After two weeks of extraordinary volatility, the likes of which haven’t been seen since 1929, the Dow Jones traded an inside day, meaning its daily range was within the previous days high and low for the first time since the equity meltdown began in mid-February.

The Dows 188 point gain dwarfed by the gyrations over the previous eight sessions of at least 1000 points or more, prompting the question, have the measures undertaken by policymakers and central bankers reached a scale large enough to convince the markets collective psyche that the global economy can weather the Covid-19 storm. Or is this the calm before the next storm?

There is a range of considerations here. On the virus front, there are a host of theories as to whether the virus can be contained or whether its spread will continue. The truth is no one knows and this remains a dark cloud to be sure. Another dark cloud on the horizon would be U.S. Congress failing to pass the $1.2 trillion fiscal stimulus package in quick time. If the bill is not passed by very early next week, I would expect to see stocks retest recent lows.

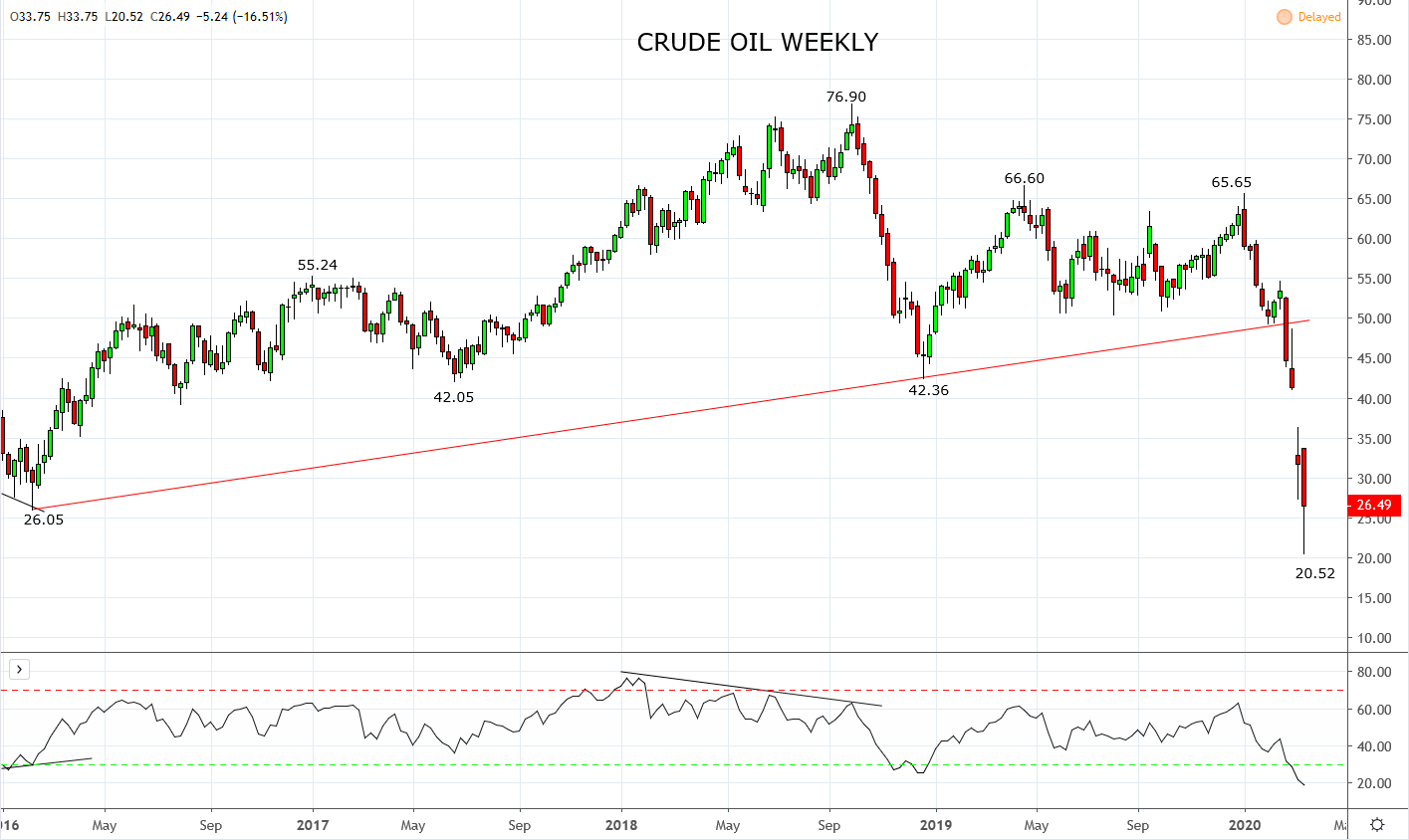

Finally, when we look to when stocks started accelerating to the downside it was two weeks ago after Russia blocked OPECS plans for a supply cut. A price war followed, taking oil to near U.S $20, its lowest level since 2002.

Overnight, crude oil gained +25% after President Trump indicated he was looking for the “medium ground” in the ongoing dispute between Russia and Saudi Arabia and this followed President Trump's tweet last week he would look to fill the U.S. Strategic Petroleum Reserve at current prices.

When viewed on the weekly chart below, there is ample room for crude oil to trade higher towards the “gap” near U.S $35.00. More so if the Saudis and Russians can agree to mend fences for their mutual benefit, thereby helping to bring some much-needed stability to global equity and asset markets as a whole.

Source Tradingview. The figures stated areas of the 20th of March 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation