FX Handover: All Appears Calm Ahead Of G20 Meetings

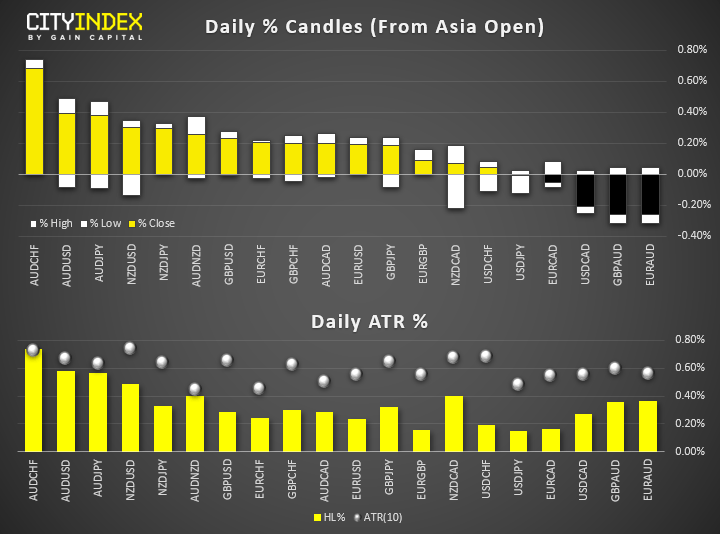

- A data-light session in Asia saw volatility remain low, with the largest movers in FX being technically driven retracements against last week’s price action. AUD is currently the strongest major and CHF is the weakest, seeing AUD/CHF gain 0.35% from its multi-month lows.

- The US is to announce ‘major sanctions’ on Iran on Monday, Trump tweeted.

- A mixed picture for equities, with STI and ASX200 leading the declines with stocks in China and seeing marginal gains. Still, volatility remains capped ahead of the highly anticipated G20 meetings in Japan which begin on Thursday.

- RBA’s Lowe: Risks to the global economy are tilted to the downside. If everyone is easing, effect on exchange rate is offset. Australian government can borrow at record low rates but should be for projects that make a return and more infrastructure projects would benefit the Australian economy.

- China’s Vice Commerce Minister says China supports normal operations and reforms of WTO. And the Assistant Foreign Minister says China will not allow G20 to discuss Hing Kong issue, as HK matters are an internal affair for China.

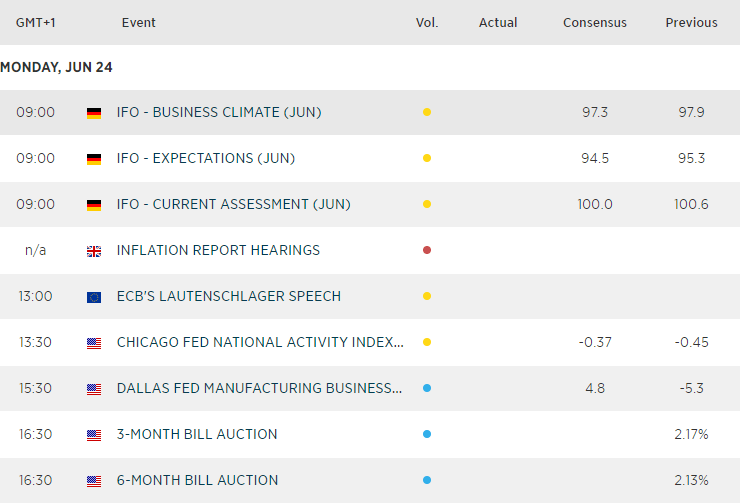

- 80% of economists polled by Reuters see the ECB either cutting rates or lowering their forward guidance further by the end of September.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM