FX Brief: Signs Of A Global Slowdown Continue To Appear

- Signs of a global slowdown continue to appear with Singapore’s exports sinking to their lowest level since February 2013 at -17.3% YoY (-7.6% MoM). This follows on from Q2 GDP contracting and raises the potential for a technical recession.

- WTO appeal’s judges ruled that the US didn’t fully comply with a previous WTO ruling and could face Chinese sanctions.

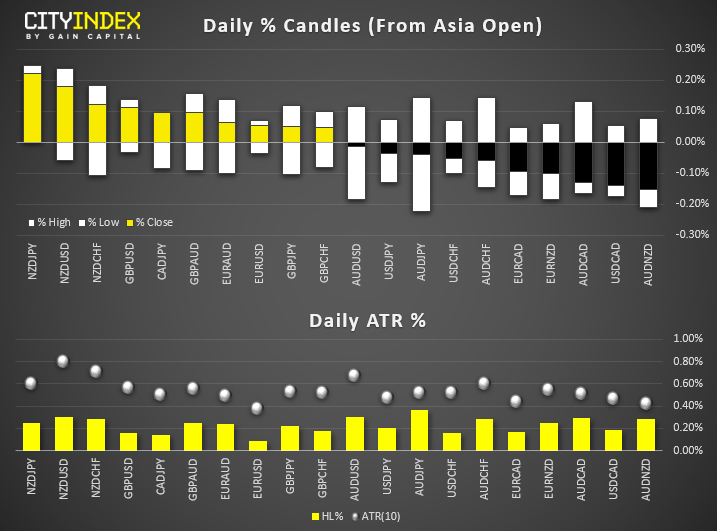

- Volatility remained calm across asset classes (even Bitcoin) which saw FX pairs confined well within their typical daily ranges, following a relatively turbulent US session.

- GBP/USD remains just off 25-month lows, WTI trades in a small range below $58 after its most bearish session in -weeks, gold continues to coil around $1400. CHF and GBP are the strongest majors, NZD and EUR are the weakest, but difficult to look too much into this given the small ranges.

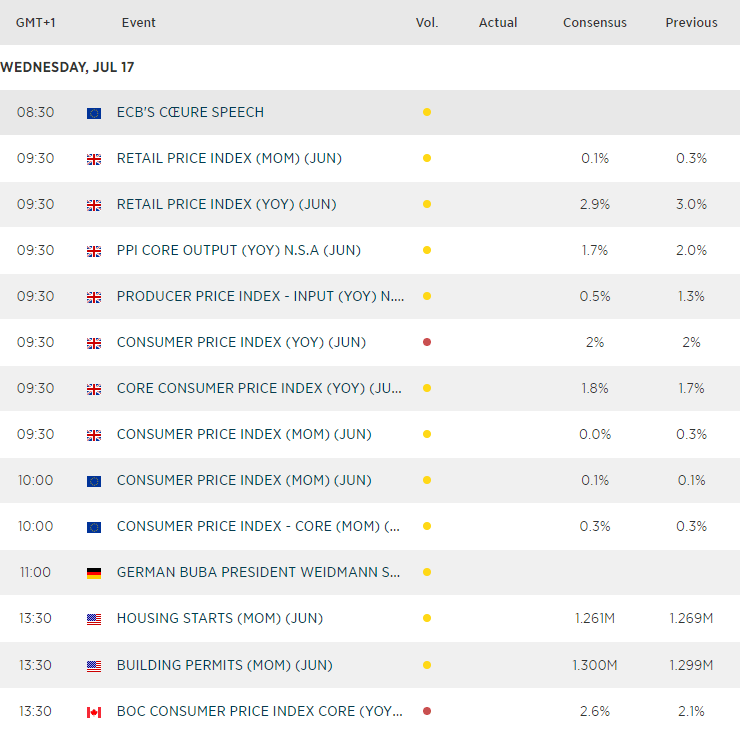

Up Next:

- GBP is already in the doldrums, but today’s inflation set could probably find a way to make it worse if it falls short of expectations. With inflation around BoE’s target, it may not be hot enough to warrant that hike, which already seems a far stretch given the dovish undertone from BoE of late.

- Inflation for the Eurozone are final reads, so less likely to instil volatility (although that’s not to say it should be ignored).

- Canada’s economic data has continued to excel relative to expectations, so perhaps a CPI beat is not too difficult to imagine. CAD crosses are the clear focus here.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM