The FTSE is crashing lower on Thursday, giving back gains from earlier in the week as coronavirus fears return to haunt the markets. With Italy closing all schools, a state of emergency declared in California and the number of cases rapidly increasing across Europe, traders are bracing themselves for the worst.

On the FTSE, few stocks are managing to keep in positive territory. Morrisons and Dettol maker Reckitt Benckiser are two notable performers as judging by the empty shelves, sales are soaring. The charge southwards is being led by Evraz and the miners amid concerns over metal consumption and future demand in China.

Trying to frame the problem

Sentiment is key driving force here. Markets hate uncertainty and struggle to deal with events in which the outcome can’t be framed. Virologists are struggling to gauge the potential range of outcomes for the coronavirus outbreak, let alone attach probabilities to them. This means that companies are finding it close to impossible to quantify the cost and scale of the problem. In essence, it is proving impossible to put a floor under the issue. Without a floor or a frame around the potential outcomes and costs the market is left in a state of panic and freefall.

Sentiment is key driving force here. Markets hate uncertainty and struggle to deal with events in which the outcome can’t be framed. Virologists are struggling to gauge the potential range of outcomes for the coronavirus outbreak, let alone attach probabilities to them. This means that companies are finding it close to impossible to quantify the cost and scale of the problem. In essence, it is proving impossible to put a floor under the issue. Without a floor or a frame around the potential outcomes and costs the market is left in a state of panic and freefall.

Levels to watch

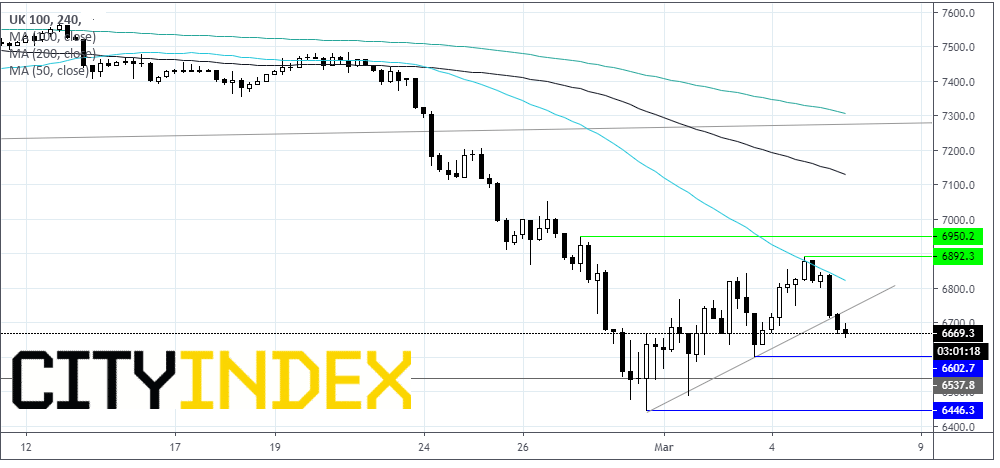

The FTSE has is trading down 1.7% at 6700, having picked up from session lows of 6661. On the 4 hour chart the bears have taken control as the price breaks through an ascending trend line support intact from 28th February. We would look for a close above the trend line support turned resistance at 6730 to see further gains.

Immediate support can be 6657 (today’s low) prior to 6602 (low 3rd March & trend line) before 6447 (low 28th Feb).

Resistance can be seen at 6730 (trendline resistance) prior to 6880 (today’s high) before 6948 (high 27th Feb).

Latest market news

Yesterday 11:48 PM

Yesterday 11:16 PM

Yesterday 05:00 PM

Yesterday 01:13 PM

Yesterday 11:00 AM