Volatility is showing no signs of disappearing at the start of the week. The FTSE initially failed to hold onto early gains and slipped back into negative territory as traders fretted over the economic fallout of coronavirus on the global economy, before jumping 1% higher as the US markets open.

Traders are grappling with a stark warning by the OECD over the economic hit of coronavirus and a chorus of central bankers vowing support to their economy's in the case of a coronavirus inspired economic slowdown.

The OECD became the first international organization to sound the alarm on coronavirus, warning that the global economy was at risk. The OECD quantified the expected damage forecasting that global growth will halve this year compared to last, potentially pushing the global economy into recession.

Yet Wall Street has focused on the prospect of the Fed loosening monetary policy, leading the index to surge 1% on the open and drag European indices off their lows.

Yet Wall Street has focused on the prospect of the Fed loosening monetary policy, leading the index to surge 1% on the open and drag European indices off their lows.

FTSE vs. Dax

The FTSE is fairing relatively well, back in positive territory, compared to its German counterpart, which remains firmly in the red. There are a few reasons for this.

Firstly, Germany is an exporter nation so the economy could take a harder hit in the case of a global recession.

Secondly, the euro has soared in recent weeks and extended those gains by 1% today. The unfavorable exchange rate is another hit for German exporter firms.

Meanwhile, the FTSE found some support from a weaker pound. Sterling dropped below $1.28 as UK manufacturing activity slipped dipped to 51.7, down from 51.9 in January and as the Bank of England pledged to take all the steps necessary to protect stability in the UK economy.

The FTSE is fairing relatively well, back in positive territory, compared to its German counterpart, which remains firmly in the red. There are a few reasons for this.

Firstly, Germany is an exporter nation so the economy could take a harder hit in the case of a global recession.

Secondly, the euro has soared in recent weeks and extended those gains by 1% today. The unfavorable exchange rate is another hit for German exporter firms.

Meanwhile, the FTSE found some support from a weaker pound. Sterling dropped below $1.28 as UK manufacturing activity slipped dipped to 51.7, down from 51.9 in January and as the Bank of England pledged to take all the steps necessary to protect stability in the UK economy.

FTSE 250 more telling

With the number of cases in the UK ramping up by the hour, the UK is on the cusp of a possible explosion in the number of coronavirus cases. These fears are more evident in the FTSE250, the more domestic focused index, which remains 0.3% lower, despite the uplift in the internationally focused FTSE 100.

With the number of cases in the UK ramping up by the hour, the UK is on the cusp of a possible explosion in the number of coronavirus cases. These fears are more evident in the FTSE250, the more domestic focused index, which remains 0.3% lower, despite the uplift in the internationally focused FTSE 100.

Levels to watch

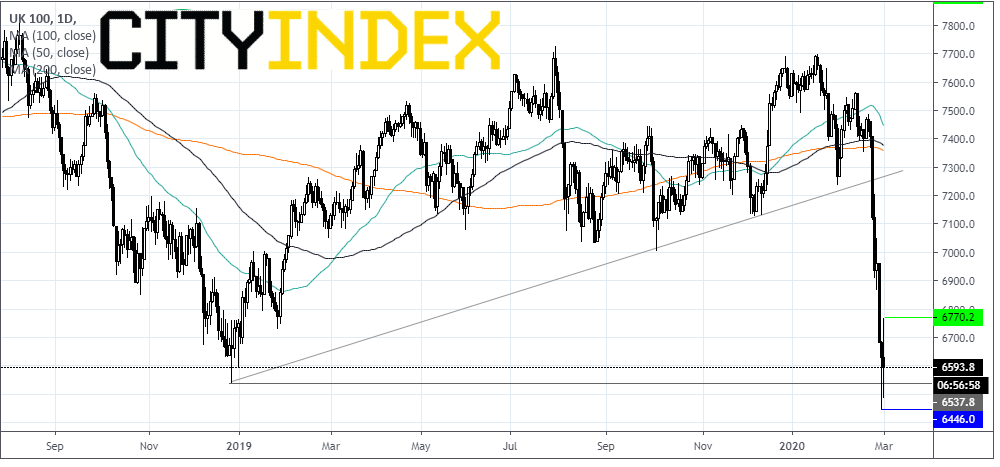

Despite the uptick of 0.4% today, the FTSE remains firmly below its 50, 100 and 200 sma. It has broken through trend line support with strong bearish momentum still intact.

Immediate support can be seen at 6447 (last week’s low). Immediate resistance can be seen at today’s high 6767.

Latest market news

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM