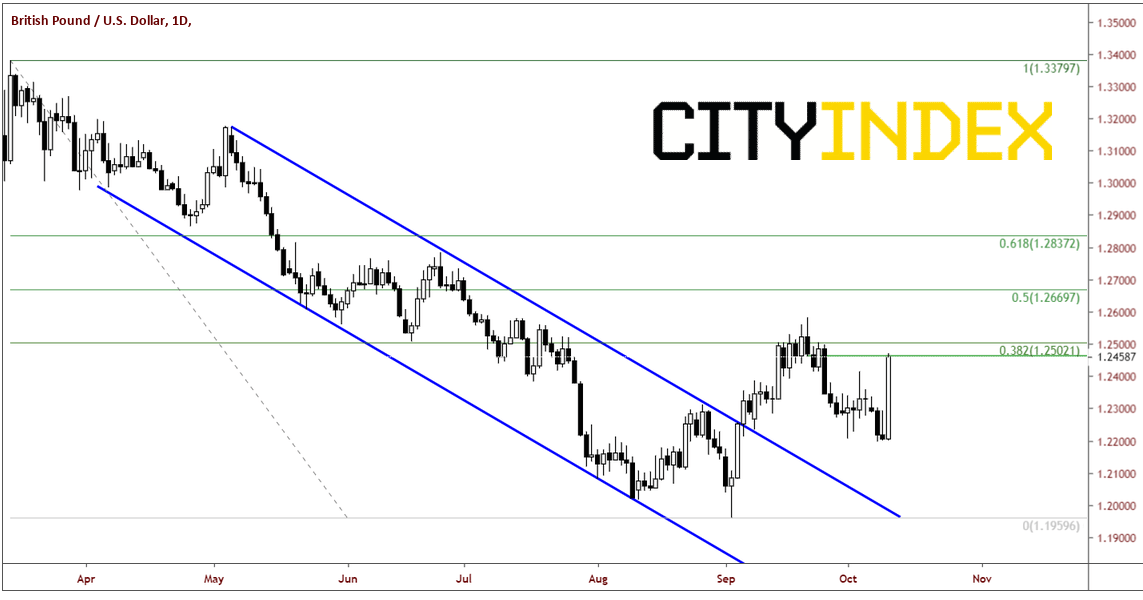

GBP/USD closed up nearly 250 pips on the day, or 2.0%. The pair halted its ascent at the September 20th lows and horizontal resistance and the lows at 1.2460. The 38.2% Fibonacci retracement level from the March 13th high to the September 3rd low sits just above at 1.2500. However, be aware that if a Brexit deal looks more and more likely to get done, GBP/USD could be at 1.3400 in an instant.

Source: Tradingview.com, City Index

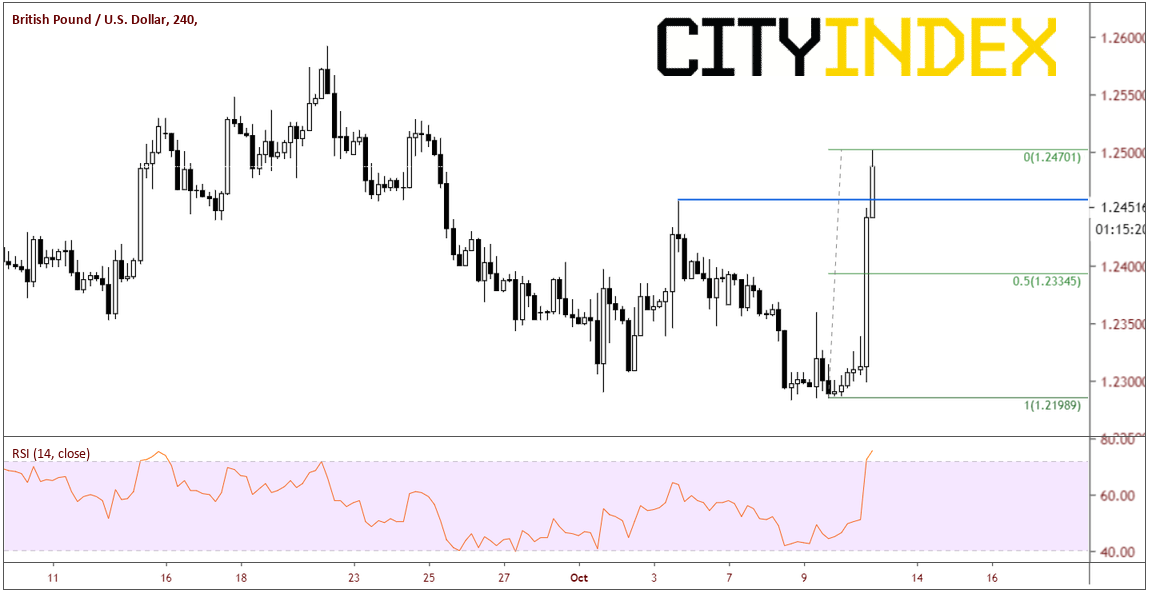

On a 240-minute chart, support is down at 1.2413. Next support is at 1.2335, which is a 50% retracement of today’s move. Don’t read too much into the RSI on the 240 minutes chart, as they tend not to be as reliable during fast markets.

Source: Tradingview.com, City Index

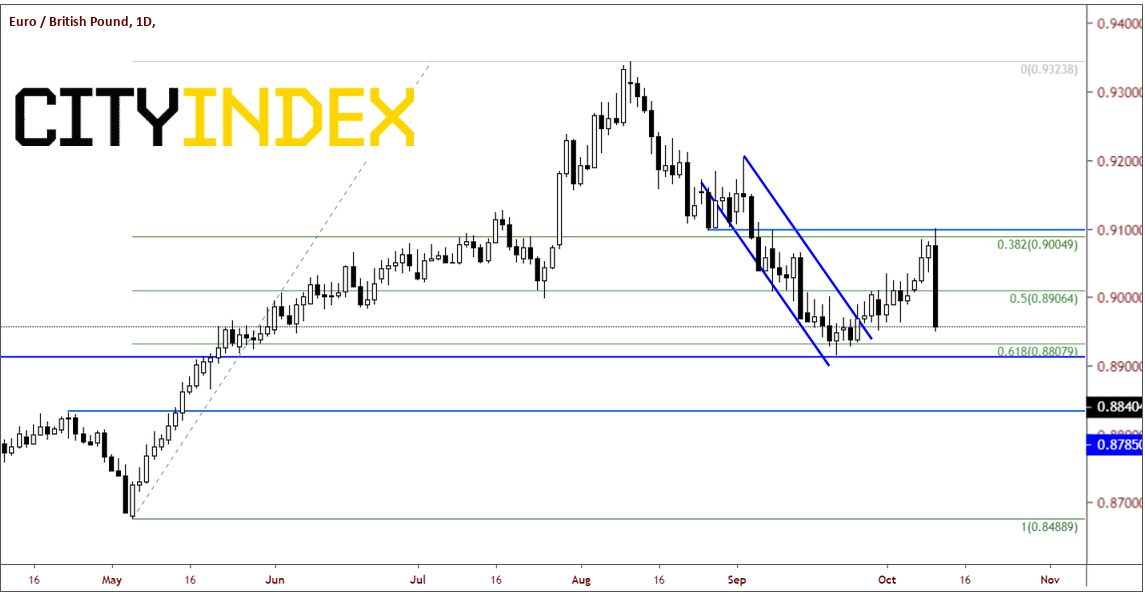

After bouncing around for a few months between the 38.2% Fibonacci retracement level and the 61.8% Fibonacci retracement level from the May 6th lows to the August 12th highs, EUR/GBP ran right into horizontal resistance at .9018 and fell off dramatically from there. Price is back the bottom of the range, closing down 1.7% on the day. First support is the September 20th lows near .8786. Below that, horizontal support comes in at .8982.

Source: Tradingview.com, City Index

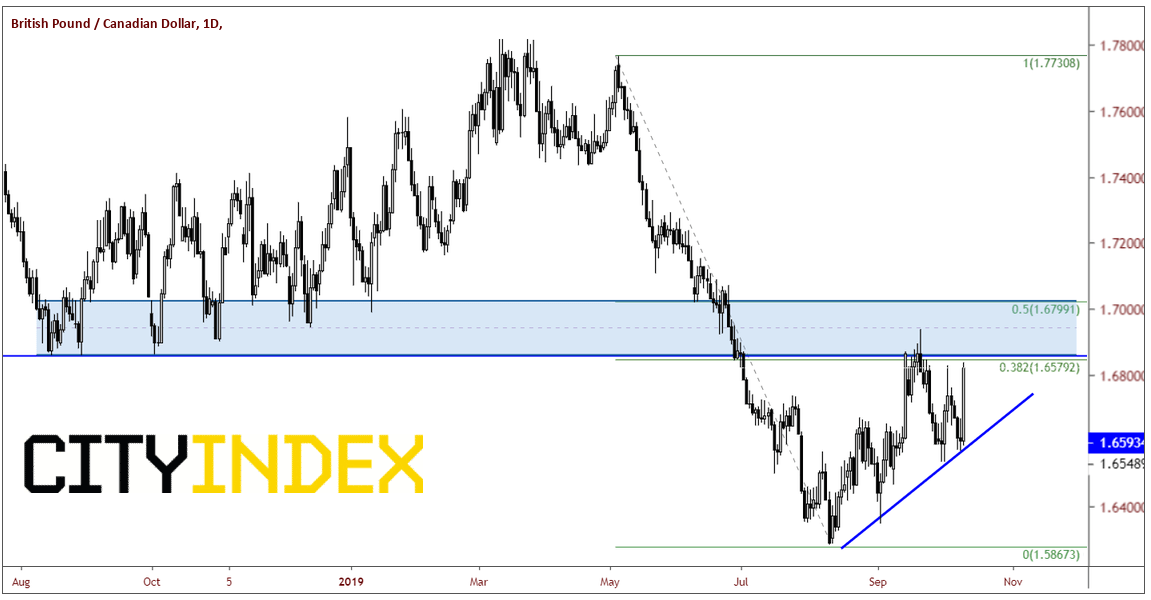

GBP/CAD also traded higher, up 1.8%, near 1.6563. This is just below horizontal resistance and the 38.2% Fibonacci retracement level from the May 3rd high to the August 8th low at 1.6579. There is actually a large resistance zone between the 38.2% and 50% Fibonacci retracement levels, as there are a number of prior lows in that area, which now act as resistance. First support comes in at 1.6403, which is 50% of today’s trading range. Below that, horizontal and trendline support come in near 1.6336.

Source: Tradingview.com, City Index

GBP/AUD and GBP/NZD also closed up nearly 1.5% for the day. Note that these 2 currency pairs will not only be greatly affected by Brexit, but also by US-China trade talks. The Australian dollar and the New Zealand dollar are greatly affected by China. These pairs could remain volatile over the next few weeks!