FX Handover: Big Retail Sales Revisions Boost Buck to Two-Week Highs

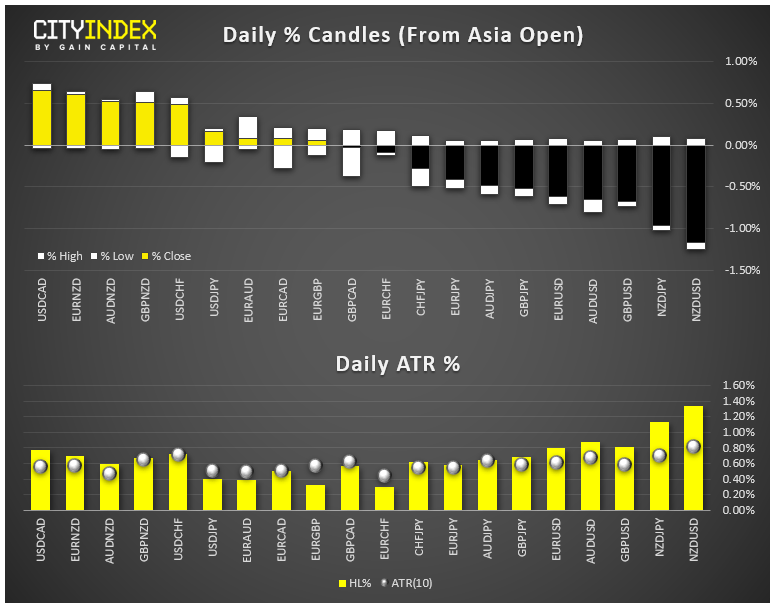

- US Retail Sales (May) bounced back to +0.5% m/m, but last month’s reading was also revised higher from -0.2% to +0.3%. Industrial Production figures also beat expectations, making the US dollar the strongest major currency on the day.

- In a dramatic shift in tone from last week, President Trump now says it doesn’t matter if President Xi attends the G20 Summit – reining in expectations of a resumption in trade talks?

- The kiwi was the weakest major currency today, with NZD/USD threatening to close at its lowest level since October as traders start to price in a potential rate cut from the RBNZ in August.

- Gold pared its gains after the better-than-expected US data.

- See the key releases and themes we’ll be watching next week!

*No major macroeconomic releases are expected during Monday’s Asian session.

Latest market news

Today 10:37 AM