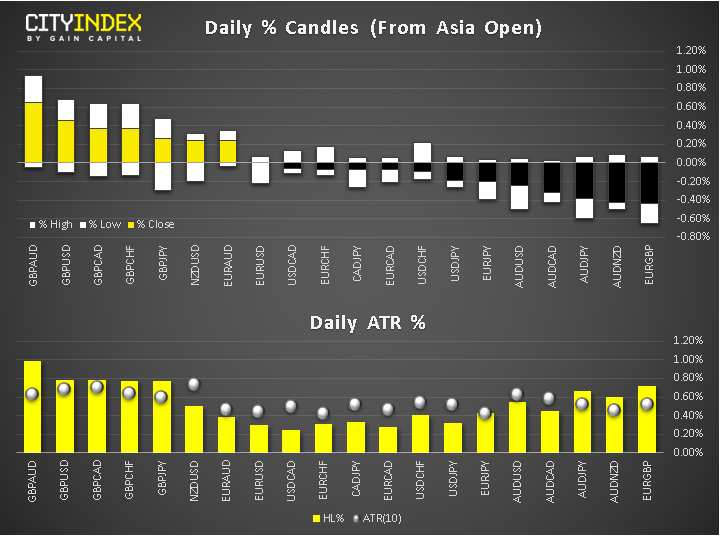

- As we head towards the latter end of the European session, the GBP was the strongest and AUD and EUR among the weakest.

- GBP continues to shine on short-covering after the expected announcement of Boris Johnson as the new Tory leader and PM yesterday. EUR undermined by Eurozone’s latest manufacturing PMIs, which were recessionary. They have come a day before the ECB makes its interest rate decision. Calls have grown louder for the ECB to introduce more stimulus, or at least promise to do so. The probability of a 10 basis point cut in the deposit rate tomorrow rising to just under 50% from around 40% before.

- Greek debt crisis? What crisis? The 10Y GGB yield has plunged below 2% for first time ever.

- Thanks to falling bond yields across the developed economies, sentiment towards stocks and precious metals continue to remain favourable.

- Gold is up after staging a corrective pullback over the past few days; silver has hit a new 2019 high!

- Stocks are not as eye-catching as the day before, but sentiment still positive after Mnuchin said he expects his trip on Monday to China trip will be followed by Washington meetings. Company earnings coming in thick and fast: Facebook and tesla among companies reporting after the bell. It may be worth keeping an eye on tech names after the US government announced last night that it was investigating Google, Amazon, Apple and Facebook for anticompetitive practices.

- No major data expected today

Latest market news

Today 08:15 AM

Today 05:45 AM

Yesterday 11:09 PM

Yesterday 11:01 PM