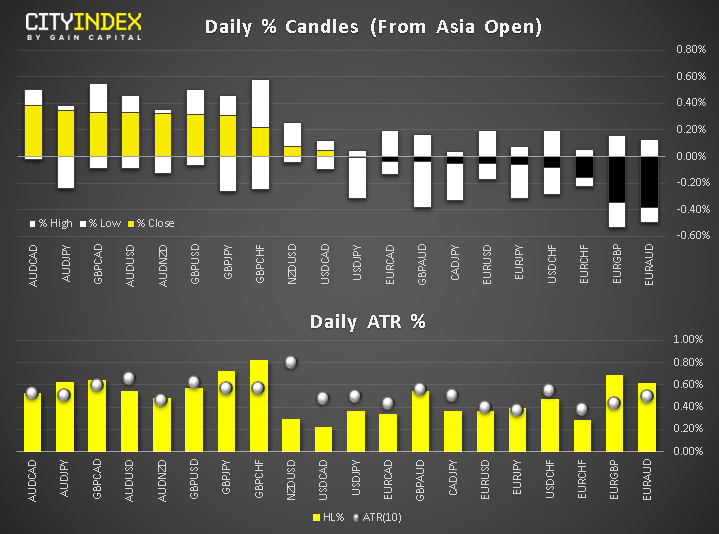

- At the start of the US session, the EUR is the weakest, while the AUD is strongest. The EUR/USD, which is in the process of creating a potential head and shoulders pattern, faces a big couple of weeks with the release of Eurozone PMIs and ECB rate decision next week and the Fed on the last day of the month.

- GBP has found some much-needed support on the back of retail sales beat (+1.0% m/m vs. -0.3% expected) and after the House of Lords backed an amendment designed to block the next Prime Minister from pushing through a no-deal Brexit by suspending parliament. This comes after Brexit Secretary Steve Barclay said the chances of a no-deal Brexit are under-priced, while Tory front-runner Boris Johnson warned that a free trade deal with UK’s closest ally – the US – will take time.

- Stocks will be in focus amid earnings results after disappointment from NFLX sent major indices lower Thursday; Bitcoin and crude oil are heading lower again, while silver is shining brightly.

Latest market news

Today 05:00 PM

Today 07:55 AM