If it wasn’t for the last minute nothing would get done – it would seem that the time pressure of the looming Brexit date has finally sparked a sense of urgency among leaders to move the EU and the UK closer to a deal.

Whilst a new deal is still not done and dusted by any means, early reports from both sides following the Michel Barnier and Steve Barclay Brexit meeting are sounding optimistic and indicate that a deal could be agreed before the 19th October deadline. Intensive Brexit talks will continue with investors watching developments closely.

The pound surged a further 1% in early trade, extending 1.8% gains from the previous session and hitting a fresh three week high of $1.2549. Pound trader are growing in confidence that a no deal Brexit will be avoided in three weeks’ time.

With a strong pound and multinationals making up around 70 % of the FTSE 100, the gauge of the top 100 stocks is not necessarily the best gauge for Brexit.

Why is the FTSE 250 a good Brexit fear/ optimsm gauge?

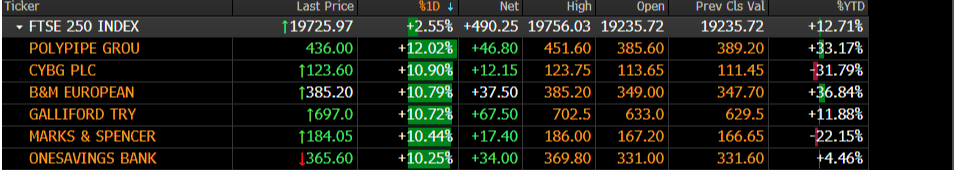

The FTSE 250, which is compiled of mainly domestically focused stocks is soaring up 2.5% from the open. The likes of Marks and Spencer, Galliford Try and Grafton Group have gains into double digits, to name a few.

The stocks on the FTSE 250 are very exposed to the UK economy and UK consumer sentiment. They took a big hit following the Brexit referendum and have experienced a challenging trading environment since as Brexit uncertainty has dragged on consumer confidence. A no deal Brexit could have inflicted significant further damage on these stocks. The prospect of a no deal Brexit being avoided is like Christmas has come earlier and this optimism is being reflected in the soaring prices.

These will be the stocks to continue watching; stocks that could well push higher on increased Brexit deal optimism, or lower if fear of a no deal creeps in again.

Source: Bloomberg

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM