FX Brief: NZD Weaker On Mention Of QE

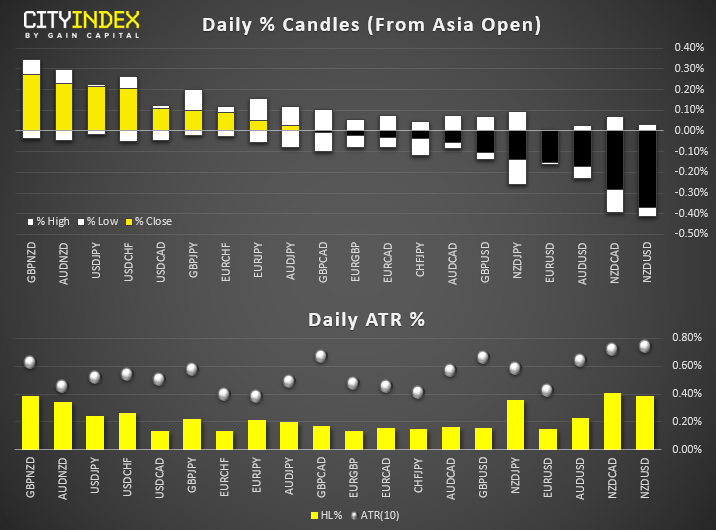

- NZD took a knock in early trade on reports that RBNZ were ‘at the very early stage’ of looking at refreshing unconventional policy (QE). NZD is the weakest major and USD is the strongest, sending NZD/USD down to a 3-day low.

- RBA’s Kent says RBA will adjust policy ‘if needed’ to meet targets. Australia are a long way from QE and it remains a low likelihood. Policy easing is still a positive for Australia and expects AUD would be trading higher without recent cuts. On the Fed, rate cuts should be already prices into currencies.

- News that South Korea had fired a warning shot at a Russian military plane failed to register with markets.

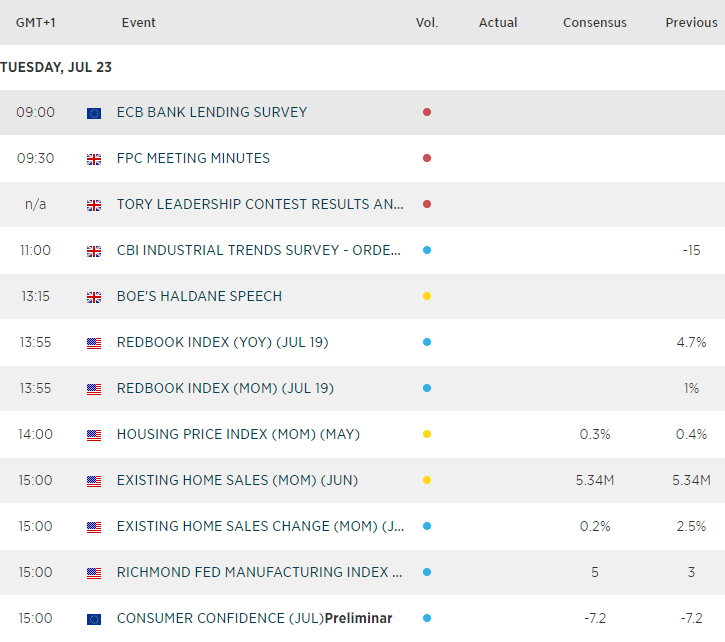

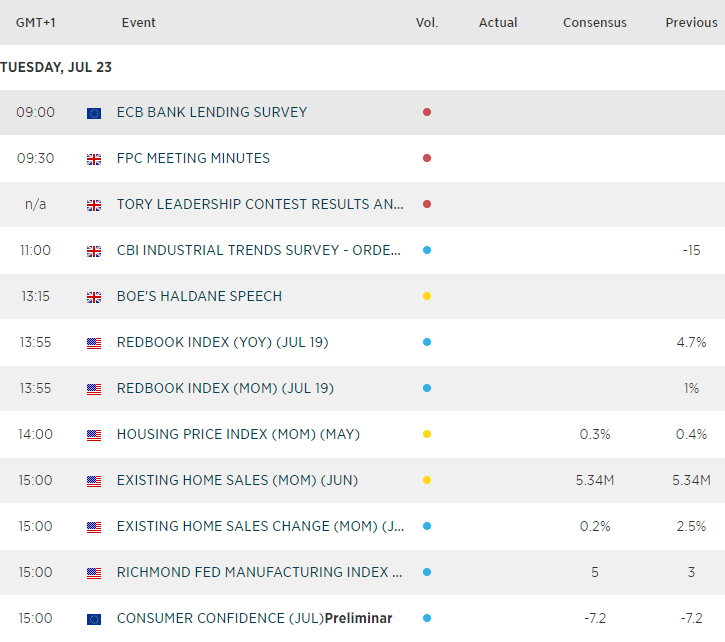

Up Next:

- It’s widely expected that the UK conservative party will announce Boris Jonson as their new leader today and, therefore, UK’s new PM. With the British pound remaining under pressure ahead of the event, we may well see some profit taking if the expected is confirmed. However, if the unexpected were to materialise with Jeremy Hunt taking the job, we could see further upside for GBP over the near-term. Overall, we don’t expect the announcement to be a volatile event.

- Data-wise its mostly low tiered data, so we could find markets remain in tight ranges in the lead up to this week’s ECB meeting.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM