- CAD crosses higher on the back of firmer crude prices after Russia’s energy minister Alexander Novak said that all oil ministers approve 9-month OPEC+ extensions. This is arguably a better deal from the OPEC’s point of view than a 6-month extension, but with the same production quotas being retained, it has disappointed calls for deeper cuts. As such, the new deal will probably fail to address the rising non-OPEC supplies at a time the world economy is slowing, which could mean lower demand growth. Thus, the oil market is likely to be oversupplied again in due course, which means prices may struggle to push significantly higher from here.

- US-China trade optimism is driving the markets today with S&P 500 set to open at a fresh record, while safe havens gold, yen and franc give way. Watch for tech stocks to jump after Trump said he would allow US corporations to resume business dealings with Huawei on certain products after it was blacklisted earlier due to national security concerns.

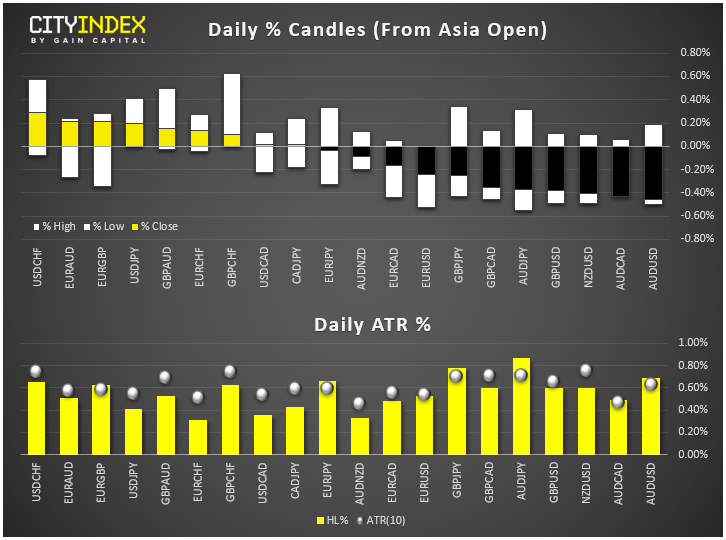

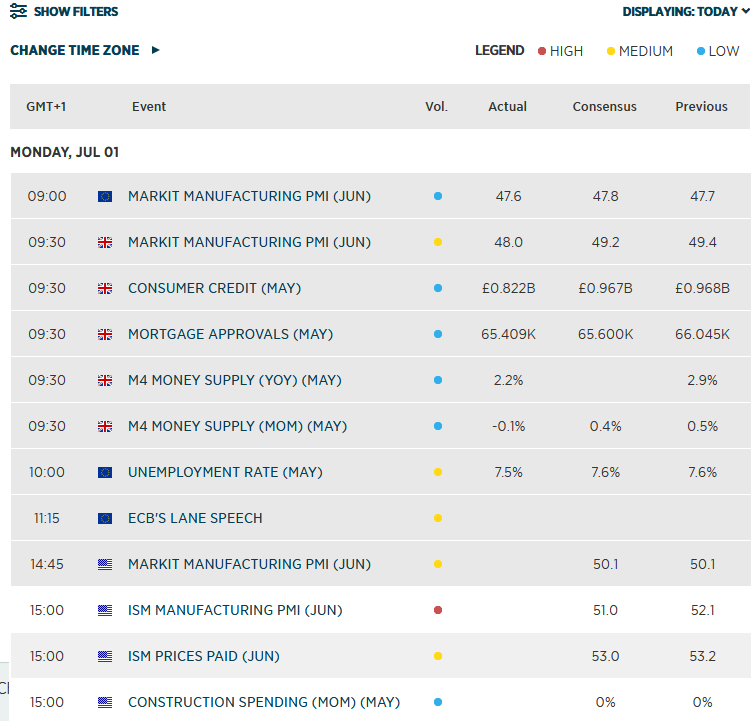

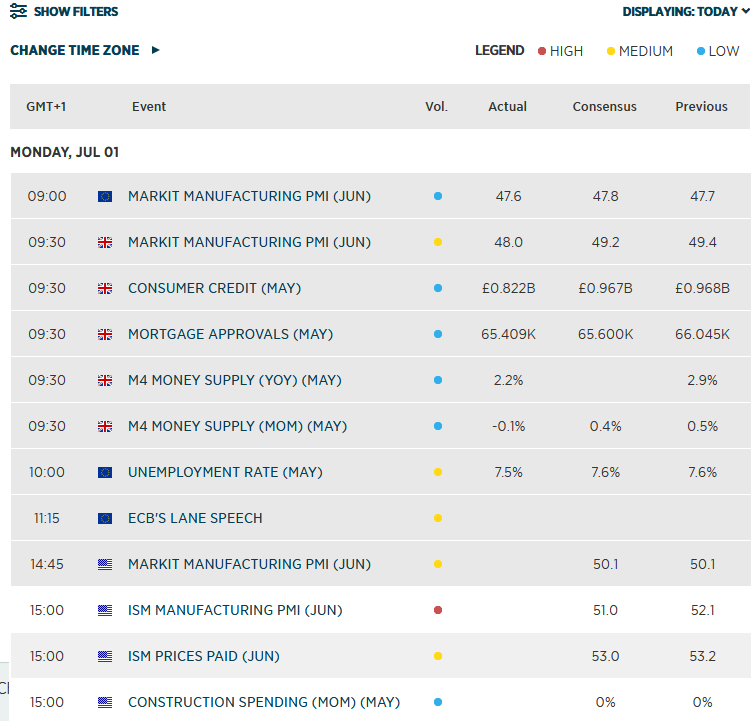

- However, it has been a poor day for global PMI data and copper prices have eased off the highs sharply with gold also having a bad day. This explains why the AUD is the weakest, despite trade optimism lifting global shares. Will the RBA cut rates to just 1% tomorrow?

Latest market news

Today 08:15 AM