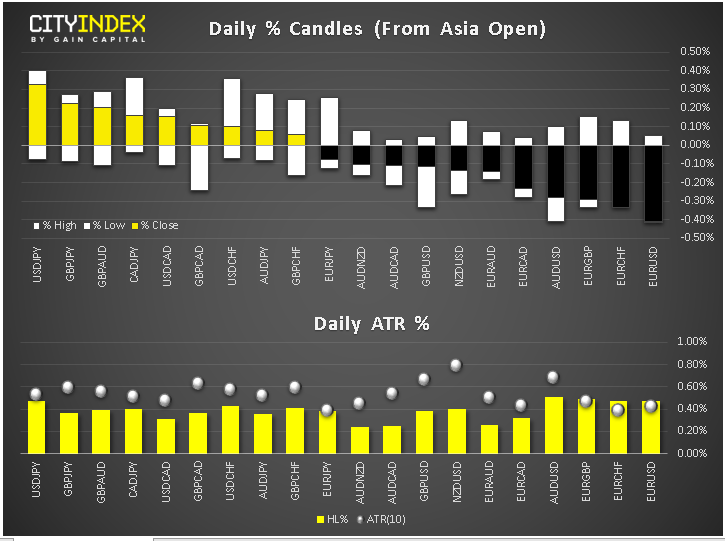

- As the US session begins, the USD is the strongest and EUR the weakest. With USD/JPY at resistance, could the greenback ease back from here or stage a more meaningful rally to close the week?

- The dollar has been on the rebound ever since a Fed spokesman last night came out to issue a statement that NY Fed President John Williams did not intend to suggest that the FOMC would be making a large interest rate cut at the FOMC’s upcoming meeting this month. Earlier, Mr Williams had sent the dollar lower after delivering a rather dovish speech.

- US stock index futures were holding near yesterday’s highs; silver was up for the fifth day; gold was in consolidation mode after breaking to a new 2019 high, and oil was coming off its highs after finding support on renewed tensions in the Middle East on the back of news that the US shot down an Iranian drone in Strait of Hormuz.

- FOMC members Bullard (16:05 BST) and Rosengren (21:30) will be speaking later on today.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM