Fresnillo higher as gold surges

Precious metal miner, Fresnillo topped the FTSE leader board tracing the price of gold higher. The Fed ditching its “patient stance” in a dovish shift sent non-yielding gold soaring to 5 year high, as the opportunity cost of carrying a non-yielding asset declined.

Oil rallies

Heavy weight oil majors also offered support to the UK index. Oil surged over 3% as tensions flare in the Middle East. Other factors are also helping oil, Including the weaker dollar, an agreement by the US & China to meet to discuss the ongoing trade dispute and OPEC potentially extending the output cut when they meet at the start of July.

Less hawkish BoE hits pound and banks

The pound slipping away from session highs gave the FTSE an extra dose of strength in early afternoon trade. The BoE kept rates on hold as expected. They also insisted that should their forecasts bear out then they would still need to hike rates. However, downgrading of growth in Q2 to zero, in addition to acknowledgment that the chances of a no deal Brexit have increased have left investors doubting whether a rate hike is really feasible. Banks, which were under pressure following a more dovish Fed found little solace in the BoE’s assessment.

Then there were 3

Attention is now turning to the final round of voting in the Conservative leadership contest. Sajid Javid is the latest Tory out of the leadership race. Further voting is to continue today with the final two being whittled down at 6pm GMT. We are not expecting any big moves on the results this evening, the fact that Boris will be in the final two has been priced in for a while now. The leader will be announced in 4 weeks. Should the other candidate be it Hunt or Gove manage the seemingly impossible and beat Boris Johnson, then under those circumstances we could see a small relief rally in the pound and those Brexit affected stocks such as housebuilders, airlines, retailers and domestic focused banks.

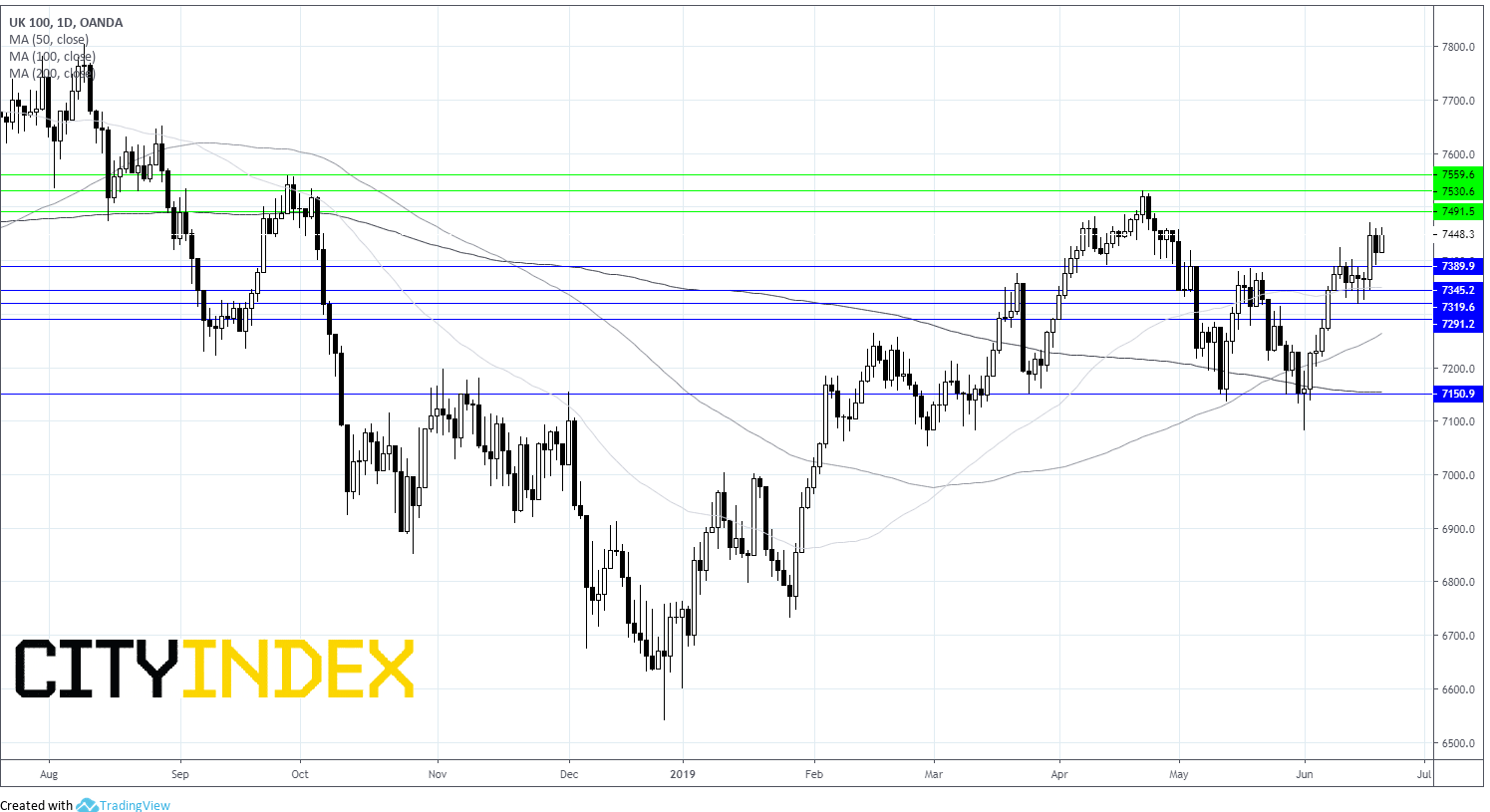

FTSE levels to watch:

The FTSE is currently flirting with resistance at 7450. A break through this level could see it extend to 7490 prior to 7530. Failure to break through at 7450 could see the index pull back to 7390 on its way back to 7345.