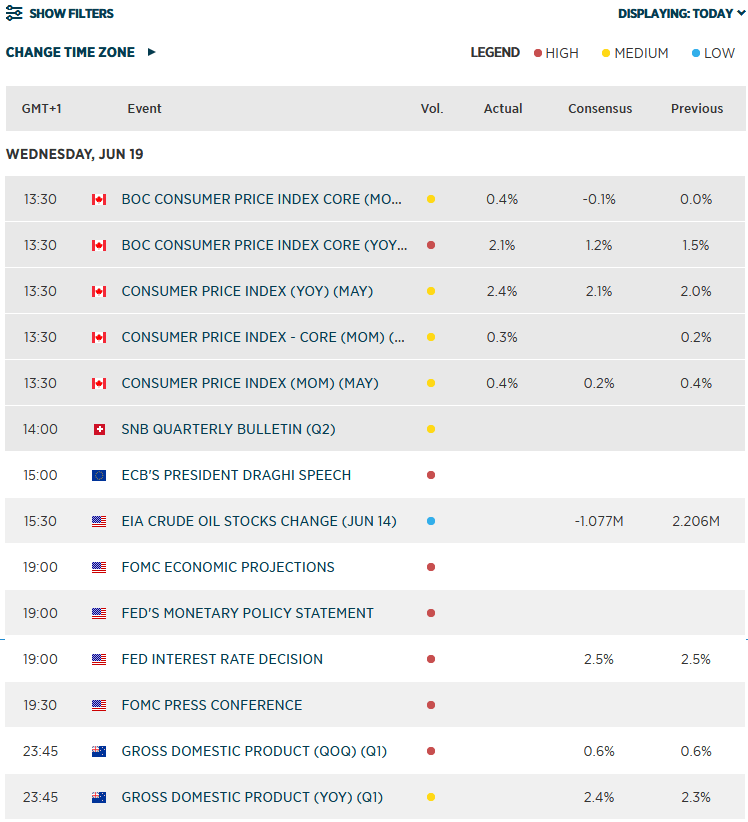

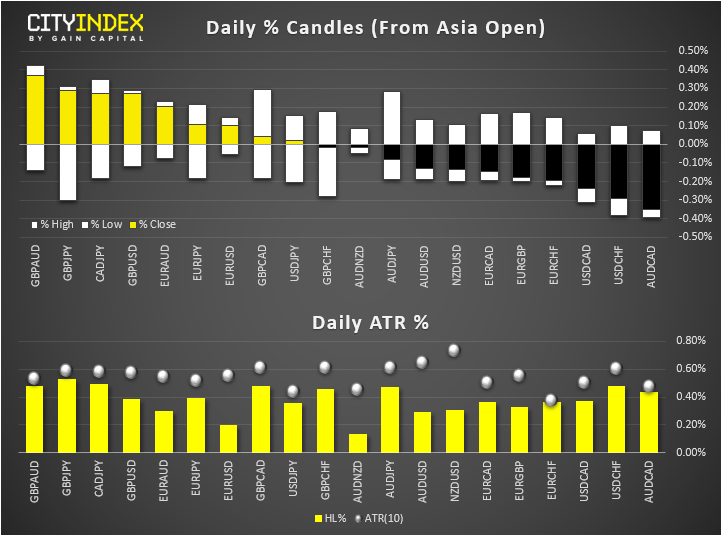

- GBP has been the strongest so far on the day ahead of the BoE rate decision tomorrow after a slight beat in UK core CPI and as Boris Johnson softened his tone towards Brexit

- CAD higher after Canadian Median CPI rose to 2.1% from 1.9% year-over-year. The headline CPI month-over-month figure printed 0.4% vs. +0.1% eyed.

- Other commodity dollars lower as equities pause for breather and in holding pattern as investors await the Fed rate decision. With the markets discounting a (slight) chance of a rate cut, we could see a knee-jerk minor bounce in the buck and dip in stocks if the Fed stands pat.

Latest market news

Today 08:18 AM

Yesterday 10:40 PM