Miners are a noticeable drag on the UK index following dismal GDP reading from China. Economic growth in China slowed to just 6%, the weakest level in almost 30 years, putting on full show the impact of the ongoing US – China trade dispute.

Dominating the upper reaches of the FTSE are the no-deal Brexit vulnerable stocks, such as the house builders and domestically focused banks as investors look ahead to tomorrow’s Parliamentary Brexit vote.

The pound is proving to be neither a help or a hindrance to the FTSE on Friday. Sterling is treading water versus the dollar, with traders opting to sit on the side lines until there is more clarity as to whether Boris Johnson can get his deal through Parliament.

Potential FTSE reaction to Saturday’s vote

Deal Accepted

Should the deal get the majority required in Parliament for the UK to leave the EU in an orderly fashion, we could expect sterling to rally and the FTSE to jump higher in a knee-jerk reaction, similar to what we saw on Thursday’s announcement of the Brexit deal.

However, the stronger pound could eventually weigh on the FTSE given the index’s high percentage of multinationals earning abroad which will be hit by the less favourable exchange rate.

Deal Rejected

On the other hand, should Boris Johnson’s selling skills fail him, and a deal not pass through Parliament we can expect the pound and the FTSE to sell off sharply, the reverse of Thursday’s reaction, with the FTSE then potentially rebounding as it responds to sterling’s decline.

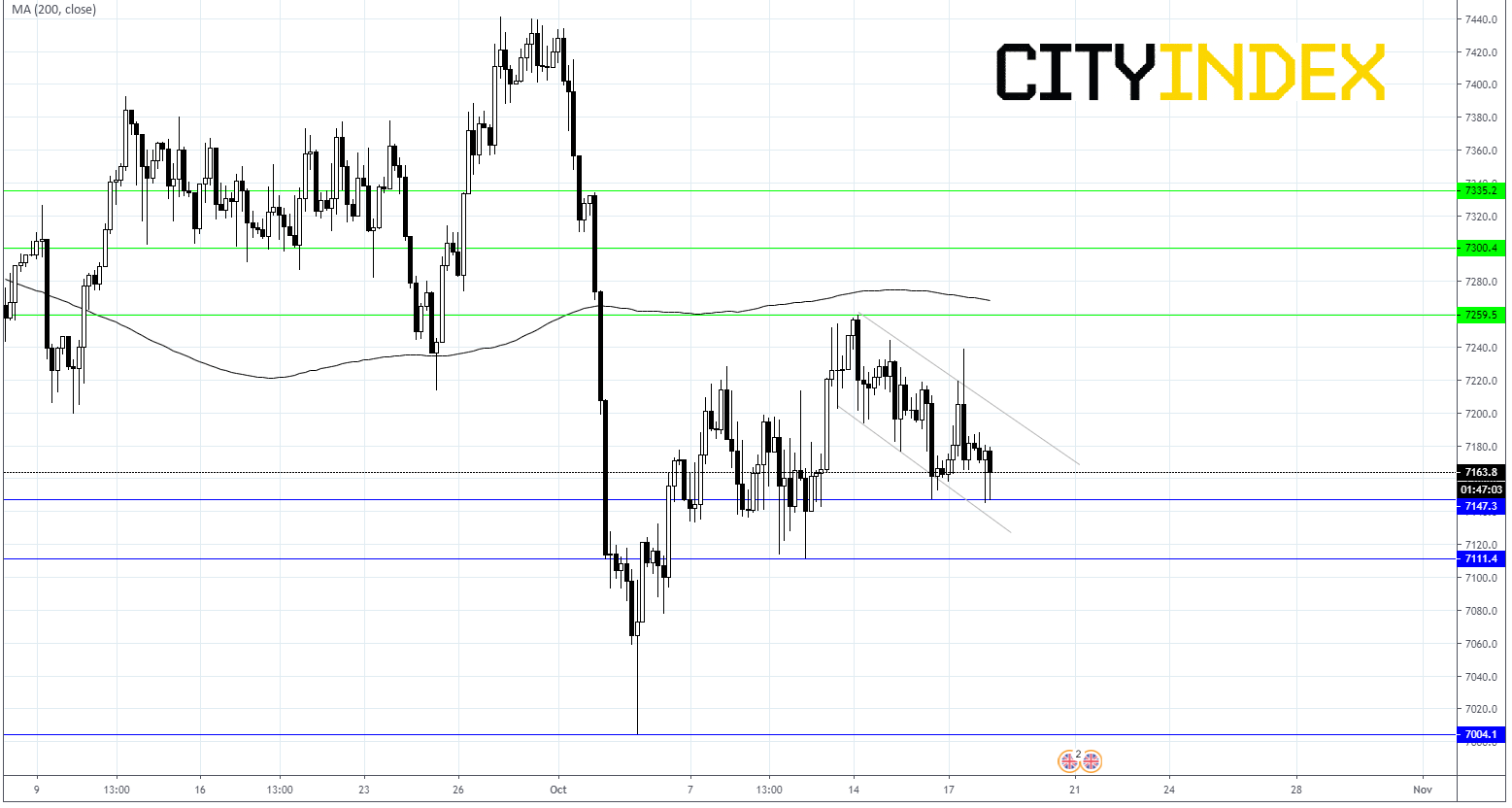

FTSE Levels to watch:

A break below strong support at 7147 could see the sell off extend to support at 7110 prior to 7000.

On the upside a break above 7260 could be start of a more bullish trend, opening the doors to 7300 and then 7350.