FX Brief: Tight Ranges Ahead Of European And US Data

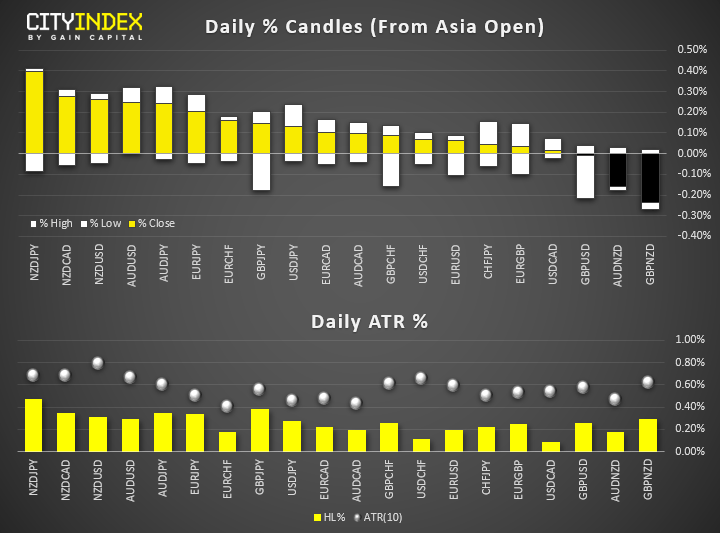

- NZD CPI rose in line with expectations to alleviate a little pressure for RBNZ to ease in August. NZD remains the firmest major this session and over the past month. NZ TWI has moved up to a 3-month high.

- AUD and CHF are currently the weakest majors. Although AUD/USD did briefly move to an 8-day high in quiet trade.

- Equities and index futures traded cautiously higher ahead of earnings and US data.

- Brexit concerns continued to weigh on GBP and EUR, with investors nervous that Boris Johnson winning the leadership contest in just a couple of weeks.

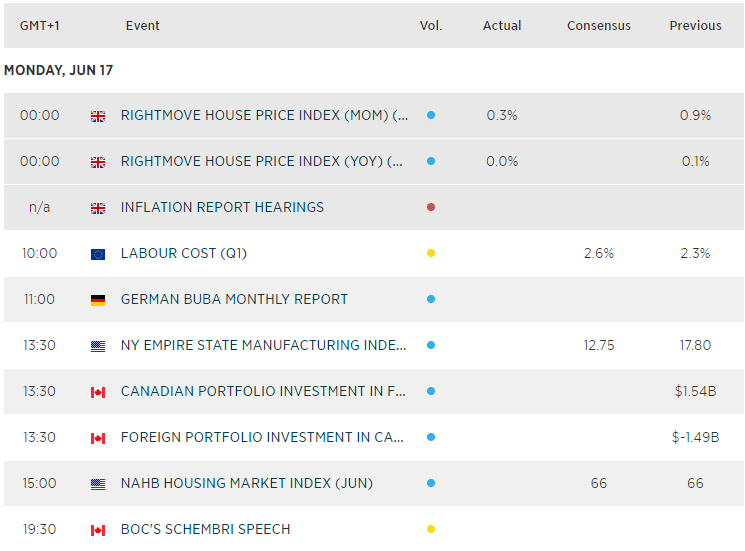

Up next:

- UK employment data puts GBP crosses into focus, at a time when traders are adjusting to the potential for BOE to ease in-light of recent comments (therefor likely sensitive to any weakness in the data).

- Germany’s ZEW economic sentiment, which is seen as a leading indicator for the Eurozone’s broader ESI, has turned markedly lower at -21.1%, which could keep EUR crosses under pressure if these cracks continue to widen.

- US retail sales, industrial production, manufacturing production make the bulk of data in the US session to make the major in focus for traders.

Latest market news

Today 01:15 PM

Today 11:30 AM

Today 08:18 AM