Newly elected Prime Minister Boris Johnson has said that there will be no extension to the transition period, fuelling fears that the UK could still crash out of the EU without a trade deal in place.

Blink and you missed it - with the Boris Johnson honeymoon period over those domestic focused stocks that rallied following a resounding win from the Conservatives and Brexit clarity are once again on the back foot amid the growing threat of no (trade) deal Brexit. Lloyds, RBS and home builders are dominating the lower reaches of the index.

Pound dives 1%

The pound has slipped in early trade, down over 1% versus the dollar on no deal Brexit fears. A greater than expected fall in UK average weekly wages is also dragging on demand for sterling. Weekly wages increased 3.2% year on year in the three months to October, down from 3.6% in September and below expectations of 3.4%. On a positive note unemployment remained at 3.8%. The weaker pound supports the multinationals on the FTSE which benefit from the preferential exchange rate. However, risk off sentiment is dominating causing traders to sell out of riskier assets such as stocks.

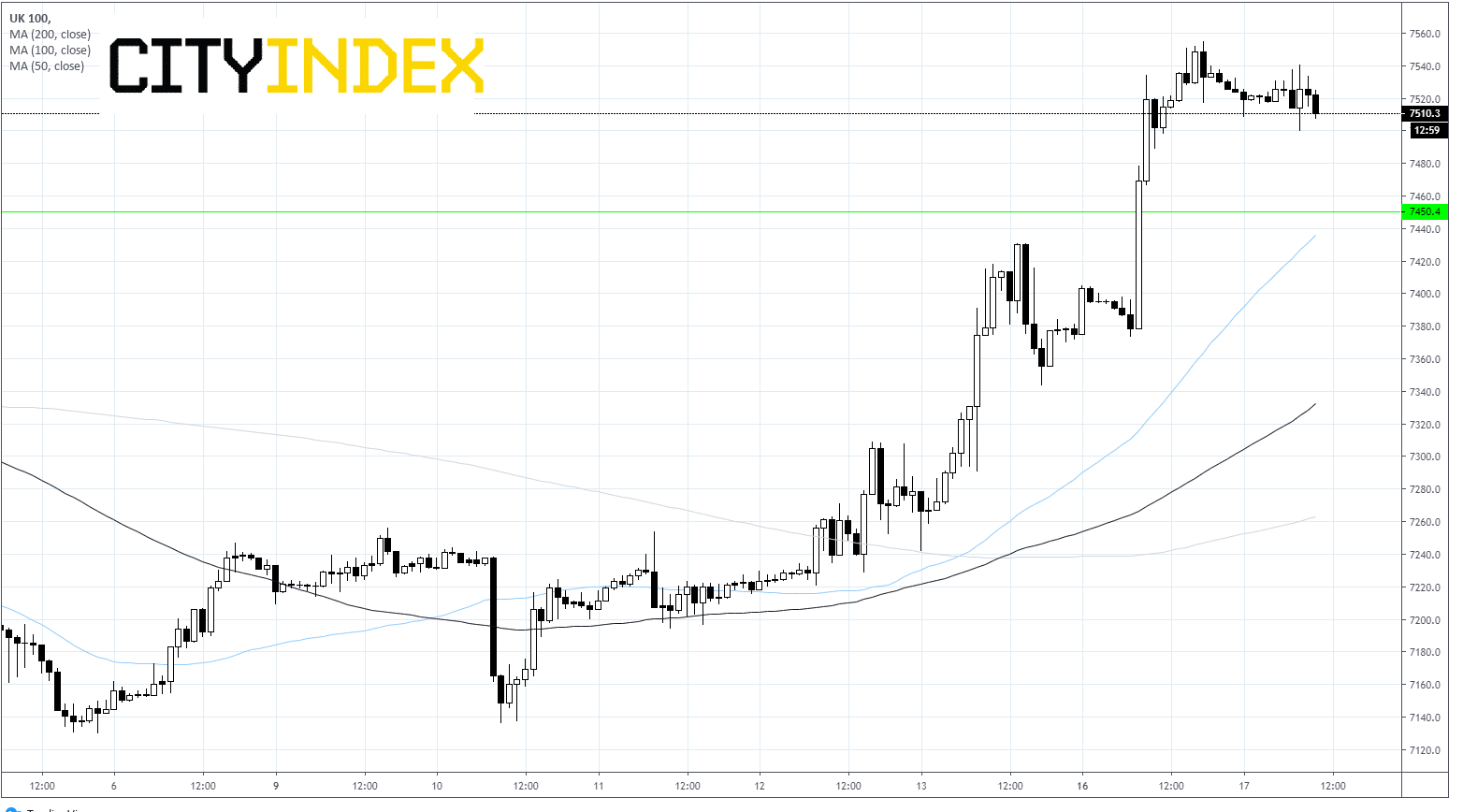

FTSE levels to watch:

Despite this mornings pullback the FTSE continues to trade above its 50,100 and 200 sma. We would be looking for a breakthrough support at 7446 (high 27 Nov) to negate the current bullish bias. On the upside a break above yesterday’s high of 7554 could indicate further upside to come.