Following a stronger session in Asia overnight, the FTSE powered higher on the open. Last week fears of a global recession amid the ongoing US – Sino trade war dragged on sentiment. As the new week kicks off risk appetite is improving; stocks are in demand amid increased optimism over US and China reaching a trade deal and as investors anticipate stimulus measures to sure up slowing economies:

1. Germany has said that it will increase spending should the German economy fall into recession. Given that Germany contracted in the second quarter and data points to further softening in the third quarter a recession is looking increasingly likely.

2. China also joined the stimulus chorus, unveiling measures to reduce borrowing costs for companies to sure up its slowing economy.

3. Adding to the optimistic atmosphere, President Trump also expressed optimism over reaching an agreement with China. This would address what is considered the root cause of the global slowdown.

4. Central bankers will be meeting at the end of the week at the annual Jackson Hole meeting in Wyoming. The meeting takes place to a backdrop of financial markets flashing recession warning signs, adding to rising pressure for further support from central banks.

1. Germany has said that it will increase spending should the German economy fall into recession. Given that Germany contracted in the second quarter and data points to further softening in the third quarter a recession is looking increasingly likely.

2. China also joined the stimulus chorus, unveiling measures to reduce borrowing costs for companies to sure up its slowing economy.

3. Adding to the optimistic atmosphere, President Trump also expressed optimism over reaching an agreement with China. This would address what is considered the root cause of the global slowdown.

4. Central bankers will be meeting at the end of the week at the annual Jackson Hole meeting in Wyoming. The meeting takes place to a backdrop of financial markets flashing recession warning signs, adding to rising pressure for further support from central banks.

Yields ease, gold falls and Fresnillo drops to the bottom of the FTSE

Last week’s safe haven trade is unwinding, gold, bond yields and Japanese yen are seen moving lower in early trade on Monday. Precious metal miner Fresnillo, which has benefited royally from gold’s impressive rally over the past few weeks was tracing the precious metals lower in early trade, topping the FTSE loser board.

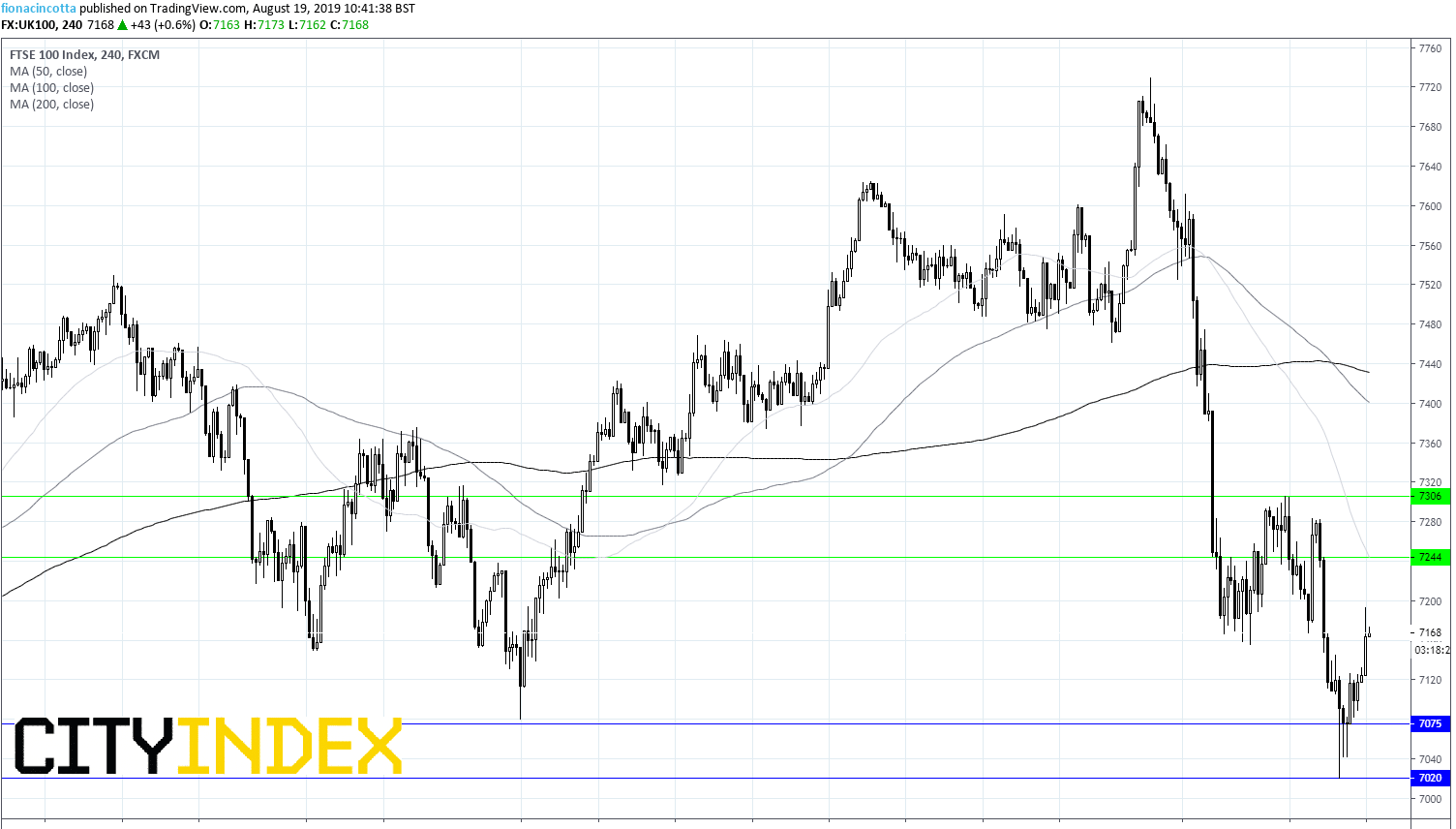

FTSE levels to watch:

The FTSE is clawing back some of the lost ground from last week. Whilst the index is moving higher, it still remains below its 50, 100 and 200 sma on the 4 hr chart; a bearish chart. The Index would need to break above 7245 and then 7305 to negate the bearish outlook.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM