FX Handover: FOMC Dominates Markets During A Lively Asia Session

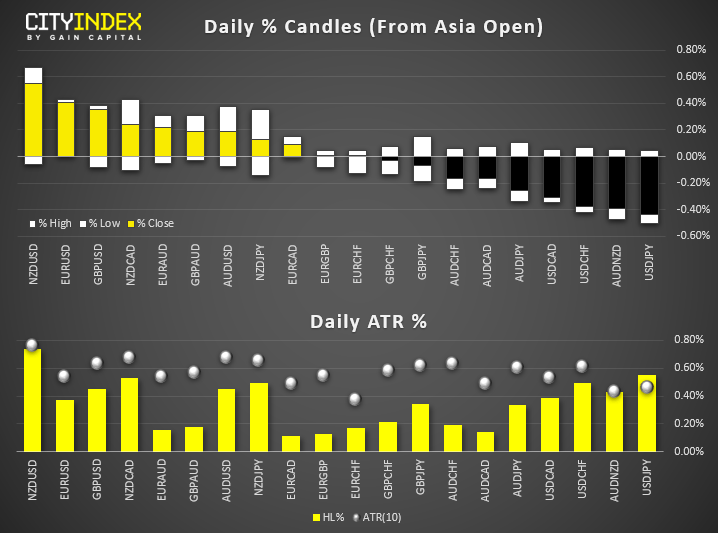

- The dovish FOMC meeting continued to weigh on the US dollar throughout Asia, seeing USD/JPY drop to its lowest level since the January flash crash.

- RBA’s Lowe hammered home the likelihood of another cut, saying it’s unrealistic to think 25bps cut can alter growth, it’s not unrealistic to expect a further reduction in cash rate and the possibility of a lower cash rate remain on the table.

- Australian yields hit fresh record lows with the AU2 and 10yr yields falling to 0.93% and 1.29% respectively. The ASX200 pushed to a fresh post-GFC high and hones-in on the all-time high.

- AUDNZD fell to its lowest level since early April. Better than expected GDP data from NZD and expectation for RBNZ to hold next week have weighed on the cross.

- Asian caught the tailwind from the FOMC meeting, trading mostly higher led by Singapore and Hong Kong.

- Gold is on track for tis most bullish week in 3 years, after spiking higher to $1392, its highest level in five years.

- Trump is to meet with Putin at the G20 meeting next week.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM