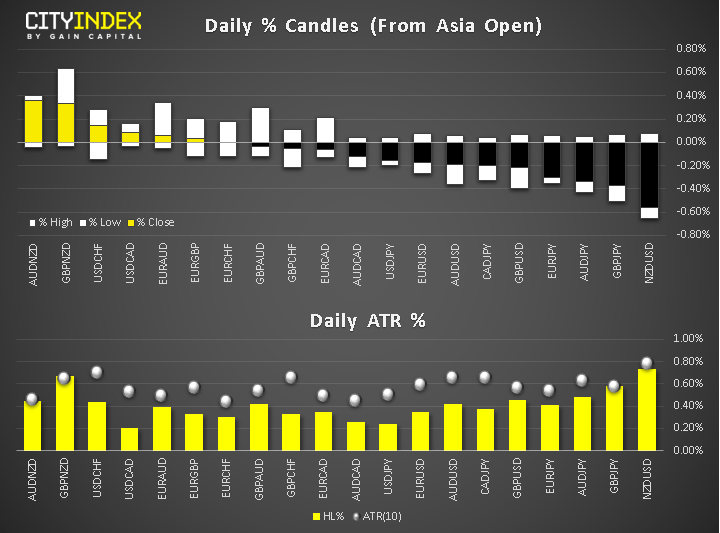

- As US traders enter the fray, the Japanese yen is among the strongest currencies amid safe haven flows, as fresh industrial data from China further raised global growth concerns. Gold and bond prices rose and yields fell further along with stocks.

- NZD slumped on weak manufacturing PMI data from New Zealand overnight - activity barely expanded at 50.2, this was the slowest rate since December 2012.

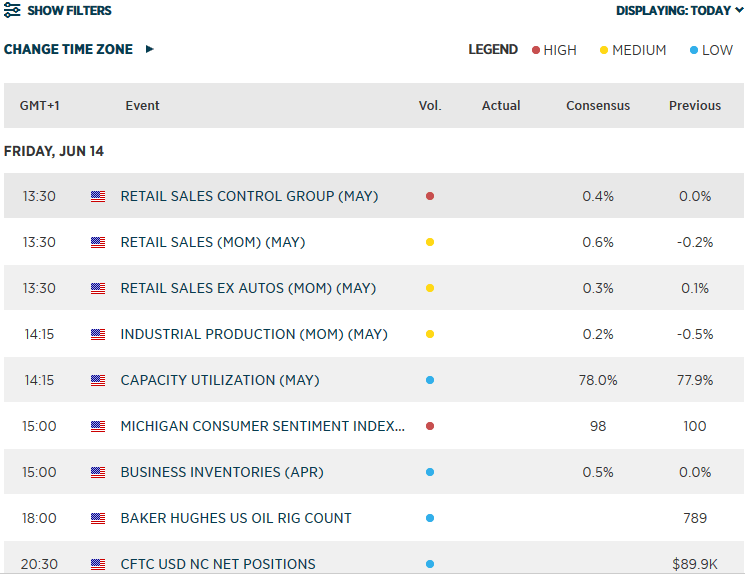

- Investors are watching US retail sales – any weakness here could see the dollar take another leg lower with the buck holding its own slightly better this week after last week’s slump (except against yen and gold, of course).

Latest market news

Yesterday 01:03 PM

Yesterday 12:52 PM

Yesterday 12:11 PM

Yesterday 07:49 AM