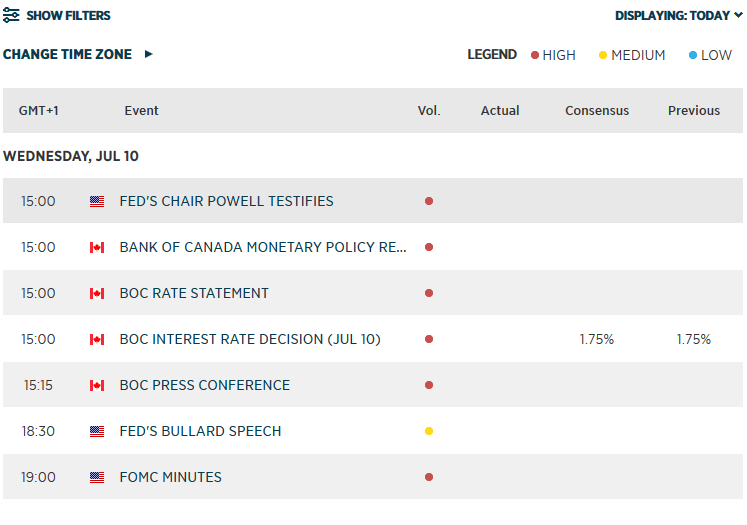

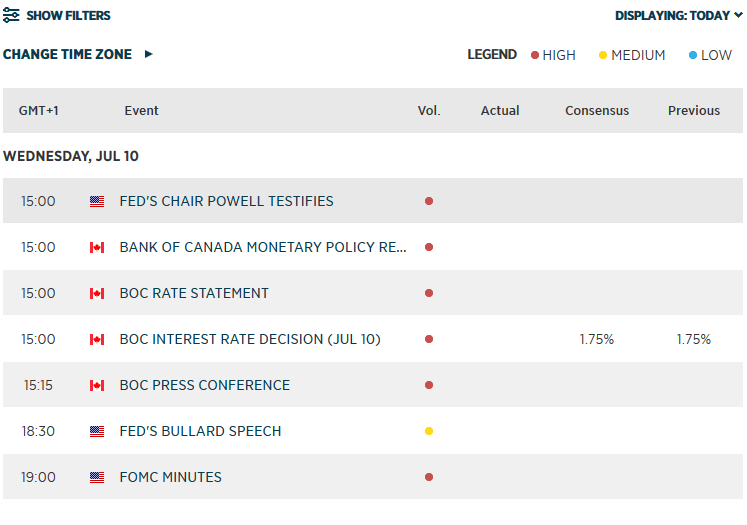

- USD slumped after Fed Chairman Powell's prepared remarks ahead of his testimony seem to suggest a rate cut later this month is a "done deal," with 2-year yields dropping 7bps in the 5 minutes since the release. Powell said that in the June FOMC meeting many of his colleagues saw the case for somewhat easier policy and that uncertainties since have continued to rise.

- FOMC meeting minutes will be released later, ahead of US CPI on Thursday. So, the dollar will remain in focus for the next 24 hours or so.

- Stocks rebounded sharply after the dovish Powell remarks hit the wires, while gold and silver also jumped. Crude oil was higher ahead of EIA oil inventories data, supported further by a weaker US dollar.

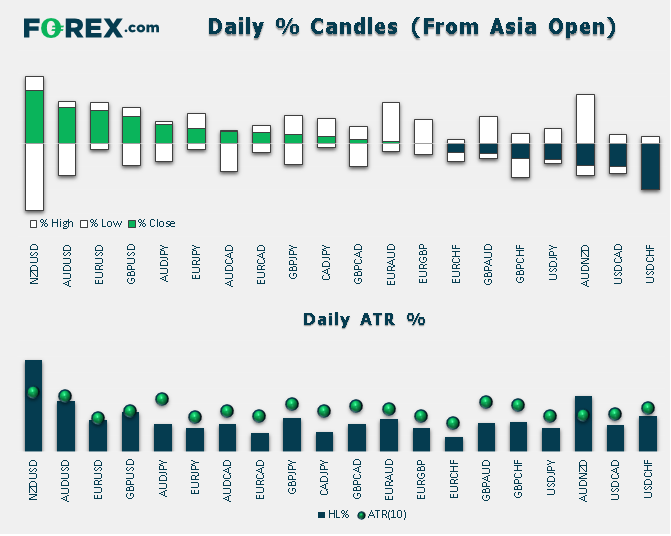

- Up next is the BOC rate decision. The BOC is expected to hold rates but, given their strong economic data in recent weeks then be on guard for a slightly hawkish undertone. CAD crosses are clearly the ones to watch as we head into the North American session.

Latest market news

Today 08:33 AM

Yesterday 11:48 PM

Yesterday 11:16 PM