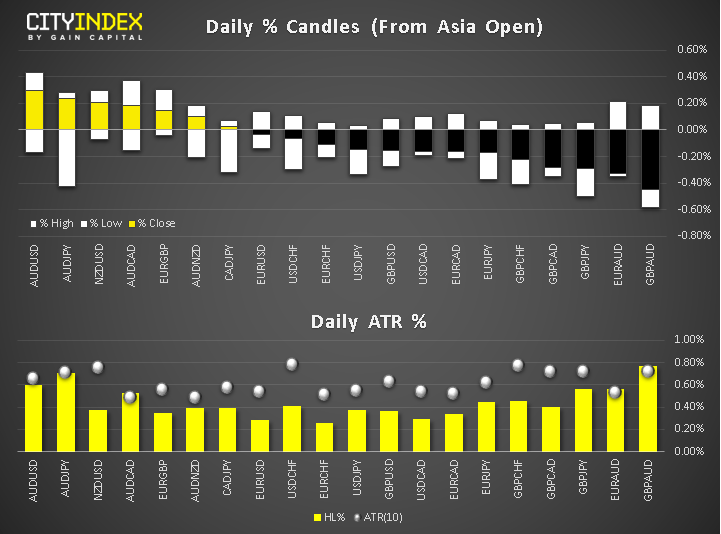

- Ahead of the open on Wall Street, the GBP has been the weakest among the major currencies on increased risks of an economic downturn and a potential rate cut by the BoE.

- AUD has been the strongest for the second consecutive day after the RBA’s rate cut to a historic low of 1% was accompanied by a policy statement which was deemed to be a lot less dovish than expected.

- European stocks and US index futures were higher; crude oil managed to regain some lost ground after yesterday’ big drop and gold was giving back some of yesterday’s sharp gains as demand for haven assets fell.

- US ADP Employment came in at +102K in June vs. 140K expected, with the previous reading revised higher to 41K from 27K. This bodes ill for the NFP. Among other pre-NFP leading indicators will be the employment component of the US ISM non-manufacturing PMI, due for release at 15:00 BST.

Latest market news

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM