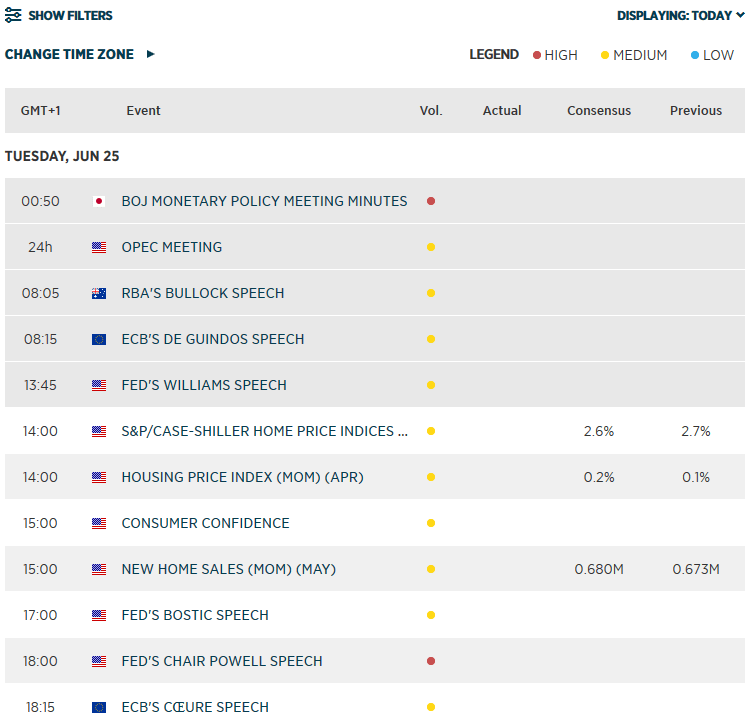

- Short-covering had helped to boost the dollar after its multi-session falls following the Fed’s dovish hold last week. Safe haven assets which had rallied sharply overnight were on the retreat with gold coming off its multi-year overnight highs although yen was still in the positive. Franc was the weakest.

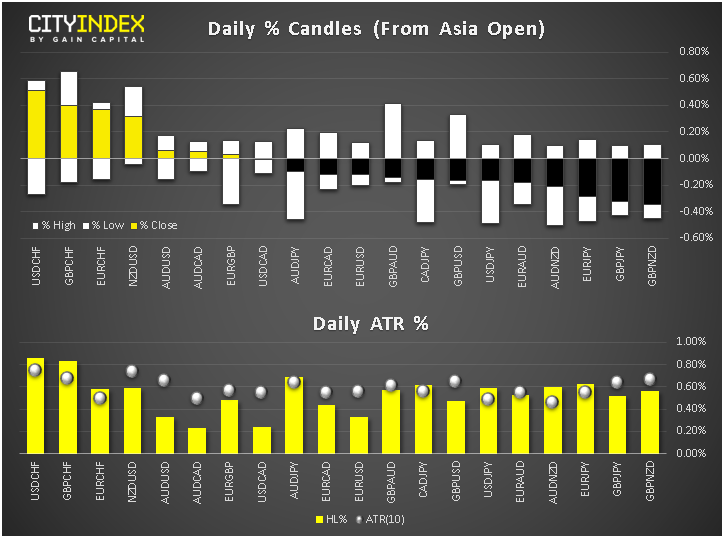

- Most majors had already created daily ranges consistent with their ATR (10), meaning dollar’s bears may see this as an opportunity to re-enter at better levels as we head to the start of the US session.

- We think stocks could resume higher this week, with investors likely to anticipate a positive outcome from the G20 meetings regarding US-China trade spat.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM