Further falls to come as markets close the week lower

The Week Ahead Report stated in Monday’s edition that the bullish momentum would be brief and the markets may run out of steam. Certainly the […]

The Week Ahead Report stated in Monday’s edition that the bullish momentum would be brief and the markets may run out of steam. Certainly the […]

The Week Ahead Report stated in Monday’s edition that the bullish momentum would be brief and the markets may run out of steam. Certainly the bearish scenario has played out. But what is clear now is that next week is critical for the markets. If we see a break below this week’s low then that would provide a technical confirmation for a trend continuation to the downside for the weeks ahead.

This would mean that the lows seen this week are more than likely to be taken out. Meanwhile gold prices have continued higher to reach upside targets with room for higher prices still achievable. Uncertainty in stock markets is creating certainty for higher gold prices.

The Week Ahead Report stated in Monday’s edition that the bullish momentum would be brief and the markets may run out of steam. Certainly the bearish scenario has played out. But what is clear now is that next week is critical for the markets. If we see a break below this week’s low then that would provide a technical confirmation for a Trend Continuation to the downside for the weeks ahead. This would mean that the lows seen this week are more than likely to be taken out. Meanwhile Gold prices have continued higher to reach upside targets with room for higher prices still achievable. Uncertainty in stock markets is creating certainty for higher gold prices.

Breaking below 5772 set the FTSE up to fall sharply this week. The bearish play is still on the cards even if we see a brief rally next week. But any rallies are likely to face upside resistance followed by further moves to the downside. The UK FTSE 100 will need to find support at 5430 and close above to trade higher. But now that we have seen an Impulsive move take place the odds are higher to see 5090 being reached at some point once the corrective upside move has been resolved. The 20 period moving average is some distance away but more importantly the index remains below the indicator confirming weakness.

FTSE 100 Daily

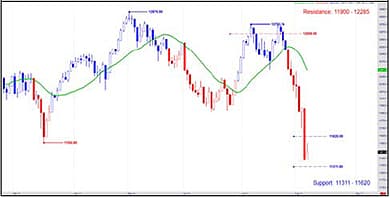

Having broken below 12203 the US Dow Jones index had not time to pause whilst it cracked to the downside. There is support at 11311 which the index is trading close to. If the Dow manages to get above 11620 once it has completed this initial bearish move then upside resistance stands at 11900 followed by 12285 as a key barrier. The double top pattern provided an early warning signal and now we will need a key reversal pattern at the lows to find a Dead Cat Bounce. The Bears have plenty of power to bring this market lower to ultimately reach 10860 in the coming weeks.

Dow Jones Daily

As markets reached critical state the price of Gold continues higher as expected. Although the commodity has reached the first target of $1,626 the target for $1,727 is where a symmetrical pattern completes before seeing a correction on Gold take place. The break out of its channel has seen an extension to the upside but now Gold will need to hold above support at $1,605 to stay bullish otherwise lower support sits at $1,587 which is a key level for the intermediate term trend. If stock prices drop further next week this would support higher gold prices.

Gold Daily