This time last week the Federal Reserve announced a series of monetary easing measures, the like never seen before. Not to be outdone, just a few days later U.S. Congress signed into action a U.S. $2tn economic relief package, equivalent to 10% of U.S. GDP. Before the ink was even dry, rumours of a fourth stimulus package had begun to circulate.

Locally, the Australian Government announced over the weekend that residential and commercial landlords will be banned from evicting tenants under financial stress for six months. This is expected to be followed by news in coming days the government will subsidise by as much as 75-80%, the wage bills of businesses placed into “hibernation.”

The effects of such government and central bank measures have been to provide a layer of insulation to asset markets against the headline shocks provided by Covid-19. An example being the lack of reaction to the 3.28m jump in initial jobless claims in the U.S. last Thursday, providing further evidence to our view that volatility has peaked.

That said, we do have one eye nervously focussed on a possible spike in volatility due to end of month and end of quarter rebalancing flows. As mentioned last week, there is likely to be large inflows into equity markets at the expense of the bond market. As part of this rebalance, FX hedges will also need to be adjusted.

The risk of a larger than usual FX rebalance, prompted the Global Foreign Exchange Committee (GFXC) to send the following warning to institutional market participants late last week.

“Given the intense volatility seen in global financial markets this month, it is possible that FX market participants may execute larger than usual FX volumes during end-of-month benchmark fixings. In addition, FX market participants may face more operational constraints reflecting lockdown in some financial centres. In light of these possible developments, significant volatility and price movements may be observed during FX fixings in the coming days.”

I generally avoid trading over month-end, due to higher than normal volatility and the unpredictable nature of rebalancing flows. Because of the huge moves experienced in asset markets this month and because liquidity in the FX space is yet to return to more normal levels, fellow FX traders may wish to tread an extra cautious path over the next 48 hours.

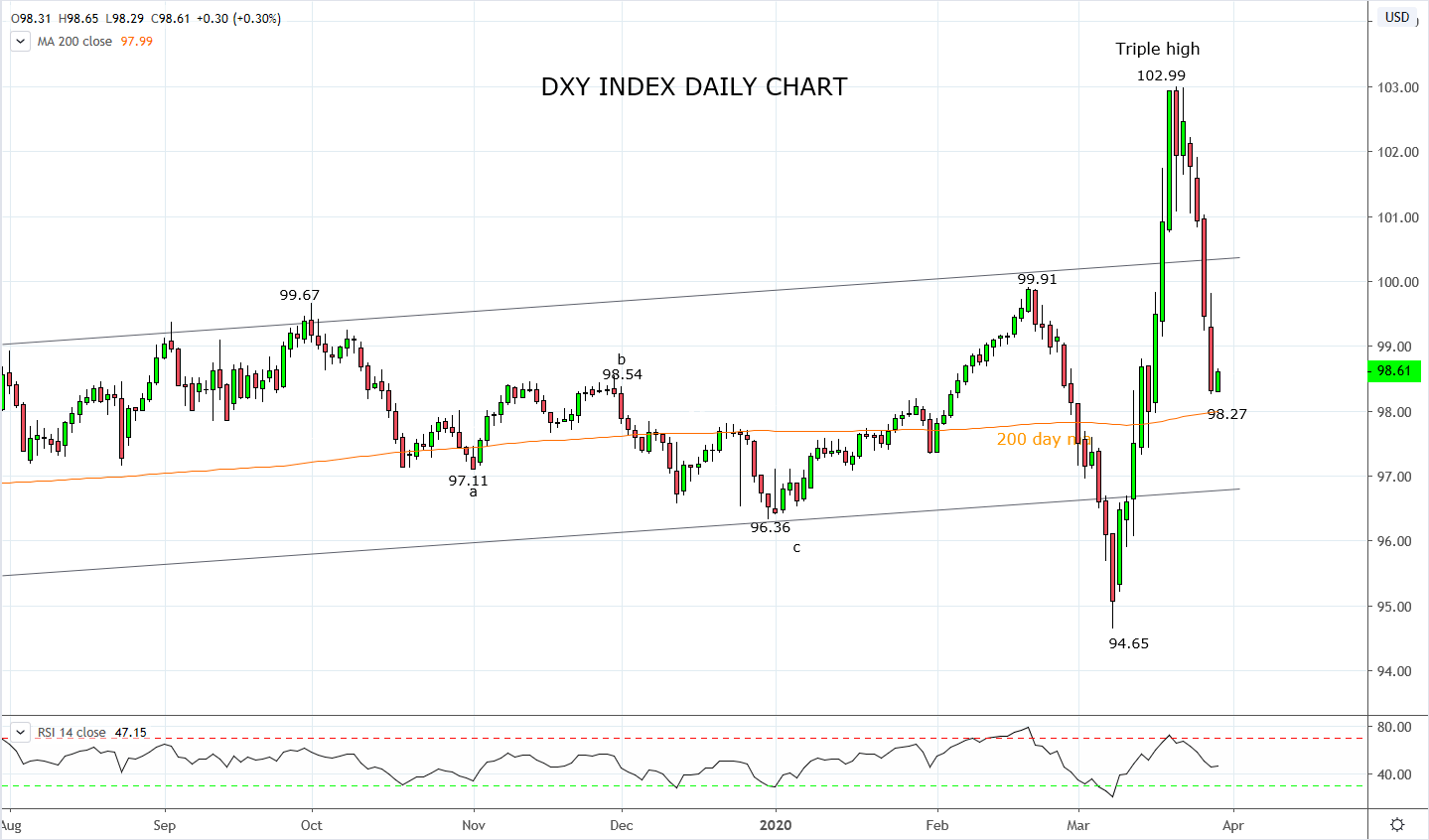

Source Tradingview. The figures stated areas of the 30th of March 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation