G4S stock shows signs of a comeback after swing to first half profit

G4S plc. shares have traded at the top of the FTSE 100 Index today (Wednesday, 13th August), continuing their recent good run after first half […]

G4S plc. shares have traded at the top of the FTSE 100 Index today (Wednesday, 13th August), continuing their recent good run after first half […]

G4S plc. shares have traded at the top of the FTSE 100 Index today (Wednesday, 13th August), continuing their recent good run after first half results beat expectations. This marks a recovery after the firm reported a loss during the same period last year.

The world’s largest security business posted pre-tax profit of £85m compared with a pre-tax loss of £94m reported at the same point a year ago.

The group said operating profit was £185m, ahead of a consensus forecast of £177m, led by strong demand in emerging markets.

G4S, like its outsourcing peer Serco, has been engaged in rebuilding its reputation following a series of scandals which culminated in G4S being named and shamed by the government for apparently fraudulent business practices.

The results of an official investigation released late last year into £5.9bn of outsourcing contracts held by G4S and Serco Plc. showed evidence of inconsistent management in 22 out of the 28 deals across eight UK government departments and agencies.

Both Serco and G4S remain under investigation by the Serious Fraud Office.

All in all though, both Serco (which reported first-half results on Tuesday) and G4S have taken significant steps forward in the process of their corporate rehabilitation, including strategic reviews and disposal programmes.

Read more about G4S’s earnings here and more about the background to the rise in G4S’s stock last week here.

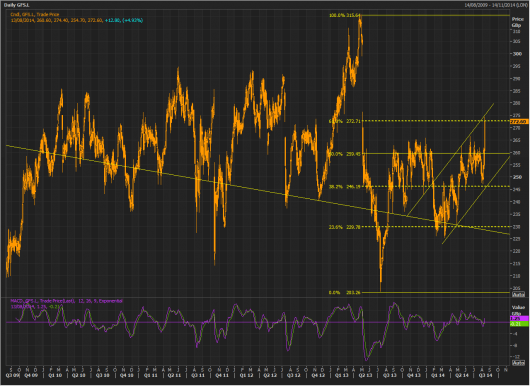

The stock may right now be getting its best chance for months to recover from a cataclysmic collapse off five-year highs near 315.64p reached at the end of February 2013.

The bottom of that decline came at 203.26p in April of the same year.

As can be seen from the chart, a strong rebound this year has taken the stock up to the 61.8% retracement level—perhaps the most pivotal of all in the Fibonacci series.

For greater confidence of a sustained rising trend, I would prefer to see the price break out of its rising channel on the upside. Prices would need to continue rising past the current 4.9% gain on the day at 272.60p.

Failure would re-introduce risk of slippage back to 260p in the medium term and perhaps even a fall down to the base of the current up-leg around 247.20p, or lower.