FX Handover: US and China ‘Tentatively’ Agree Trade Truce Ahead Of G20

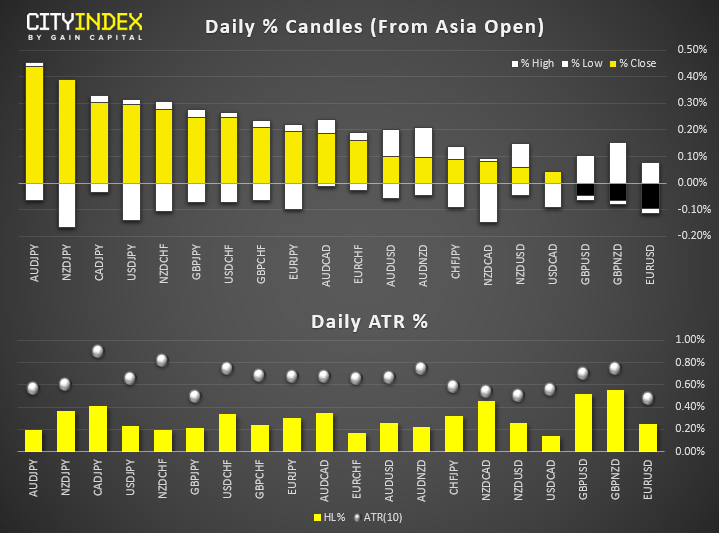

- US and China have ‘tentatively’ agreed to a trade truce ahead of the G20, lifting sentiment and risk assets with it. Asian equities trade broadly higher and JPY and CHF are today’s weakest majors. Yields are also higher, with the US10Y briefly toughing a 4-day high. Still, as this is just a ‘tentative’ truce and not a deal, markets trade cautiously higher and volatility remains capped.

- Clearly not happy with less dovish than desired comments this week, Trump claims he has a right to demote or fire Powell, saying he’s doing a “bad job” and “out to prove how tough he is”.

- The US and North Korea are reported to be arranging a 3rd summit behind the scenes. Separately, reports have also surfaced that North Korea has detained an Australian man after friends claim he has gone missing, which risks inflaming tensions between the two nations.

- Chinese industrial profits rose 1.1% in May, Japanese retail sales expanded 1.2% YoY as expected, and New Zealand’s business outlook fell in June, with 38.1% of respondents expecting the economy to deteriorate over the next 12 months.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM