FX Brief: G20 Underway, Safe Havens Hit A Bid

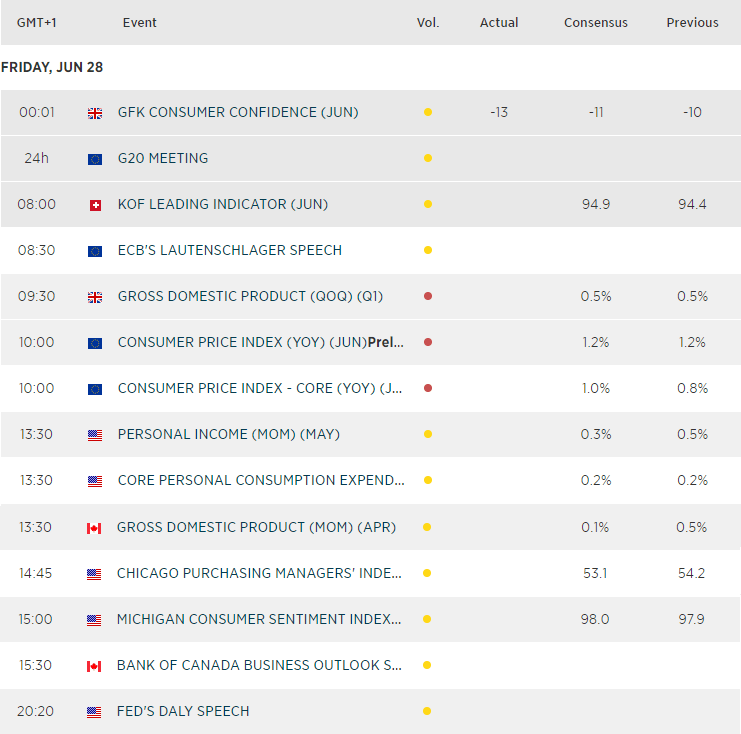

- Equites were lower as doubts began to creep in that Trump and Xi could pull off a successful talk at the G20, weighing on equities although volatility remain contained overall.

- Trump agreed to ‘no preconditions’ for the Trump-Xi meeting. Once questioned about whether he’ll ask Putin not to meddle in the US elections, he responded “yes, of course I will”, then turned to Putin with a smile and told him not to meddle in the elections. Brilliant.

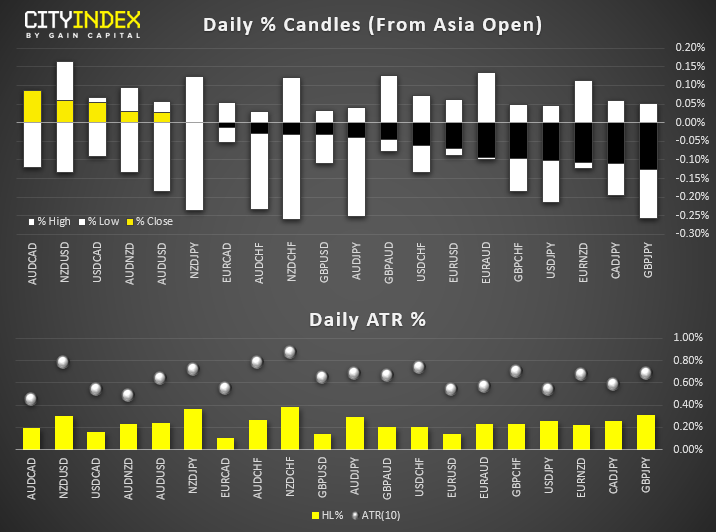

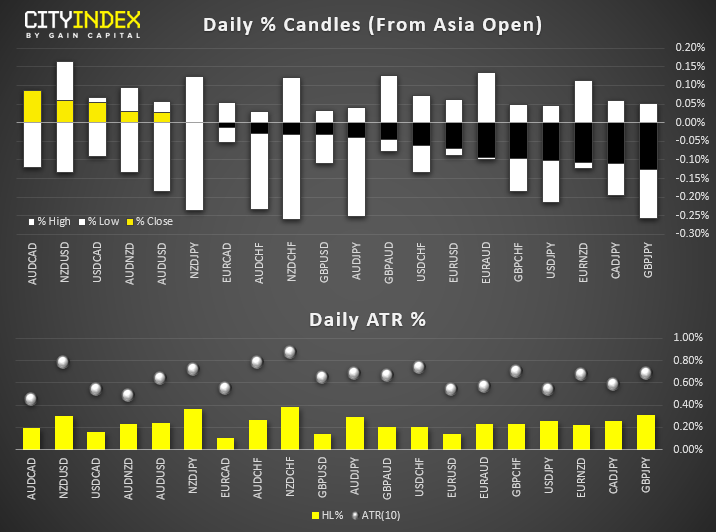

- JPY and CHF are currently the strongest majors in a slight risk-off session, all FX pair have remained well within their typical daily ranges. This could leave plenty of ‘meat on the bone’ for moves to unfold if we see headline shaking news throughout the US or European sessions.

- Gold has tested a 2-day high as markets shift to the defensive, whilst USD/CNH carves out a potential dead cat bounce (bearish pattern). US10Y remains anchored to 2%, which appears to be a pivotal level around the G20.

- We expect the G20 to dominate sentiment as we head towards the weekend. President Trump is due to meet with Xi Jinping at 02K30 GMT on Saturday, so we wouldn’t be surprised to see traders de-risk ahead of market close, which could see equities under pressure and demand for JPY, CHF and gold rise.

Related analysis:

Markets On Tenterhooks As G20 Kicks Off | USD/JPY, CHF/JPY

Daily Forex Technical Trend Bias/Key Levels (Fri 28 Jun) ahead of G20

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM