FX Rates could be Quiet until PMIs and Jackson Hole Later this Week

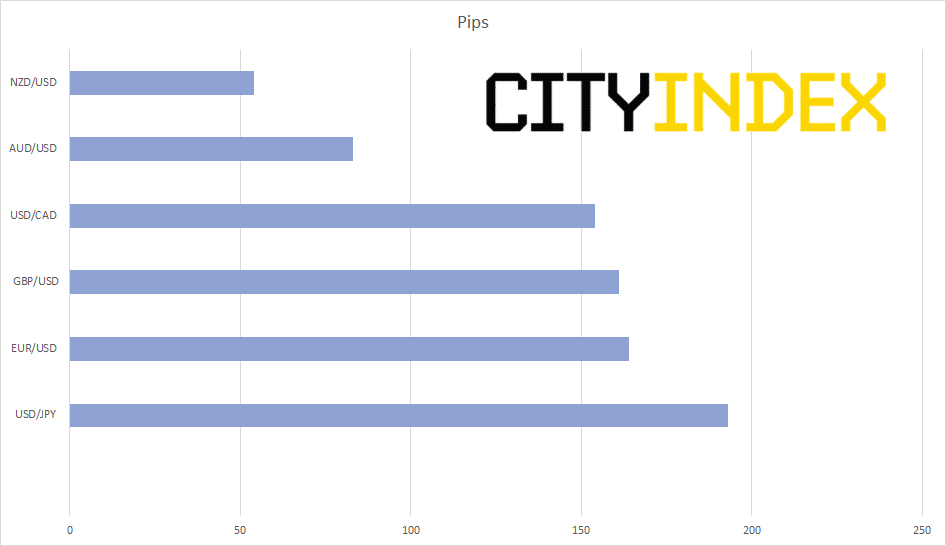

For all the negativity in the markets last week, such as possible recessions, inverted yield curves, worsening of trade wars, protests in Hong Kong, and the results of the primary elections in Argentina, major USD fx pairs have been in relatively tight ranges. Below are the ranges of some of some major currency pairs for last week:

Source: City Index

These tight ranges were despite Fixed Income screaming higher, and stocks and gold moving lower.

This week begins in similar fashion for USD pairs, with minimal movement in the aforementioned pairs. So what is it going to take to get volatility back into these pairs?

We may have to wait until later in the week to find out. On Thursday, PMIs are due out, and on Friday, Fed Chair Powell is due to speak at the Jackson Hole symposium. These events could spark volatility in the USD major FX pairs.

PMI stands for Purchasing Managers Index. A reading above 50 is considered to show economic expansion, and a reading below 50 is considered to show economic contraction. The expectation for Germany is 43.0. This is already is low expectation, and any actual reading worse than this could send the Euro aggressively lower. Expectations for the Eurozone as a whole is 46.3 (although the German number is more closely watched), and expectation for the US is 50.5.

Chairman Powell is speaking at 10:00am EST on Friday at the Jackson Hole symposium. Although we’ll get a glimpse into the Fed’s thinking on Wednesday when the FOMC meeting minutes are released, the minutes are backward looking. Therefore, it will be more important what Powell has to say on Friday regarding the Fed’s current outlook. There are many answers the market will be looking for out of Powell on Friday: Is the Fed worried about an inverted yield curve? How worried is the Fed regarding the US-China trade war? How concerned is the Fed about a global manufacturing slowdown? If Powell’s comments are more dovish, the US dollar may move lower.

Regardless of the direction of the currency pairs, we may have to wait until Thursday and Friday to see the volatility.