Sterling dropped sharply last night following the release of the latest YouGov poll which shows that the Tory’s lead is receding. The highly regarded MRP poll shows that the Conservative advantage has slipped from 68 to just 28 seats. This is the poll that correctly predicted a hung Parliament in 2017 and indicates that the scenario could repeat itself given that many constituents are hard to call.

The sharp selloff in the pound gives us a taste of what could be to come. Should the Conservatives win an overall majority sterling gains are expected to be less pronounced than in the case of a hung Parliament or a Corbyn victory. These are outcomes which are considered less market friendly either due to the Brexit impasse continuing or in the case of a labour government, economic policy concerns. There would be a less pronounced gain on a Tory majority because the market is anticipating this outcome; a market friendly outcome.

Scenarios:

1. Large Conservative Majority (by 30 plus seats)

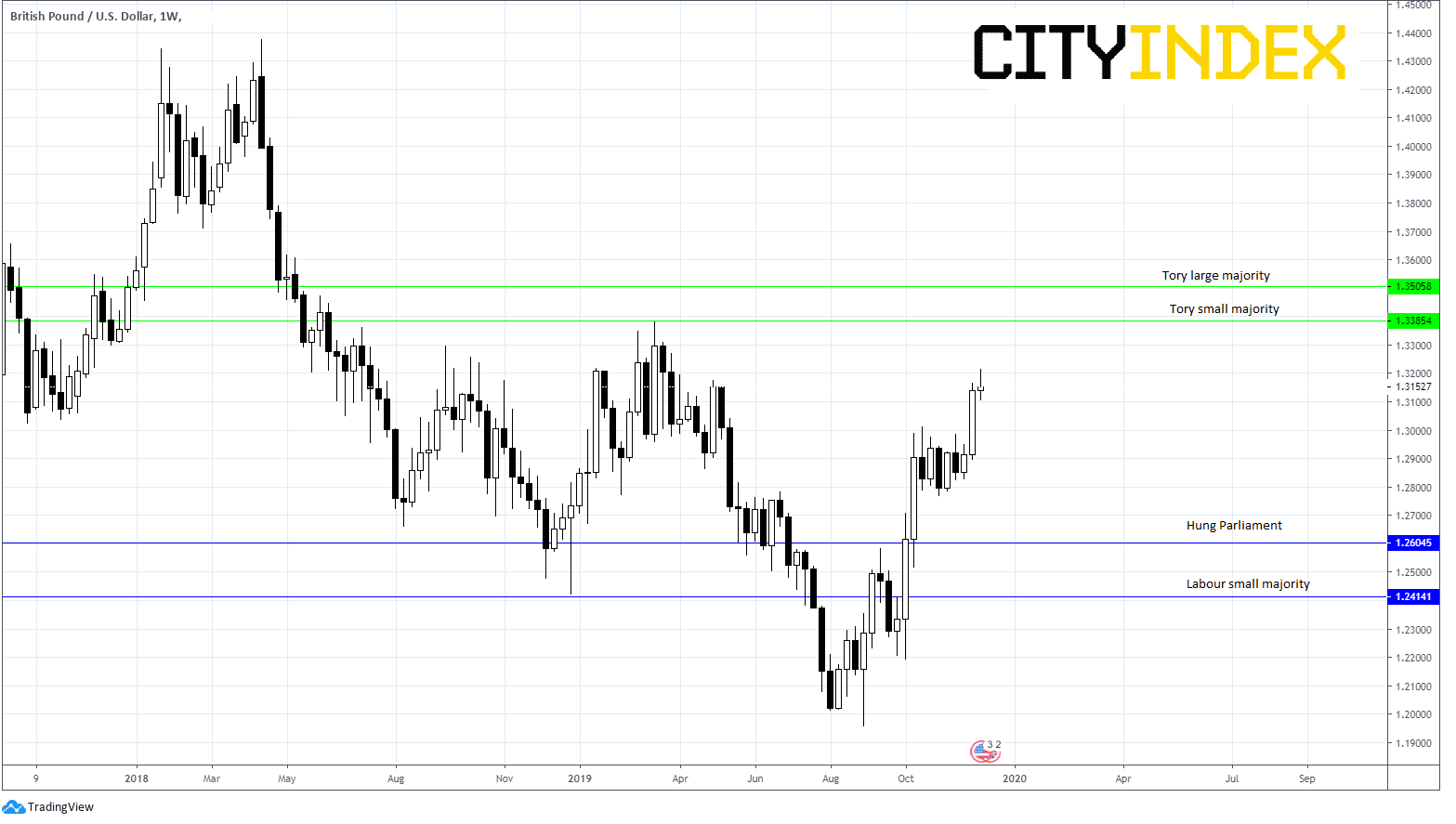

This is the most market friendly outcome and could see sterling extend its gains. A high Tory majority would mean reduced uncertainty over Brexit and the transition period. The pound could advance towards 1.35 in the near term.

This is the most market friendly outcome and could see sterling extend its gains. A high Tory majority would mean reduced uncertainty over Brexit and the transition period. The pound could advance towards 1.35 in the near term.

2. Smaller Conservative Majority

The pound could advance but gains would be limited. Whilst the Withdrawal Agreement would be passed through Parliament concerns would arise over whether an extension to the transition period would be agreed in 2020. Looking beyond the election result, historically the pound has underperformed in small majority governments.

The pound could advance but gains would be limited. Whilst the Withdrawal Agreement would be passed through Parliament concerns would arise over whether an extension to the transition period would be agreed in 2020. Looking beyond the election result, historically the pound has underperformed in small majority governments.

3. Hung Parliament

The prospect of Brexit being done early next year would evaporate and the pound would price in further Brexit uncertainty taking it back to 1.26

The prospect of Brexit being done early next year would evaporate and the pound would price in further Brexit uncertainty taking it back to 1.26

4. Labour Small Majority

This is the least market friendly outcome given market concerns over Labour’s nationalisation and fiscal policies, in addition to further Brexit uncertainty. The market is not pricing in a Labour win.

Will we see an impact on other G10 currencies?

If there is any spill over we expect it to be short lived given that Brexit is a domestic event. Post the Brexit referendum, the US dollar and Japanese yen outperformed, whilst the euro came under pressure.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM