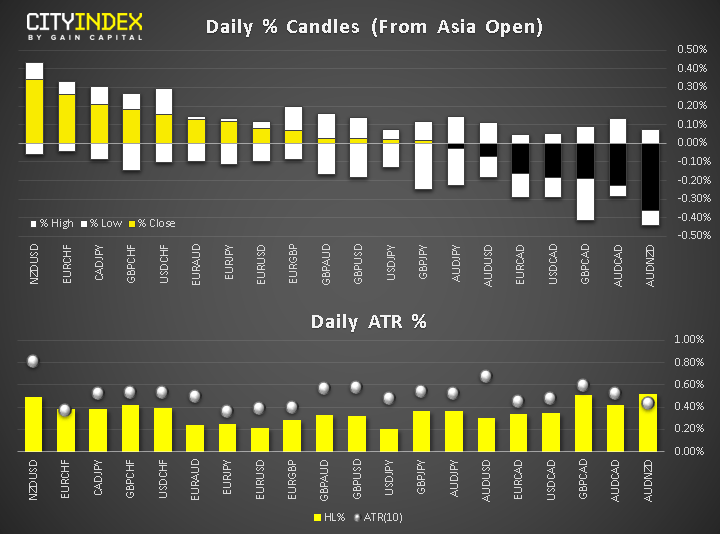

- NZD strongest, AUD weakest, while the Dollar Index is a touch lower after yesterday’s data-fuelled rally. EUR has found some mild support.

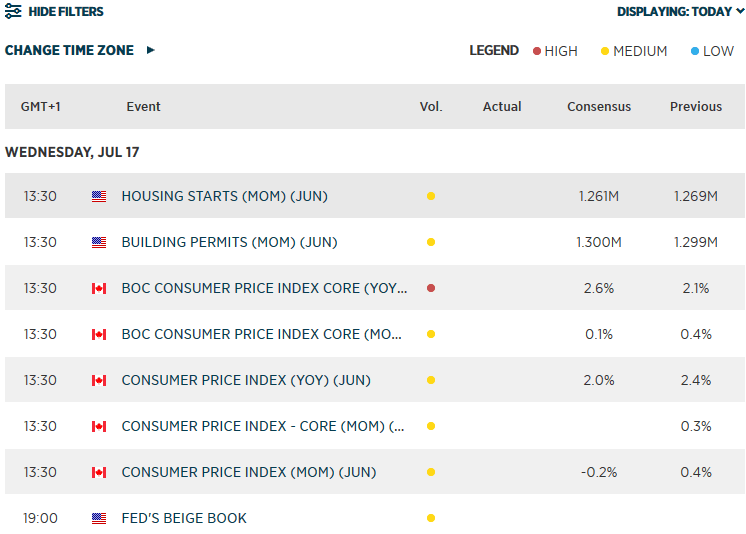

- UK headline and core CPI were both flat in June, keeping the year-over-year rate at 2.0% with core edging up to 1.8% from 1.7%, both as expected. Eurozone CPI was unexpectedly revised higher to 1.3% from 1.2%, with core CPI remaining unchanged at 1.1%. European car registrations fell sharply in June, resuming their downward spiral. Canadian CPI up next.

- Stock indices lower as Trump reignited trade war fears: “We have a long way to go as far as tariffs where China is concerned… We have another $325 billion we can put a tariff on.” Meanwhile stock investors are also digesting bank earnings, which are coming in thick and fast, with Bank of America beating quarterly profit estimates today, boosted by strong retail division and cost control. Watch Netflix tonight – your favourite show(s) or the stock’s reaction to its earnings, whichever rocks your boat.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM